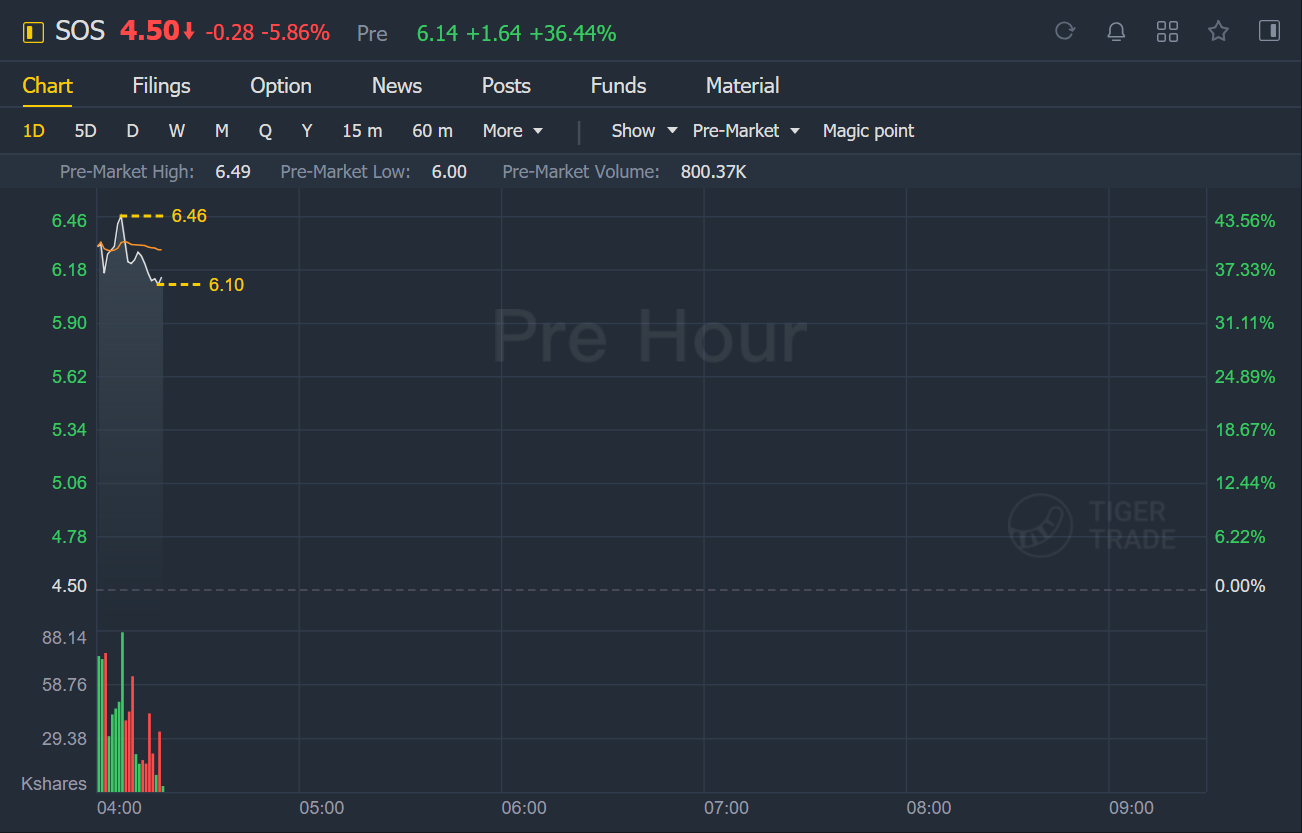

SOS Limited stock surged 37% in Wednesday premarket trading.

Law Offices of Howard G. Smith announces that a class action lawsuit has been filed on behalf of investors who purchasedSOS Limited("SOS" or the "Company") (NYSE: SOS) American Depositary Shares ("ADSs" or "shares") between July 22, 2020 and February 25, 2021, inclusive (the "Class Period"). SOS investors have until June 1, 2021 to file a lead plaintiff motion.

On February 26, 2021, Hindenburg Research ("Hindenburg") and Culper Research published reports regarding SOS, alleging that the Company was a "pump and dump" scheme that used fake addresses and doctored photos of crypto miners to create an illusion of success. The reports pointed out that SOS lists a hotel room as the company’s headquarters and questioned whether SOS purchased mining rigs from HY International Group New York Inc. ("HY"), which appeared to be a shell company. They also claimed that FXK Technology Corporation ("FXK"), which SOS announced it would purchase, was actually "an undisclosed related party shell." Moreover, the reports noted that the photographed SOS "miners" weren't the A10 Pros the company claimed to own but were actually Avalon's A1066 miners. Hindenburg went even further and found the original images from SOS's site belonged to a rival RHY.

On this news, the Company’s share price fell $1.27, or 21%, to close at $4.77 per share on February 26, 2021.

精彩评论