U.S. stock futures rallied on Tuesday after inflation data.

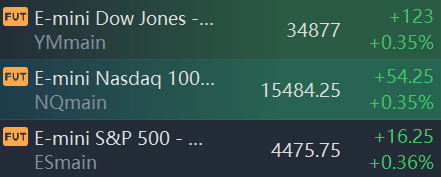

U.S. S&P 500 E-minis were up 16.25 points, or 0.36%, at 08:35 am ET. Dow E-minis were up 123 points, or 0.35%, while Nasdaq 100 E-minis were up 54.25 points, or 0.35%.

U.S. prices for an array of consumer goods rose less than expected in August in a sign that inflation may be starting to cool, the Labor Department reported Tuesday.

The consumer price index, which measures a basket of common products as well as various energy goods, increased 5.3% from a year ago and 0.3% from July.

Economists surveyed by Dow Jones had been expecting a 5.4% annual rise and 0.4% on the month.

Stocks making the biggest moves in the premarket:

Oracle(ORCL) – Oracle reported quarterly earnings of $1.03 per share, 6 cents a share above consensus estimates. The business software giant’s revenue fell short of forecasts, however, amid increasing cloud computing competition. Oracle fell 3% in the premarket.

Lucid Group(LCID) – Electric vehicle maker Lucid Group fell 6% in premarket trading. An equity research analyst at Morgan Stanley initiated coverage of the company at underweight.

Angi(ANGI) – Angi rose 3.3% in premarket trading after the digital marketplace for home services reported its August metrics, which included a 21% jump in revenue from a year earlier.

Herbalife Nutrition(HLF) – Herbalife shares tumbled 9.2% in the premarket after the maker of nutrition products cut its outlook. Herbalife cited lower than expected levels of activity by its independent distributors, likely due to pandemic-related uncertainty.

Apple(AAPL) – Apple issued a patch to its iOS system to fix a vulnerability related to the iPhone’s iMessage function. An Israeli firm had been exploiting the vulnerability since February to infect iPhones, according to research group Citizen Lab.

Intuit(INTU) – Intuit announced a deal to buy digital marketing firm Mailchimp for about $12 billion in cash and stock. That follows the TurboTax maker’s acquisition of Credit Karma last year for more than $7 billion. It had been reported earlier this month that Intuit and Mailchimp were in acquisition talks.

Coinbase(COIN) – The cryptocurrency exchange operator’s shares rose 1.3% in premarket trading after Piper Sandler reiterated an “overweight” rating on the stock.

Cameco(CCJ) – The Canada-based uranium producer continued its recent rally, up 1.6% in the premarket after rising in 10 of the past 11 sessions. It’s among uranium-related stocks that have caught the attention of investors on social media.

Fox Corp. (FOXA) – Fox finalized a deal to buy celebrity news platform TMZ from AT&T’s(T) WarnerMedia unit. Terms were not disclosed, but The Wall Street Journal reported that TMZ was valued at less than $50 million after earlier indications that the two sides were talking about a price between $100 million and $125 million. Fox rose 1.1% in premarket trading.

Southwest Airlines(LUV) – Southwest President Tom Nealon is retiring from the carrier effective immediately. His departure comes three months after CEO Gary Kelly announced he would retire in January and named longtime Southwest executive Bob Jordan as his successor. Nealon had been seen as a possible candidate to succeed Kelly.

SeaChange International(SEAC) – SeaChange reported a quarterly loss of 3 cents per share, smaller than the 9 cents a share loss anticipated by analysts. The video management solutions company saw revenue exceed Street forecasts. The company said it has a “robust pipeline” of sales opportunities and significant momentum. The stock rallied 11.9% in premarket trading.

Monmouth Real Estate(MNR) – The real estate investment trust added 1% in premarket action after saying it was re-exploring strategic alternatives, following investor feedback and prior expressions of takeover interest in the company.

精彩评论