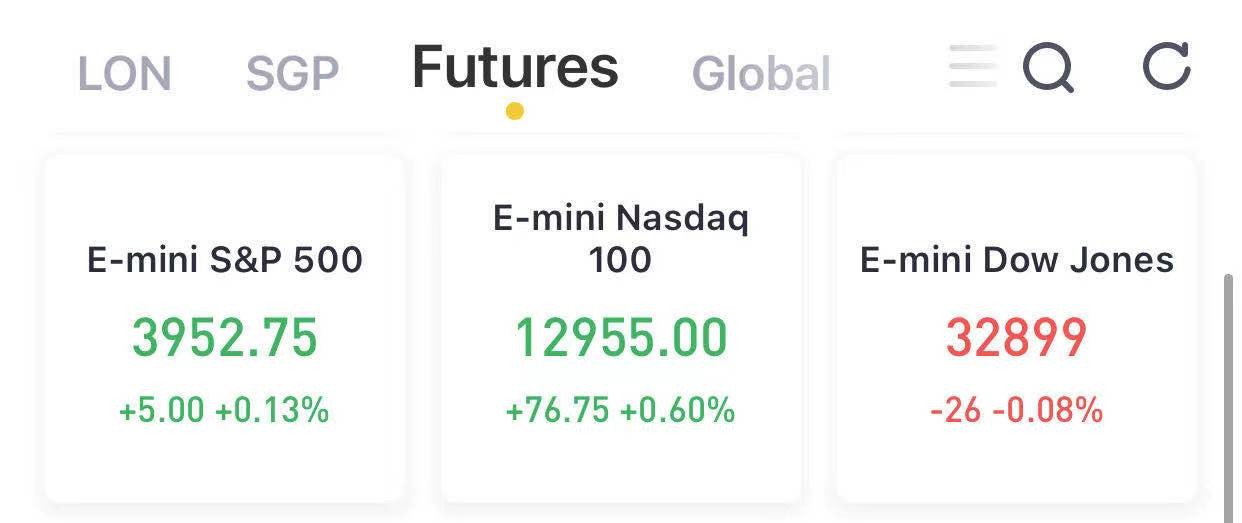

- U.S. Futures Mixed, Nasdaq future rally;

- Private payrolls rose by 517,000 in March, vs 525,000 estimate, ADP says.

- Chewy, BlackBerry, BioNTech & more making the biggest moves in the premarket.

(March 31) S&P 500 futures were flat on Wednesday, as investors awaited details of how President Joe Biden would fund a massive infrastructure plan, while Wall Street headed for its fourth straight quarterly gain on signs of a strong economic rebound.

At 8:01 a.m. ET, Dow E-minis were down 26 points, or 0.08%, S&P 500 E-minis were up 5 points, or 0.13% and Nasdaq 100 E-minis were rose 76.75 points, or 0.60%.

Stocks making the biggest moves in the premarket: Chewy, BlackBerry, BioNTech & more:

1) Chewy(CHWY) – The pet products seller earned a surprise profit of 5 cents per share, compared to expectations of a 10 cents per share loss. Revenue also beat estimates as net sales surged 47% from a year ago, as homebound consumers ordered more of their pet food and other pet products. Chewy shares surged 10.4% in premarket trading.

2) BlackBerry(BB) – Shares of the communications software company fell 5.9% in premarket action following its quarterly results. BlackBerry matched estimates with adjusted quarterly earnings of 3 cents per share, but revenue fell short of forecasts amid slower demand for the company’s QNX care software.

3) Pfizer(PFE) – The drugmaker said the Covid-19 vaccine made by Pfizer and German partnerBioNTech(BNTX)was 100% effective and well-tolerated in a trial of 12- to 15-year-olds. Given those results, Pfizer said it expects to ask regulators to approve the use of the shots for that age group. BioNTech shares rose 2.8% in premarket trading, while Pfizer was up 0.7%.

4) Walgreens(WBA) – The drugstore operator reported quarterly earnings of $1.40 per share, beating the consensus estimate of $1.11 a share. The company also raised its full-year guidance. Walgreens said quarterly earnings were pressured in part by weaker sales of cold, cough and flu products. Shares of Walgreens rose 2.1% in the premarket.

5) Lululemon(LULU) – The stock fell 1.8% in premarket action despitea beat on the top and bottom linesfor the athletic apparel and leisurewear company. Lululemon beat estimates by 9 cents a share, with quarterly earnings of $2.58 per share. Revenue came in above estimates as well. Brick and mortar comparable sales slumped 28% amid the pandemic, but that was offset by a surge in digital sales.

6) Tilray(TLRY),Canopy Growth(CGC),Aphria(APHA),Aurora Cannabis(ACG) – Marijuana stocks are rising afterNew York State passed a billto become the 15th state to legalize recreational use, with Gov. Andrew Cuomo expected to sign it. Tilray rose 3.5% in the premarket, Canopy Growth gained 1%, Aphria climbed 3.9%, and Aurora Cannabis edged up 0.7%.

7) PVH(PVH) – The apparel company lost 38 cents per share for its latest quarter, 4 cents a share more than analysts were anticipating. Revenue came in slightly below estimates as well. PVH said it does expect to return to profit this fiscal year, but its projections are shy of analyst estimates and its shares fell 1.1% in premarket action.

8) Cleveland-Cliffs(CLF) – The steel producer’s shares surged 6.8% premarket after it announced preliminary results for the quarter that ends today. The projected earnings for the quarter and the full year are well above current Wall Street projections.

9) Harley-Davidson(HOG) – The motorcycle maker’s shares gained 2.9% in premarket trading after Baird upgraded the stock to “outperform” from “neutral.” Baird noted that it was the first time since 2016 that it had rated the stock “outperform,” saying the company’s change in strategic direction and lean inventories were among the positive factors behind the upgrade.

10) Apple(AAPL) – UBS upgraded Apple to “buy” from “neutral,” saying it expected more stable long-term iPhone demand and stronger average sales prices. Apple rose 1.6% in the premarket.

11) Applied Materials(AMAT) – The semiconductor manufacturing equipment maker was rated “outperform” in new coverage at Bernstein, noting what it calls a long-term positive structural stance. Applied Materials rose 2.8% in premarket trading.

Big News

1. Private payrolls rose by 517,000 in March, less than expected

- Private payrolls rose by 517,000 in March, the fastest pace since September 2020, according to ADP.

- The total was just below the Dow Jones estimate of 525,000 but well above February’s 176,000.

- Hospitality led the way, with the battered sector adding 169,000 new workers.

2. Biden set to unveil his $2 trillion infrastructure plan

PresidentJoe Bidenwill unveil a more than $2 trillion infrastructure and economic recovery package Wednesday. The plan aims to revitalize U.S. transportation infrastructure, water systems, broadband and manufacturing, among other goals. An increase in the corporate tax rate to 28% and measures designed to prevent the offshoring of profits will fund the spending,according to the White House. Biden hopes the package will create manufacturing jobs and rescue failing American infrastructure as the country tries to emerge from the shadow of Covid.

精彩评论