U.S. stock index futures gains as headline number for jobs report comes in lighter than expected.

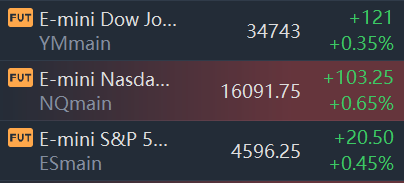

At 8:34 a.m. ET, Dow e-minis were up 121 points, or 0.35%, S&P 500 e-minis were up 20.5 points, or 0.45%, and Nasdaq 100 e-minis were up 103.25 points, or 0.65%.

The U.S. economy created far fewer jobs than expected in November, before a new Covid threat created a scare that growth could slow into the winter, the Labor Department reported Friday.

Nonfarm payrolls increased by just 210,000 for the month, though the unemployment rate fell sharply to 4.2% from 4.6%, even though the labor force participation rate increased for the month to 61.8%, its highest level since March 2020.

The Dow Jones estimate was for 573,000 new jobs and a jobless level of 4.5%.

Stocks making the biggest moves before the bell:

DocuSign(DOCU) - The software stock sank 32% after its fourth-quarter sales guidance came in at a range of $557 million to $563 million. Analysts surveyed by Refinitiv were expecting $573.8 million.

Didi Global(DIDI) - Shares of the Chinese ride-hailing firm dropped 10% in premarket trading after Didi announced that it would delist from the New York Stock Exchange and pursue a listing in Hong Kong.

Peloton(PTON) - The exercise equipment stock gained 3.7% before the bell following an initiation at buy from Deutsche Bank. The investment firm said that Peloton’s upside now outweighed its risks after a rough stretch for the stock.

Moderna(MRNA) - The volatile shares of the vaccine maker jumped 5.8% as the Wall Street Journal reported that the Food and Drug Administration is working toward a quick review process for updated Covid shots.

Ulta Beauty(ULTA) - The cosmetics retailer’s stock rose more than 5% after a stronger-than-expected third-quarter report. Ulta earned $3.93 per share on $2 billion in revenue during the quarter. Analysts surveyed by Refinitiv had expected $2.46 per share and $1.88 billion in revenue.

Marvell Technology(MRVL) - Shares of the chipmaker jumped 22% in premarket trading after Marvell beat estimates on the top and bottom lines for the third quarter. Marvell reported adjusted earnings of 43 cents per share on $1.21 billion of revenue. Analysts surveyed by Refinitiv were looking for 39 cents per share and $1.15 billion.

Ollie's Bargain Outlet(OLLI) - The discount retail chain's stock dropped 22.8% after Ollie's said supply chain issues led to a disappointing third-quarter report. The company missed estimates for earnings, revenue and comparable sales.

Big Lots(BIG) - The retail stock dipped 2.5% despite Big Lots reporting a narrower-than-expected loss per share for the third quarter. The company said that freight costs would make its full-year margins decline.

精彩评论