U.S. jobless claims total 268,000, about as expected.Stock-index futures remain slightly higher after weekly jobless claims.

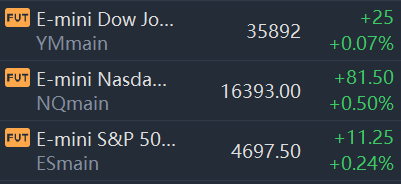

At 8:34 a.m. ET, Dow e-minis were up 25 points, or 0.07%. S&P 500 e-minis were up 11.5 points, or 0.24% and Nasdaq 100 e-minis were up 81.5 points, or 0.5%.

Stocks making the biggest moves premarket:

Nvidia(NVDA) – Nvidia came in 6 cents above estimates with adjusted quarterly earnings of $1.17 per share, and the graphics chip maker saw revenue come in above forecasts as well. Nvidia is benefiting from high demand for videogame and data center chips. The stock jumped 8.2% in the premarket.

Alibaba(BABA) – The Chinese e-commerce giant slid 6.4% in premarket action after top- and bottom-line misses in its latest quarterly report. Alibaba is attributing the drop in profit from a year ago to a decline in the value of its equity investments.

JD.com(JD) – JD.com beat estimates on both the top and bottom lines with the China-based e-commerce company continuing to benefit from sustained and elevated demand for online shopping. Shares rose 3% in the premarket.

Macy’s(M) – Macy’s surged 11.1% in the premarket after the retailer reported better-than-expected quarterly sales and profit, and raised its full-year outlook. Macy’s earned an adjusted $1.23 per share for the quarter, well above the 31-cent consensus estimate, and the raised forecast is easing concern about holiday season inventory shortages.

Roblox(RBLX) – Morgan Stanley raised its price target on Roblox to $150 per share from $88. The new target is 20% above where the stock closed Wednesday and is the highest among major Wall Street firms, according to FactSet. Shares rose nearly 4% in premarket trading Thursday.

BJ’s Wholesale(BJ) – The warehouse retailer beat estimates by 11 cents with adjusted quarterly earnings of 91 cents per share, while revenue and comparable-store sales also topped forecasts. BJ’s also announced a new stock buyback program worth up to $500 million.The shares rose 6.1% in the premarket.

Kohl’s(KSS) – Kohl’s rallied 8.5% in premarket trading as the retailer reported adjusted quarterly earnings of $1.65 per share compared with a consensus estimate of 64 cents. Kohl’s also reported better-than-expected revenue and comparable store sales, and raised its full-year sales forecast.

Petco(WOOF) – The pet products retailer beat estimates by 2 cents with adjusted quarterly earnings of 20 cents per share and revenue also above estimates. Comparable store sales were also better than expected, and Petco raised its full-year forecast.

Cisco Systems(CSCO) – Cisco tumbled 6.8% in premarket trading after forecasting current-quarter revenue below forecasts. The networking equipment company is seeing supply chain and other issues driving up costs. Cisco did report better-than-expected earnings for its most recent quarter, but revenue was slightly short of Wall Street forecasts.

Sonos(SONO) – Sonos matched estimates in reporting a quarterly loss of 7 cents per share, but the maker of wireless home audio equipment saw revenue come in slightly below analyst projections. However, Sonos also issued a better-than-expected fiscal 2022 sales forecast, even in the face of supply constraints that are impacting its production levels, and the stock added 3.6% in premarket action.

Bath & Body Works(BBWI) – Bath & Body Works reported an adjusted quarterly profit of 92 cents per share, beating the 60 cents consensus estimate, while the personal care products retailer also saw revenue beat Wall Street forecasts. The quarterly report was the first for Bath & Body Works as a standalone company following the split-up of L Brands. The stock gained 6.4% in premarket trading.

Victoria’s Secret(VSCO) – Victoria’s Secret shares surged 10.9% in premarket trading after the company beat estimates by 10 cents with adjusted quarterly earnings of 81 cents per share. This was the first quarterly report for Victoria’s Secret as a standalone company, also a product of the L Brands split-up.

Deere(DE) – Deere workers approved a new six-year contract after rejecting two previous tentative deals, ending a strike that began October 14. Deere rose 2.4% in the premarket.

Maxeon Solar Technologies(MAXN) – U.S.-listed shares of Singapore-based Maxeon Solar Technologies fell 10% as the solar technology company forecast dismal fourth-quarter revenue after posting downbeat quarterly earnings.

精彩评论