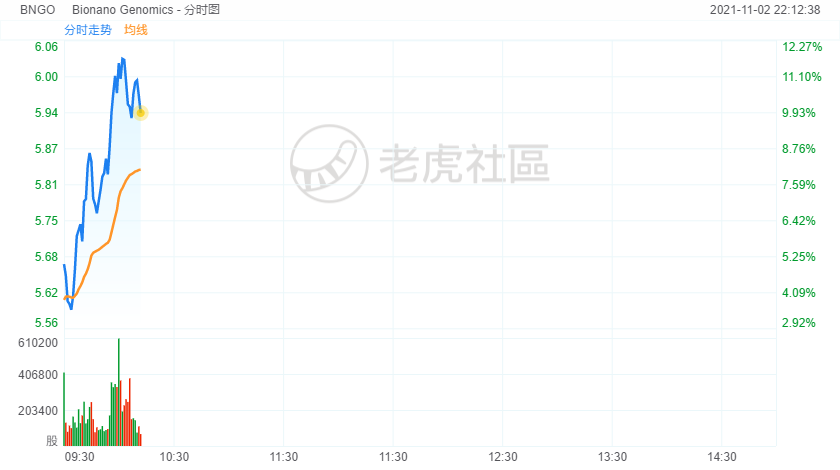

Bionano Genomics shares surged more than 10% in morning trading.

Personalized medicine is the holy grail of biotech research. Despite numerous breakthroughs in the treatment of cancer with the advent of immunotherapy, a clinical success in this field is generally characterized by response rates as low as 30%. Researchers believe that these exceedingly low response rates stem from differences in the mutation type at both the nucleic acid and whole chromosomal level within a particular patient population. Cancer, in effect, is not a monolithic disease, making it impossible to develop a one-size-fits-all type of therapy.

To boost the efficacy of these novel anti-cancer treatments, researchers thus require an accurate picture of the malignancy's genetic architecture at the individual level. That's where a company like Bionano Genomics comes into play. Bionano Genomicssportsa non-sequencing-based optical mapping technology known as the Saphyr System. The Saphyr System is designed to rapidly characterize extremely long strands of genomic DNA.

What's more, the biotech recently acquired the leading genomics data analysis software company BioDiscovery. This landmark acquisition could turn out to be a game-changing business development move for the company and its shareholders. In brief, BioDiscovery's NXClinical software solution for variant analysis, combined with the Saphyr System, has the potential to accelerate the adoption of optical genome mapping at large. Moreover, this potentially best-in-class platform might ultimately grab an outsize portion of this multi-billion dollar market within the next few years.

Bionano is slated to report third-quarter earnings on Nov. 4. While the biotech's Q3 revenue figure is unlikely to turn heads, investors should learn more about the long-term implications of this key acquisition. As a result, Bionano's beaten-down stock might finally start to show some signs of life after an eight-month downturn. Underscoring this point, the biotech's shares are currently down by a whopping 67% relative to their 52-week highs. Aggressive investors, in turn, may want to pick up some shares ahead of this upcoming earnings report.

精彩评论