Grab,which operates Southeast Asia's most popular "super app", providing ride-hailing, food and grocery delivery and payments in over 400 locations in eight countries,posted its Q3 financial report last week.

The following is our interpretation and analysis of the report.

Steady growth with its revenue reaching a record high in Q3

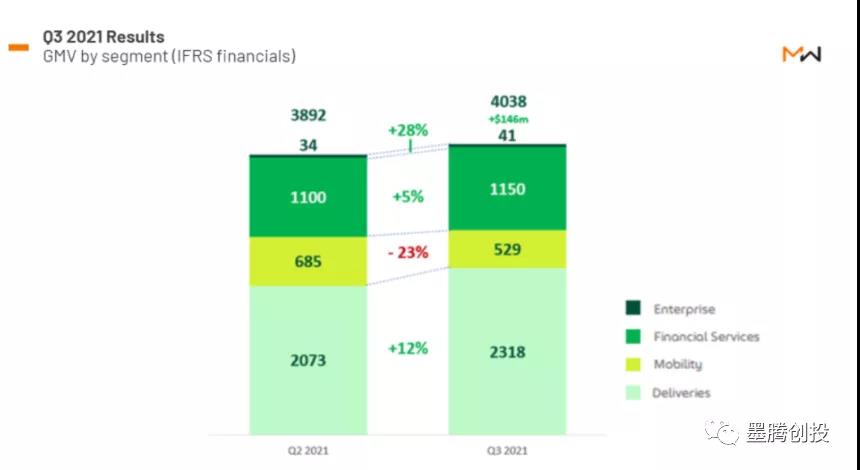

Although the repeated epidemics have brought continuous challenges to Grab's business in the region, Grab hit a record high in the third quarter of 2021, reaching US$4 billion, an increase of 32% compared with last year and an increase of 4% compared with the second quarter of 2021.

Its partners include Indomaret, one of the largest convenience store chains in Indonesia, the Mississippi Center Hypermarket (Big C) under Central Group, and Lotus Department Store in Malaysia (formerly known as Tesco-Tesco, which was acquired by Chia Tai Group in 2021andwas renamed Lotus Stores), S&R Market in the Philippines and Mega Market in Vietnam.

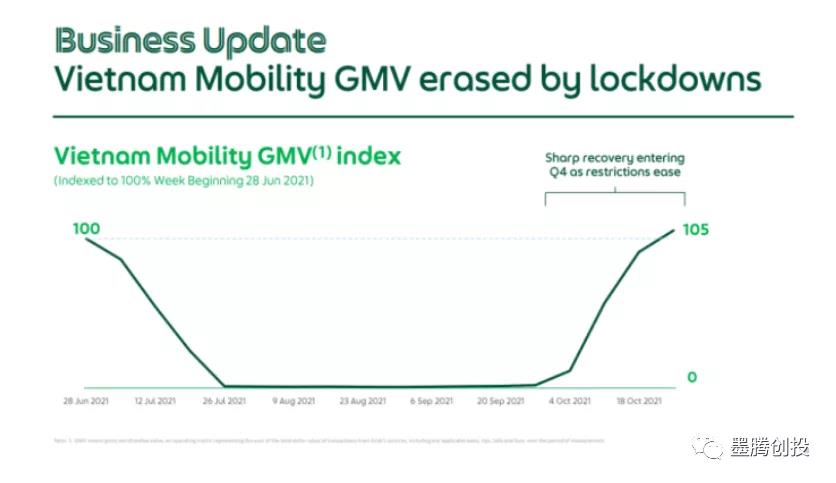

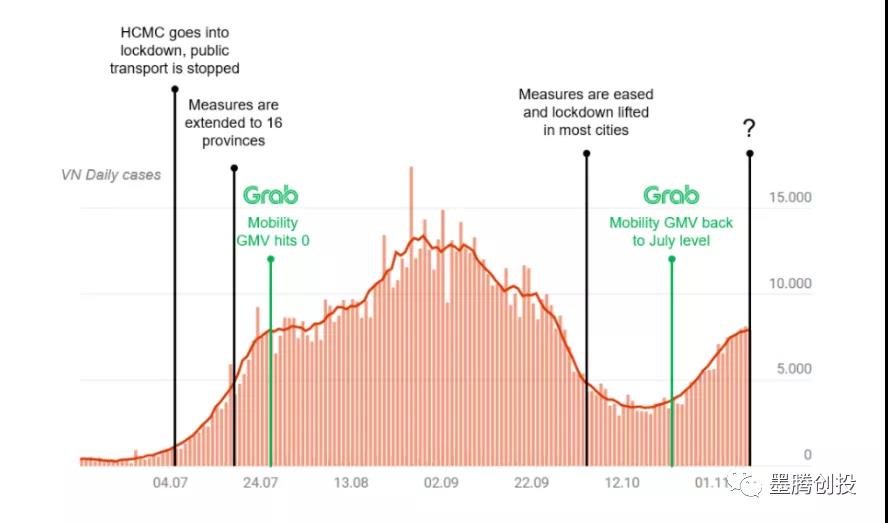

Grab's travel business was greatly affected by the repeated epidemics throughout the third quarter. Take the Vietnamese market as an example,due to a series of stringent measures such as the lockdown of the city, the travel business has almost stagnated from the end of July to the end of September.

Moreover,on Tuesday, the company announced that it was experiencing a disruption to its services, with customers and drivers in Singapore, Indonesia and Malaysia complaining that they were having trouble using the app's ride-hailing functions.

"Some of our services are not accessible at the moment," Grab posted on its Facebook page,"We are looking into this and we will update when the app is back up and running."

How to face challenges from the repeated epidemics?

In the third quarter earnings conference call, Grab proposed several new strategies, focusing on the expansion of the delivery business.

In terms of financial services,managers believe that a complete and open ecosystem is the key to enhancing consumer retention and long-term use of financial services. That’s the reason why Grab bought out Tokopedia's shares from early October and controlled the Indonesian e-wallet OVO. In addition, at the beginning of October, it announced that Xinxiang Group CEO Hong Jiyuan will start to serve as Grab's COO from January next year.

How is Grab's SPAC going?

When Grab announced the listing of the SPAC at the beginning of this year, it planned to be listed in the United States in the fourth quarter of 2021. However, according to the information disclosed in this earnings conference call, the SPAC merger and listing date has been delayed a little bit from the planned date.

On August 2, Grab submitted the F-4 file to the SEC. Since then, it has undergone three feedbacks and revisions, indicating that the US Securities and Exchange Commission still has some questions about the F-4 file submitted by Grab. After the F-4 is passed, Altimeter Growth Corp and Grab will both send notices of shareholders meetings to their shareholders. After obtaining all shareholders' approval, Grab's listing journey will be over.

However, whether it is from the recent e-mails sent by Grab to employees about the company's IPO or the collective shorting of ACG stocks by retail investors, the day for Grab to go public shouldn’t be far away.

精彩评论