(March 5) U.S. stock indexes firmed on Friday after a three-day pullback for the S&P 500 and the Nasdaq, as investors looked to data that is likely to show accelerated jobs growth in February.

The crucial nonfarm payrolls report is expected to show the U.S. economy benefited from falling new COVID-19 cases, quickening vaccination rates and additional pandemic relief money from the government.However, the report will also be a reminder that the recovery in the labor market is excruciatingly slow.

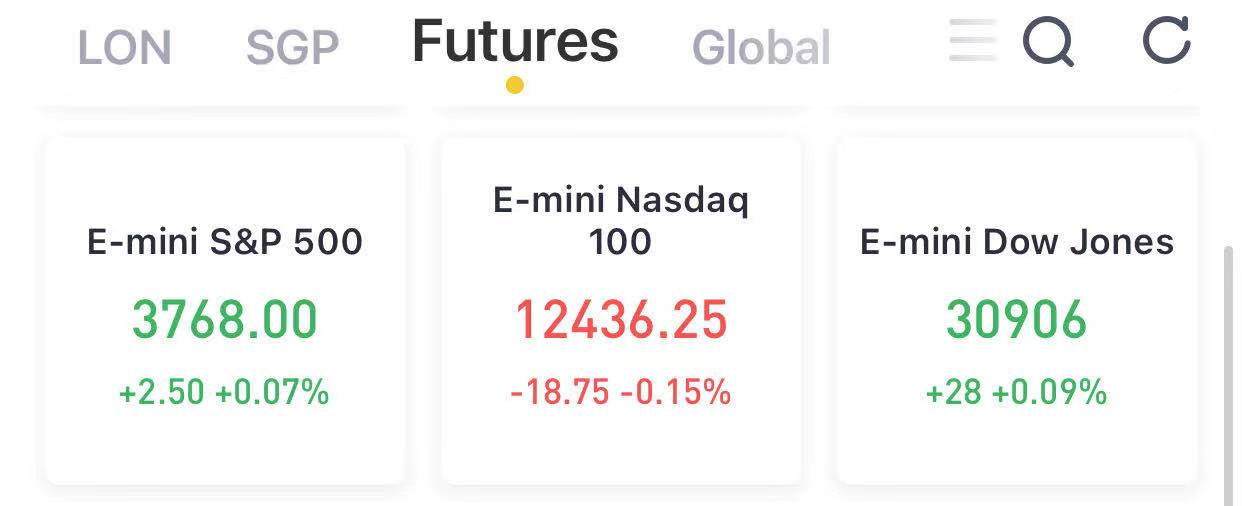

At 07:30a.m. EST, Dow E-minis were up 28 points, or 0.09%, S&P 500 E-minis were up 2.50 points, or 0.07% and Nasdaq 100 E-minis were down 18.75 points, or 0.15%.

Big News

1、The U.S. Labor Department is set to release its February jobs report Friday morning at 8:30 a.m. ET. Here are the main metrics expected from the report, compared to consensus estimates compiled by Bloomberg:

- Non-farm payrolls: +195,000 expected vs. +49,000 in January

- Unemployment rate: 6.3% expected vs. 6.3% in January

- Average hourly earnings, month-over-month: 0.2% expected, 0.2% in January

- Average hourly earnings, year-over-year: 5.3% expected, 5.4% in January

2、10-year Treasury yield holds above 1.5% before jobs report and after Powell

The 10-year Treasury yieldmoved higher Friday,trading around 1.56%, pushing toward last week’s one-year high. Yields have increased rapidly since the end of January, stoking inflation fears. Powell did little to allay those concerns, acknowledging he sees someinflationary pressures ahead. However, he also said that rising prices won’t likely be enough to spur the Fed to hike interest rates. The market had been looking for Powell to address the recent surge in bond yields more directly, with a possible nod toward adjusting the Fed’s asset purchase program.

3、Senate nears Covid relief bill votes after GOP delay

Debate in the Senate on Democrats’ $1.9 trillion coronavirus relief packageis set to continueas lawmakers try to beat a deadline to prevent a federal unemployment aid boost from expiring. The Senate voted Thursday to start debate on the rescue package, setting the stage for its approval as soon as this weekend under rules that allow for passage with a simple majority. Vice PresidentKamala Harrishad to break a 50-50 tie after a party-line vote in the evenly divided chamber. As soon as the Senate began considering the bill, Sen.Ron Johnson, R-Wis., forced the chamber’s clerks to begin reading theentire 628-page measurealoud.

U.S. Market Yesterday

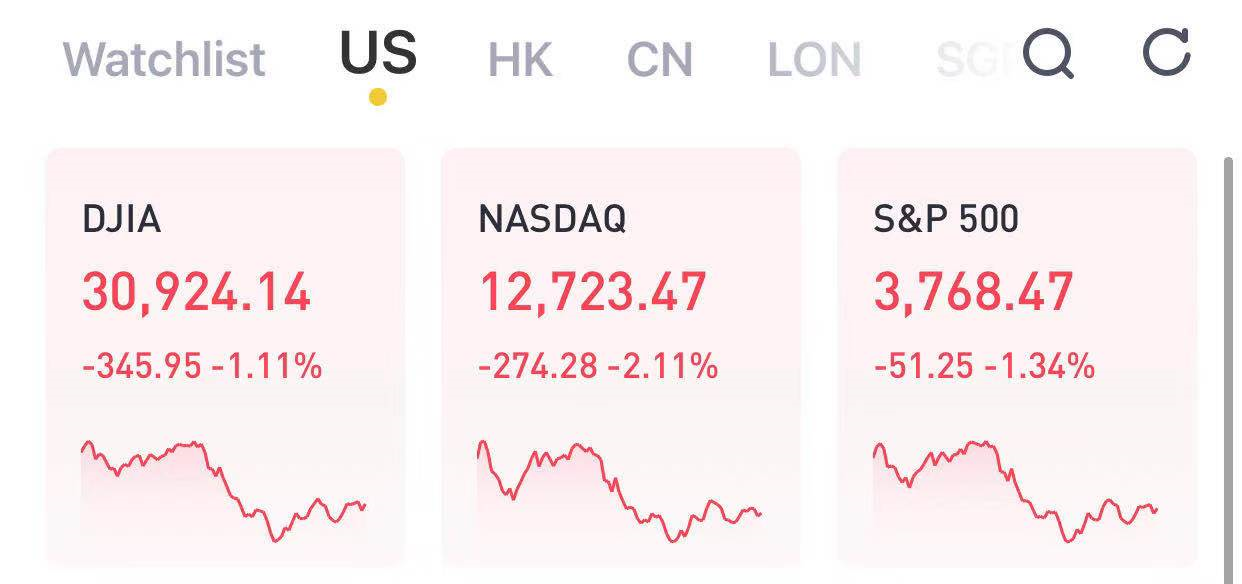

Federal Reserve Chair Jerome Powell on Thursday maintained the central bank’s dovish stance to support maximum employment and said inflation was not a worry at the moment.

His comments disappointed investors who expected him to act on the recent spike in the U.S. 10-year Treasury yield that has set the S&P 500 and the Nasdaq on course for their third straight weekly decline.

Yesterday, Dow slides, Nasdaq hits three-month low after Powell struggles to soothe bond market. The Dow lost 1.11%, the Nasdaq Composite slid 2.11%, and the S&P 500 fell 1.34%.

Latest News:

1) IMAX(IMAX) – IMAX lost 21 cents per share, one cent a share more than analysts had anticipated. The movie theater operator’s revenue came in above Wall Street estimates. Sales were helped by stronger performances in Asian markets, and the company is anticipating improved results as consumers return to theaters this year. IMAX shares lost 3.7% in premarket trading.

2) CoreLogic(CLGX) –CoStar Group(CSGP) dropped its bid to buy CoreLogic, with the commercial property data provider saying rising interest rates will hurt CoreLogic’s value. CoStar’s latest bid had been worth $6.6 billion or $90 per share, compared to a prior higher bid of $6.9 billion or $95.76 per share. CoreLogic — a provider of real estate data that competes withZillow(Z) — had accepted a buyout bid last month from private-equity firms Stone Capital and Insight Partners for $6 billion or $80 per share. CoStar jumped 5.5% in premarket trading, while CoreLogic fell 3.4%.

3) Big Lots(BIG) – The discount retailer reported quarterly profit of $2.59 per share, 9 cents a share above estimates. Revenue matched forecasts, however, and a comparable sales increase of 7.9% was shy of the consensus FactSet estimate of 8.4%. Big Lots said it expected its results this year to be significantly affected by the pandemic. Shares rose 1.3% in premarket trading.

4) Costco(COST) – Costco reported quarterly earnings of $2.14 per share, falling short of the $2.45 per share consensus estimate. The warehouse retailer's revenue came in above forecasts. Costco's comparable sales rose 13%, while its digital sales surged 76%. The company also experienced supply chain issues resulting in higher costs. Costco shares fell 1.9% in premarket trading.

5) Norwegian Cruise Line(NCLH) – The cruise line operator's shares tumbled 7% in premarket trading after it announced a public stock offering of 47.58 million shares. Norwegian plans to use the proceeds to retire exchangeable debt held by private-equity firm L Catterton.

6) Gap(GPS) – The parent of Gap, Old Navy and Banana Republic is predicting an apparel sales rebound this year, as the Covid-19 pandemic recedes and people return to offices and schools. Sales in its most recent quarter came in below Wall Street forecasts, though an online sales surge help offset a pandemic-related decline in-store traffic. Shares jumped 3.2% in premarket action.

7) Broadcom(AVGO) – The chipmaker beat estimates by 6 cents a share, with quarterly earnings of $6.61 per share. The company’s revenue came in slightly above estimates. Shares fell 1% in the premarket, however, as semiconductor sales were below analysts’ forecasts. The company and its peers continue to be impacted by a shortage of materials used to make chips.

8) Virgin Galactic(SPCE) – The space company’s chairman, Chamath Palihapitya, sold his personal holdings of 6.2 million shares for about $213 million, according to a Securities and Exchange Commission filing. He still owns 15.8 million shares with investment partner Ian Osborne. Its shares fell 3.1% in the premarket.

9) The Trade Desk(TTD) – The Trade Desk is on watch once again after losing 20% in value over the past two days. The provider of programmatic advertising technology was hit afterAlphabet’s(GOOGL) Google said it would not use ad tracking technology to follow people individually across the internet. The stock lost another 1.4% in the premarket.

10) Western Digital(WDC) – Western Digital shares rose 2.5% in premarket action after the disk drive and memory chip maker was upgraded to “buy” from “neutral” at Goldman Sachs. Goldman cited an improved outlook for memory chip prices, among other factors.

11) Boeing(BA) – The jet maker has approached a group of banks seeking a new $4 billion credit facility, according to reports from Bloomberg and Reuters. Boeing had told analysts in January that the company had sufficient liquidity, but was open to raising more debt as it considers options to strengthen its balance sheet.

12) Van Eck Vectors Social Sentiment ETF(BUZZ) – The new exchange-traded fund is on watch again today after falling 3.6% in its Wall Street debut Thursday. The ETF is designed to receiving attention from investors on Reddit,Twitter(TWTR) and other social media platforms.

13) Fifth Third Bancorp(FITB) – The bank was added to the “Conviction Buy” list at Goldman Sachs, which foresees a significant improvement in net interest income for Fifth Third based on current trends in both long and short term rates. Fifth Third rose 1.2% in premarket action.

7:25 a.m. ET Friday:

- Crude (CL=F): $65.40 per barrel, +$1.57 (+2.46%)

- Gold (GC=F): $1,692.60 per ounce, -$8.10 (-0.48%)

- 10-year Treasury (^TNX): +0.9 bps to yield 1.559%

精彩评论