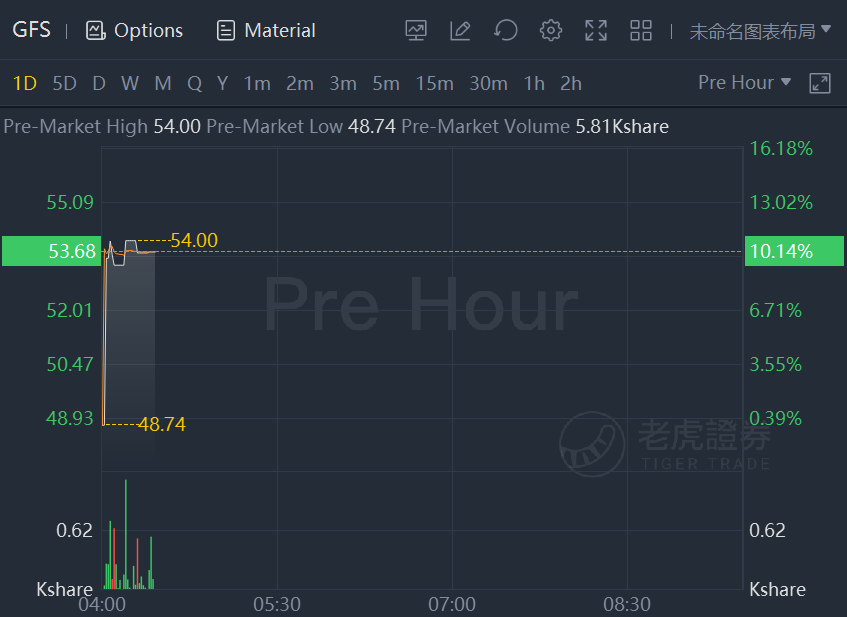

GlobalFoundries shares soared 10% in premarket trading.The stock was listed on Friday and closed up 5%.

GlobalFoundries is appealing to public-market investors as interest in the semiconductor industry hits an all-time high. Shortages caused by a surge in demand for electronics during coronavirus pandemic lockdowns and insufficient supply have made chip factories more valuable to the economy.

For the first half of the year, GlobalFoundries had a net loss of $301 million on revenue of about $3 billion, compared with a loss of $534 million on $2.7 billion in revenue a year earlier, according to the filings.

Contract chipmakers like GlobalFoundries fabricate semiconductors for large technology companies such as Apple Inc. and Amazon.com Inc. Taiwan Semiconductor Manufacturing Co. and Samsung Electronics Co. currently dominate the market, and Intel Corp. has ambitions to become a bigger force in that area too.

GlobalFoundries previously gave up on the kind of leading-edge production that would match the capabilities of Taiwan Semiconductor or Samsung. Instead, it’s serving the market for less advanced chips, which are increasingly critical to carmakers and other industries.

精彩评论