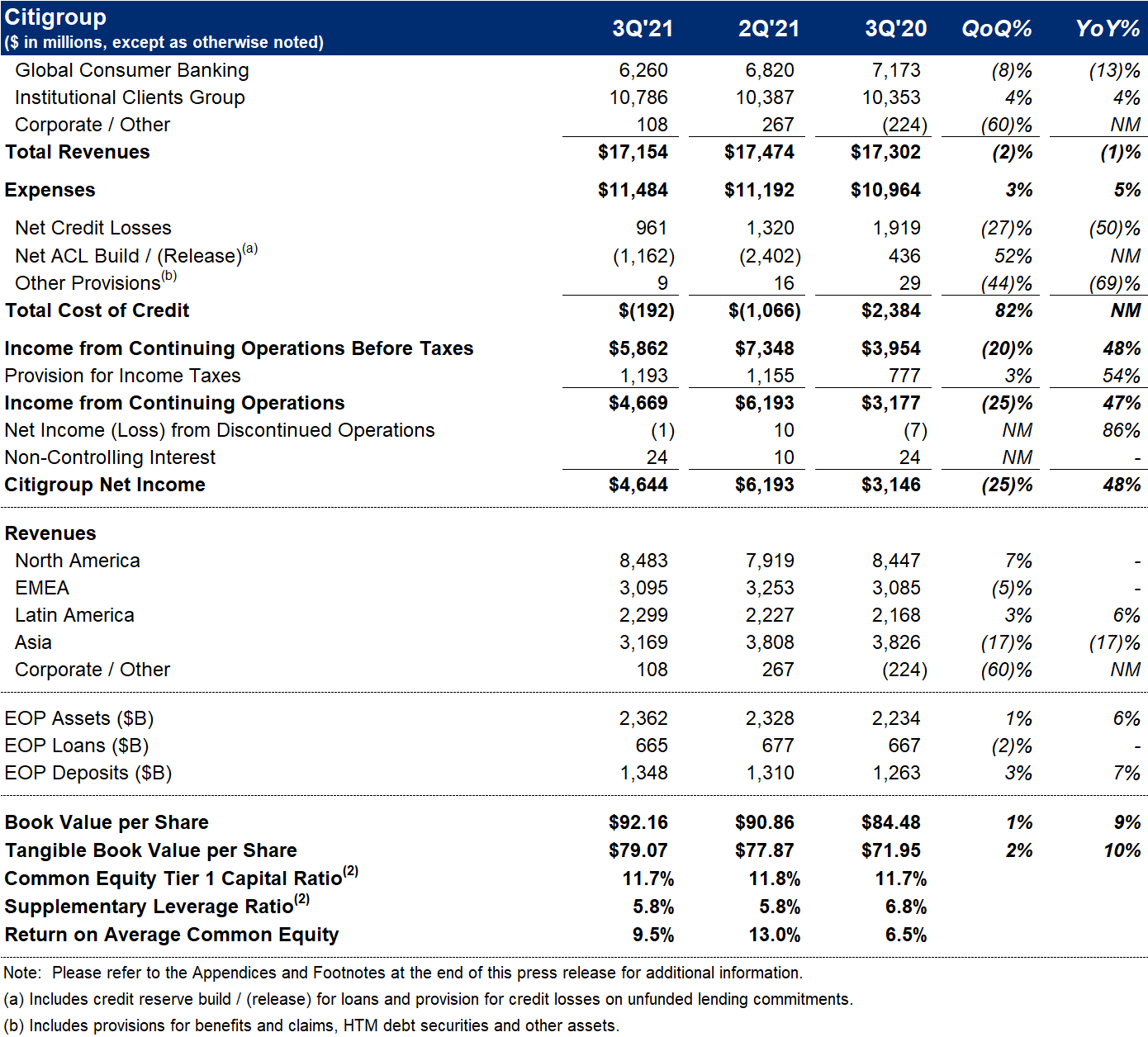

- Citigroup Q3 revenue $17.2 bln vs. $17.3 bln a year ago; FactSet consensus $16.9 bln

- Citigroup Q3 EPS $2.15 vs. $1.36 a year ago; FactSet consensus $1.71

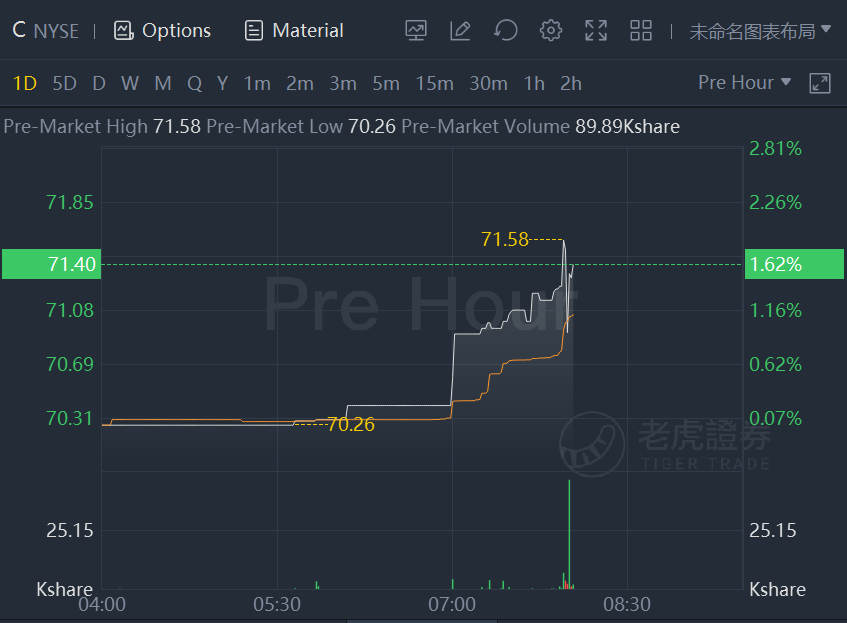

Citigroup shares rose 1.5% after quarterly results beat expectations.

Citigroup Inc. today reported net income for the third quarter 2021 of $4.6 billion, or $2.15 per diluted share, on revenues of $17.2 billion. This compared to net income of $3.1 billion, or $1.36 per diluted share, on revenues of $17.3 billion for the third quarter 2020.

Revenues declined 1% from the prior-year period, including a pre-tax loss of approximately $680 million related to the sale of the Australia consumer business in Global Consumer Banking (GCB). Excluding the loss on sale5, revenues increased 3%, largely driven by growth across theInstitutional Clients Group (ICG).

Net income of $4.6 billion increased 48% from the prior-year period driven by a lower cost of credit, partially offset by the lower revenues and higher expenses.

Earnings per share of $2.15 increased 58% from the prior-year period, reflecting the growth in net income, as well as a 3% decline in shares outstanding.

Jane Fraser, Citi CEO, said, “The recovery from the pandemic continues to drive corporate and consumer confidence and is creating very active client engagement as you can see through our strong results in Investment Banking and Equity Markets, both up approximately 40% year-over-year, in addition to double- digit fee growth in Treasury and Trade Solutions as we help our clients reposition their supply chains. And while strong consumer balance sheets have impacted lending, we are seeing higher consumer spending across our cards products. We also continue to show momentum in deposits and wealth management AUM as well as growing engagement across our digital channels. Overall, our revenues were 3% higher than last year excluding the impact of the sale of our consumer business in Australia.

“We are moving forward with urgency on our top priorities in order to responsibly narrow the returns gap with our peers: the Transformation, refreshing our strategy and building a culture of excellence. So far this year, we have returned close to $11 billion to shareholders through a healthy dividend and stock repurchases. We remain committed to returning excess capital over and above the amount necessary to invest in our franchise and to maintain our safety and soundness.

“Overall, I am quite pleased with $4.6 billion in net income given the environment we are operating in. While we have much work ahead, we are getting results from the investments we have been making and seeing both the strength and durability of our franchise," Ms. Fraser concluded.

Percentage comparisons throughout this press release are calculated for the third quarter 2021 versus the third quarter 2020, unless otherwise specified.

Third Quarter Financial Results

精彩评论