On Monday,Tesla, Inc CEO Elon Musk announced on Twitter "at least 50%" of (his) tweets were made on a porcelain throne. MIT research scientist Rex Fridman responded to say “so then Twitter is a game of thrones,” to which Musk replied with a laughing-out-loud emoji.

Fridman’s quip, a reference to the television series may also have been written to highlight Musk’s history of using the stage Twitter provides him as a game to act as a puppeteer, able to manipulate stock and crypto prices in less than 280 characters.

Recently, Musk may have begun using cryptic tweets to allude to a Dec. 9 Tesla stock split and fintwit personalities such as @robgrav3s and @adamhoov have spent time sleuthing the matter.

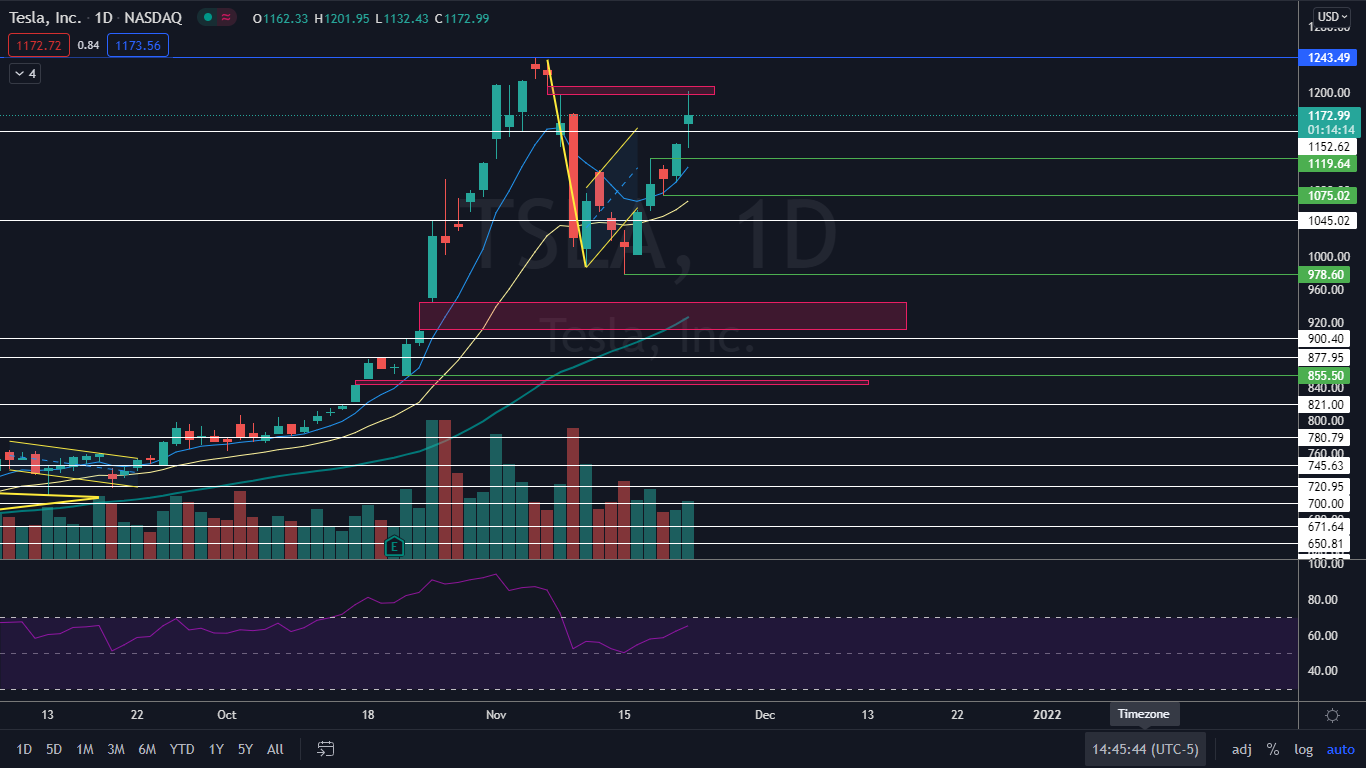

Since the theory began making its way around social media early last week, Tesla has erased most of its losses caused by Musk selling over 5.7 billion shares between Nov. 8 and Nov. 16, with Nov. 15 marking a reversal to the upside at the $978.60 level. Traders and investors may be attempting to front-run the potential stock split news because if history repeats an announcement of a second split for Tesla could take the stock on an all-time high run.

The Tesla Chart:Tesla reached a new all-time high of $1,243.49 on Nov. 4 and entered into a short-lived downtrend on the daily chart. The stock then printed a low at $978.60 and reversed course into an uptrend with the most recent higher printed on Monday and the most recent higher low printed on Nov. 18 at $1,078.02.

On Monday, Tesla partially filled an overhead gap between $1,197 and $1.208, which was a likely scenario considering gaps on charts fill about 90% of the time. There are two lower gaps with the first between $910 and $944.20 and the second between the $843.21 and $849.74 range, which are also likely to fill at some point in the future.

After filling the gap during the morning, Tesla retraced down toward the opening price in consolidation. Consolidation is needed because Tesla’s relative strength index registers in at about 65% and when a stock’s RSI nears or reaches the 70% level it becomes overbought, which can be a sell signal for technical traders.

Tesla is trading above the eight-day and 21-day exponential moving averages (EMAs), with the eight-day EMA trending above the 21-day, both of which are bullish indicators. The stock is also trading well above the 50-day simple moving average, which indicates longer-term sentiment is bullish.

- Bulls want to see continued consolidation and then for big bullish volume to come in and push Tesla up to make a new all-time high, while keeping in mind the stock will eventually need to print a higher low to continue trending up in the pattern. Above the previous all-time high there is no further resistance in the form of price history.

- Bears want to see big bearish volume come in and drop Tesla down below the $1,075 level, which would negate the uptrend. The stock has support below at $1,045 and $978.60.

精彩评论