(Sept 22) a.k.a. Brands Holding Corp. opens for trading at $9.5, down 13.64% from IPO price.

Company & Technology

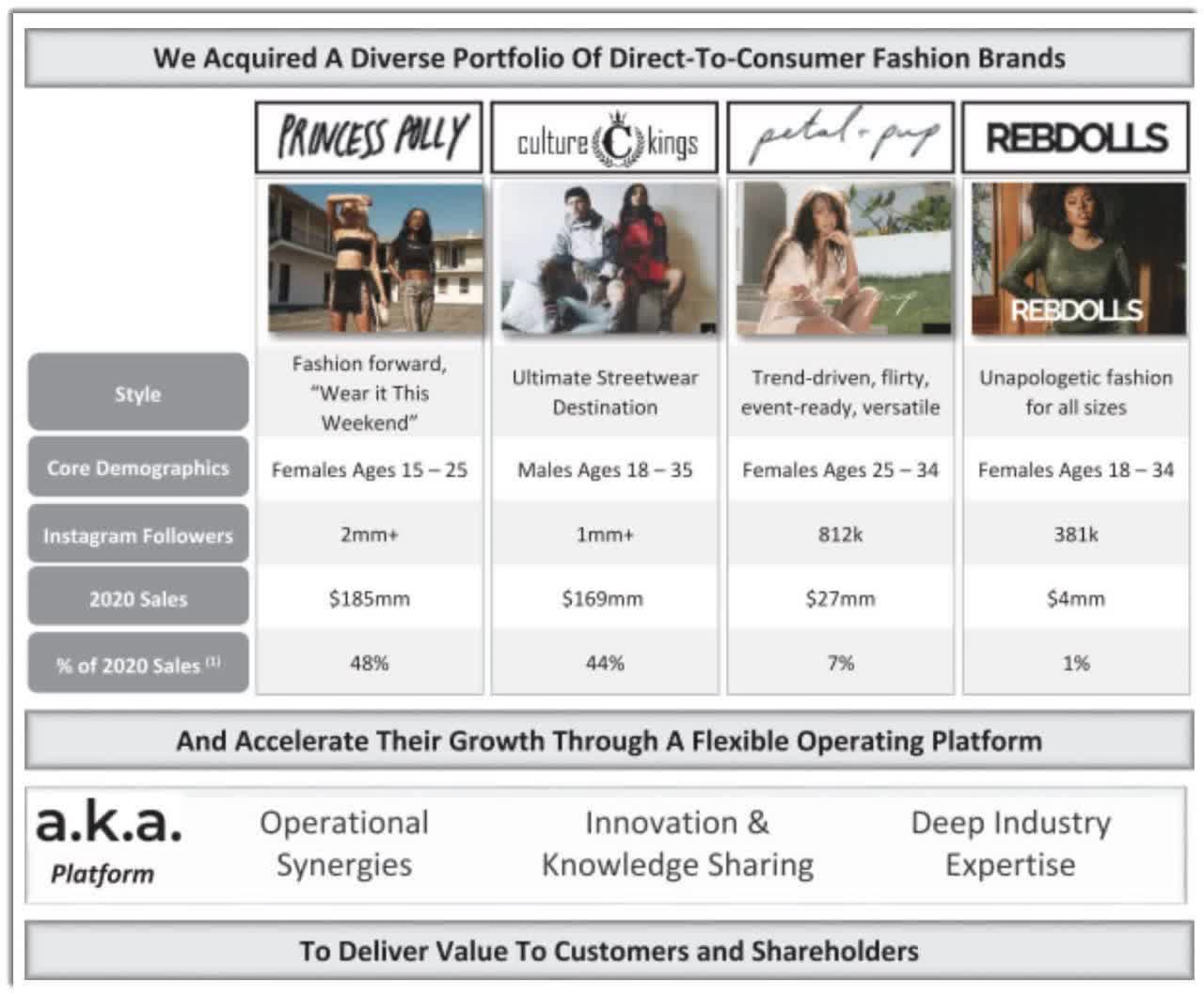

San Francisco, California-based a.k.a. Brands was founded to develop a portfolio of digitally-focused, DTC consumer apparel and fashion brands with a global reach.

Management is headed by Chief Executive Officer Jill Ramsey, who has been with the firm since May 2020 and was previously Chief Product and Digital Revenue Officer at Macy's.

The company’s primary offerings include:

- Princess Polly

- Culture Kings

- Petal & Pup

- Rebdolls

Below is the a.k.a. platform as it currently stands:

Customer Acquisition

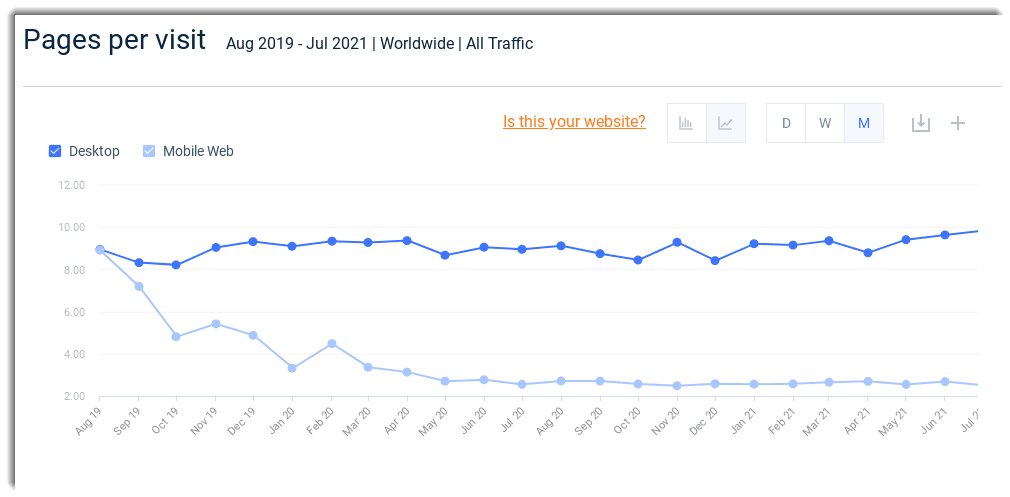

The company focuses its marketing efforts on Millennials and Gen Z consumers who 'seek fashion inspiration on social media and primarily shop online and via mobile devices.'

So, a.k.a. leverages its data to provide relevant social content and make other digital marketing strategy efforts to reach consumers directly online.

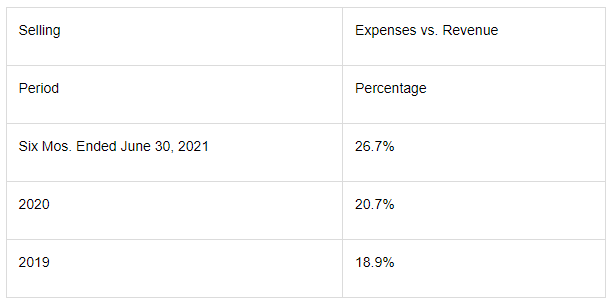

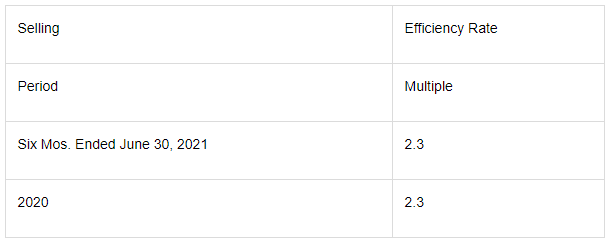

Selling expenses as a percentage of total revenue have risen as revenues have increased, as the figures below indicate:

(Source:Similarweb)

According to a marketresearch reportby BlueCart, the global market for DTC (direct-to-consumer) sales is expected to reach $20 billion globally in 2021.

This represents a forecast potential increase of 15% over results in 2020.

The main drivers for this expected growth are an increase in consumer openness to hearing directly from manufacturers via online channels.

Also, there is a growing desire by businesses to gain an edge through greater data-driven insights stemming from direct relationships with their customers rather than working through 3rd party distributors and retail outlets.

Major competitive or other industry participants by type include:

- Ecommerce companies

- In-person stores

Financial Performance

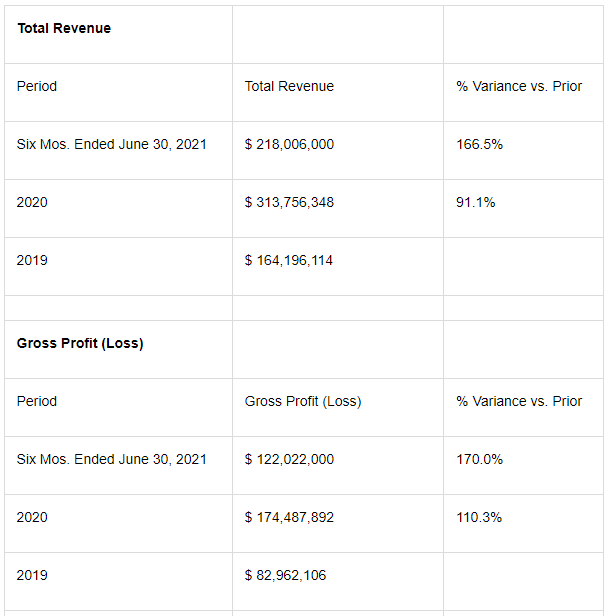

a.k.a. Brands’ recent financial results can be summarized as follows (includes 55% stake in Culture Kings Group):

- Sharply growing topline revenue

- Growing gross profit

- Increasing gross margin

- Uneven operating profit and margin

- Variable cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

Free cash flow during the twelve months ended June 30, 2021, was $28.7 million.

IPO Details

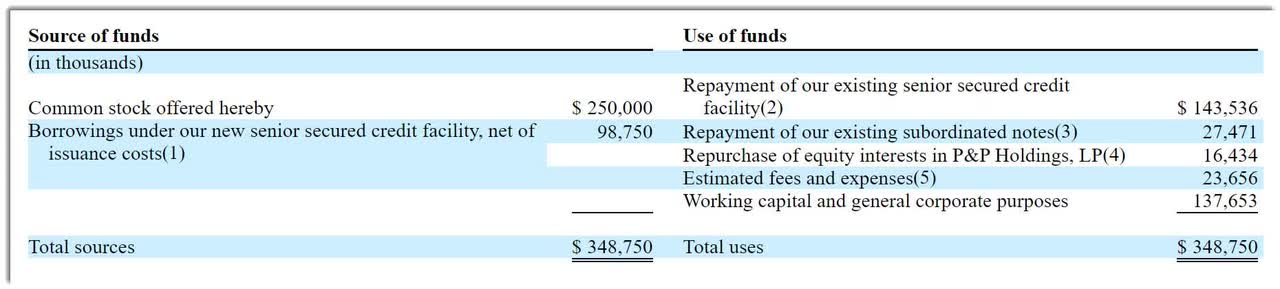

AKA intends to sell 13.9 million shares of common stock at a proposed midpoint price of $18.00 per share for gross proceeds of approximately $250 million, not including the sale of customary underwriter options.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (ex- underwriter options) would approximate $2.3 billion.

Excluding effects of underwriter options and private placement shares or restricted stock, if any, the float to outstanding shares ratio will be approximately 10.72%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

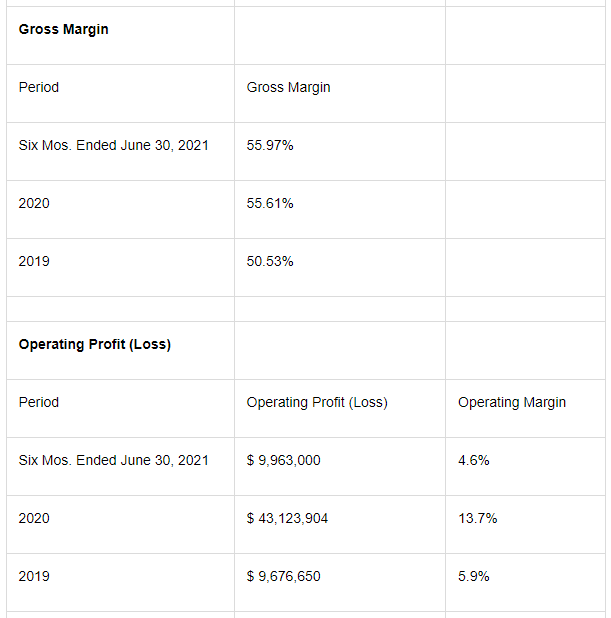

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows (in conjunction with a planned new senior secured credit facility):

(Source)

Management’s presentation of the company roadshow isavailable here.

Regarding outstanding legal proceedings, management believes that any legal claims against it would not be material to its operations or financial condition.

Listed bookrunners of the IPO are BofA Securities, Credit Suisse, Jefferies and other investment banks.

Valuation Metrics

Below is a table of the firm’s relevant capitalization and valuation metrics at IPO, excluding the effects of underwriter options:

Commentary

AKA is going public to pay down debt and for its future expansion plans.

AKS’ financials show sharply growing topline revenue and gross profit, increasing gross margin but uneven operating profit and margin and variable cash flow from operations

Free cash flow for the twelve months ended June 30, 2021, was $28.7 million.

Selling expenses as a percentage of total revenue have risen as revenue has increased and its Selling efficiency rate was stable at an impressive 2.3x.

The market opportunity for selling fashionable clothing direct to consumer [DTC] aimed at younger demographics is large and expected to grow substantially in the years ahead.

Being a mobile-first DTC firm, AKA is well-positioned to adjust to a market that is focused on using online, mobile-phone app purchase modalities.

BofA Securities is the lead left underwriter and IPOs led by the firm over the last 12-month period have generated an average return of 11.5% since their IPO. This is a mid-tier performance for all major underwriters during the period.

The primary risk to the company’s outlook is the high rate of change in consumer tastes and preferences, which can make it challenging and costly to react to changes in a compressed time period.

As for valuation, compared toa basketof publicly held Apparel companies complied by noted valuation expert Dr. Aswath Damodaran which as of January 2021 had an average EV/Sales multiple of 2.03x, AKA is seeking an EV/Revenue multiple of 5.03x.

AKA is growing topline revenue sharply, in part due to its acquisition activities but its operating margin was 4.6% in the most recent six-month period versus the public basket of an average of 5.93%.

So AKA is growing quickly through acquisition but has a lower operating margin than its public peers.

However, I favor DTC companies for things like apparel, as the firm can adjust its offering much faster and more accurately as a result of its direct relationship with customers.

Also, AKA’s mobile-first approach combined with DTC business model also positions the firm well for its target demographic of younger consumers.

Although the IPO isn’t cheap, I believe AKA has significant room to grow and continue executing its business model approach, so the IPO is worth consideration.

精彩评论