Coupang shares opened at $38.66 each on Wednesday, about 34% higher than the company’s IPO price.

Quick Take

Clear Secure (YOU) as filed to raise $376 million in an IPO of its Class A common stock, according to an S-1/Aregistration statement.

The firm provides membership-based security enrollment services for access to various public and private venues.

YOU produced contracting topline revenue and related metrics in Q1 2021 and the IPO appears pricey, so I'll pass on the IPO.

Company & Technology

New York, New York-based Clear Secure was founded to create a security platform enabling subscribers to demonstrate their identity and receive faster or more convenient access to venues and transportation systems in the U.S.

Management is headed by Chair and CEO Ms. Caryn Seidman-Becker, who has been with the firm since 2010 and was previously founder of Arience Capital and managing director at Iridian Asset Management.

The company’s primary offerings include:

- CLEAR - venue access subscription service

- CLEAR Plus - CLEAR plus aviation system access subscription service

- Health Pass - health identity connected to digital health credential

Clear Secure has received at least $651 million in equity investment from investors including Alclear Investments, T. Rowe Price & Associates Funds, General Atlantic, William Miller III, Delta Air Lines and Durable Capital.

Customer/User Acquisition

The firm has focused its direct sales & marketing efforts on U.S. airports, stadiums and major venues.

As of May 31, 2021, it counted 38 airports, 26 sports and entertainment venues and 67 Health Pass-enabled partners and events for 100 unique locations as well as numerous offices, theaters, casinos, theme parks and restaurants.

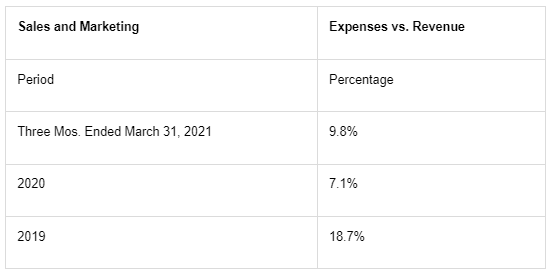

Sales and Marketing expenses as a percentage of total revenue have fluctuated as revenues have varied, as the figures below indicate:

The Sales and Marketing efficiency rate, defined as how many dollars of additional new revenue are generated by each dollar of Sales and Marketing spend, swung to a negative 2.2x in the most recent reporting period, as shown in the table below:

The firm’s CLEAR Plus member retention rate for 2020 was 78.8%. Management said it expects the negative effects of the COVID-19 pandemic to affect its airport enrollments and business in 2021 and beyond.

Market & Competition

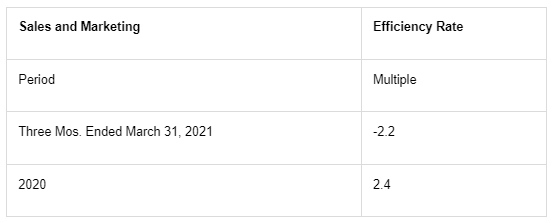

According to a 2018 marketresearch reportby Fortune Business Insights, the global stadium security market was an estimated $6.2 billion in 2017 and is forecast to reach $16 billion by 2025.

This represents a forecast CAGR of 12.8% from 2018 to 2025.

The main drivers for this expected growth are a rise in terrorist threat scenarios as well as a need to handle large crowds in a safe manner.

Also, stadium and venue owners are seeking advanced security measures as more options become available.

Below is a chart showing the stadium security market historical and forecast growth trajectory:

(Source)

Notably, the software & services segment was expected to grow at the fastest rate through 2025.

Major competitive or other industry participants include:

- Telos Identity

- Idemia Identity & Security

- PricewaterhouseCoopers

- Salesforce

- IBM

- Amazon

- Apple

Financial Performance

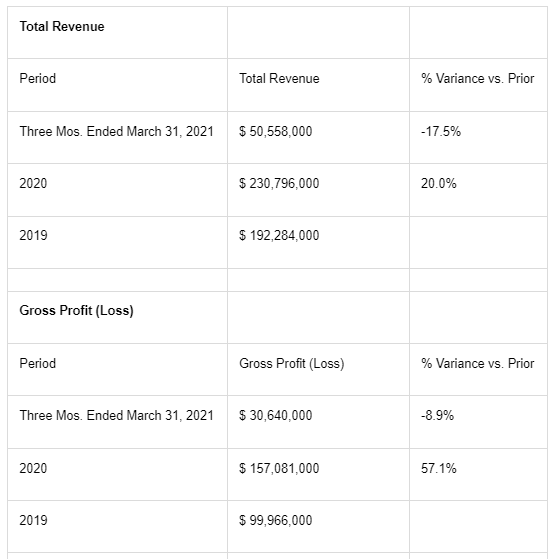

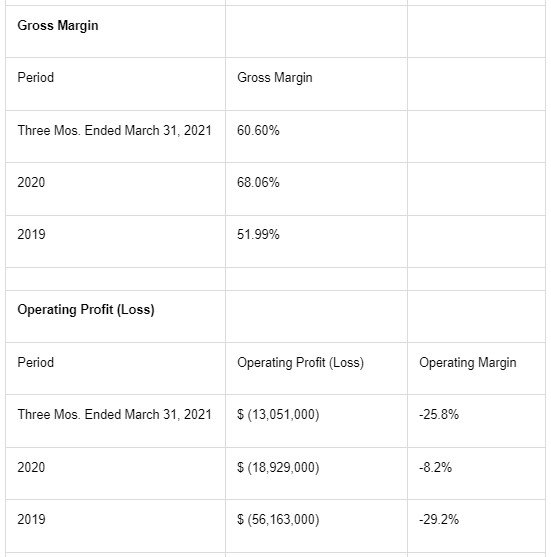

Clear Secure’s recent financial results can be summarized as follows:

- Contracting topline revenue in Q1 2021

- Reduced gross profit and fluctuating gross margin

- Increased operating losses

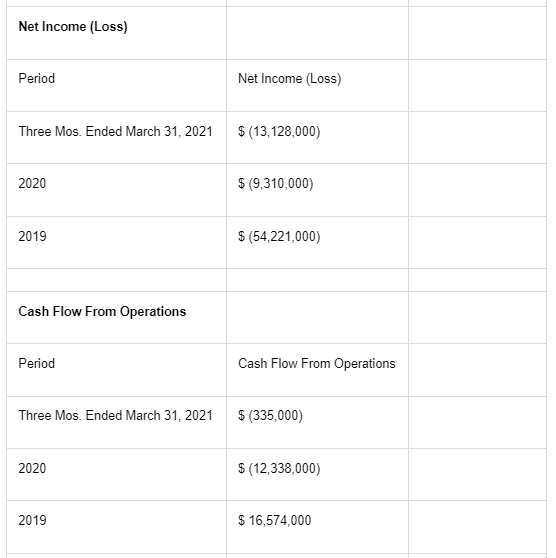

- Uneven cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

As of March 31, 2021, Clear Secure had $176 million in cash and $161.8 million in total liabilities.

Free cash flow during the twelve months ended March 31, 2021, was $8.2 million.

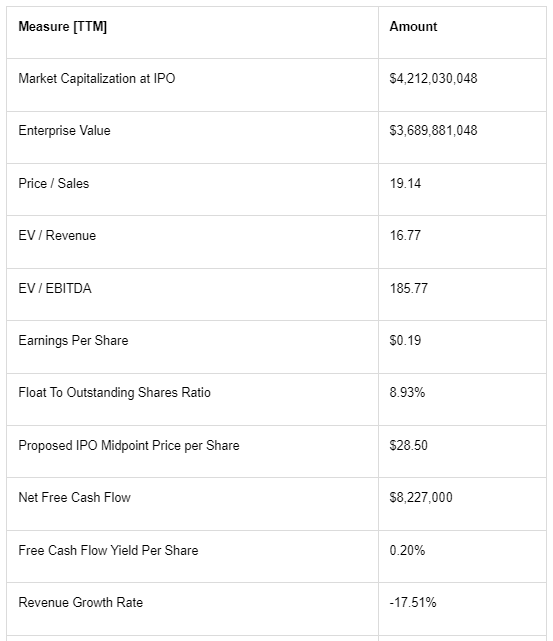

IPO Details

Clear Secure intends to raise $376 million in gross proceeds from an IPO of its Class A common stock, offering 13.2 million shares at a proposed midpoint price of $28.50 per share.

Class A and Class C common stockholders will be entitled to receive one vote per share and Class B and Class D shareholders will have 20 votes per share.

The S&P 500 Index no longer admits firms with multiple classes of stock into its index.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $3.7 billion, excluding the effects of underwriter over-allotment options.

Excluding effects of underwriter options and private placement shares or restricted stock, if any, the float to outstanding shares ratio will be approximately 8.93%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

Management says it will use the net proceeds from the IPO as follows:

We intend to contribute the net proceeds from this offering to Alclear in exchange for a number of Alclear Units equal to the contribution amount divided by the price paid by the underwriters for shares of our Class A common stock in this offering (13,200,000 Alclear Units at the midpoint of the estimated public offering price range set forth on the cover page of this prospectus or, if the underwriters exercise their option to purchase additional shares in full, 15,180,000 Alclear Units), and to cause Alclear to use such contributed amount to pay offering expenses and for general corporate purposes. (Source)

Management’s presentation of the company roadshow isavailable here.

Listed bookrunners of the IPO are Goldman Sachs, J.P. Morgan, Allen & Company, Wells Fargo Securities, LionTree, Stifel, Telsey Advisory Group, Centerview Partners, Loop Capital Markets and Roberts & Ryan.

Valuation Metrics

Below is a table of relevant capitalization and valuation figures for the company:

Commentary

Clear Secure is seeking public investment capital for unspecified future corporate expansion plans.

The company’s financials showed resilience in 2020 but a significant drop in topline revenue in Q1 2021 and continued operating losses with a lack of path to operating breakeven.

Free cash flow for the twelve months ended March 31, 2021, was $8.2 million.

Sales and Marketing expenses as a percentage of total revenue have varied as revenue has fluctuated; its Sales and Marketing efficiency rate swung to a negative 2.2x in the most recent reporting period.

The market opportunity for providing preferred venue and travel access services is significant but has been affected negatively by the COVID-19 pandemic, at least in the short term.

Management responded by developing its Health Pass service during 2020.

Goldman Sachs is the lead left underwriter and IPOs led by the firm over the last 12-month period have generated an average return of 46.6% since their IPO. This is a top-tier performance for all major underwriters during the period.

The primary risk to the company’s outlook is the ongoing uncertainties brought about by the COVID-19 pandemic and changing consumer habits.

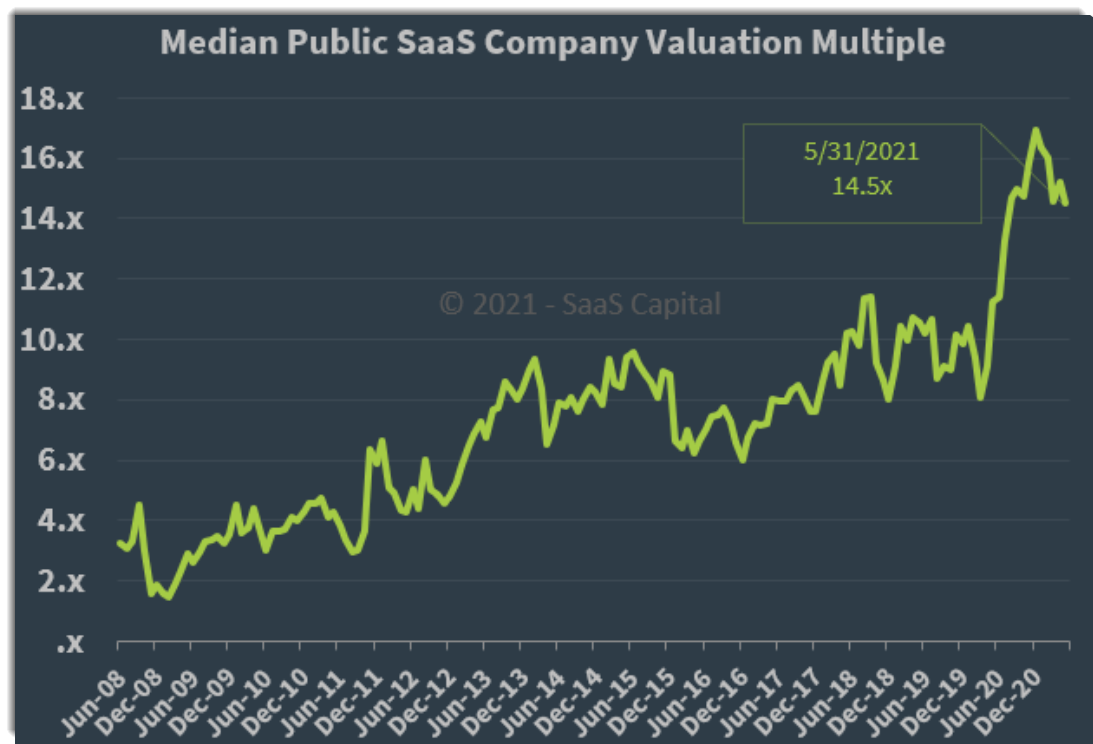

As for valuation, YOU is primarily a subscription-based business and is asking investors at IPO to pay an Enterprise Value / Revenue multiple of 16.8x, which is well above the typical software-based SaaS public stock median, as shown below:

I’m also concerned by the contraction in topline revenue and related metrics in Q1 2021...not a good result leading into the IPO.

I'll watch the IPO from the sidelines.

Expected IPO Pricing Date: June 29, 2021

精彩评论