Stocks were higher in early trading Monday following a volatile week on Wall Street as investors eye a key event where the Federal Reserve could hint at prospects for tapering stimulus.

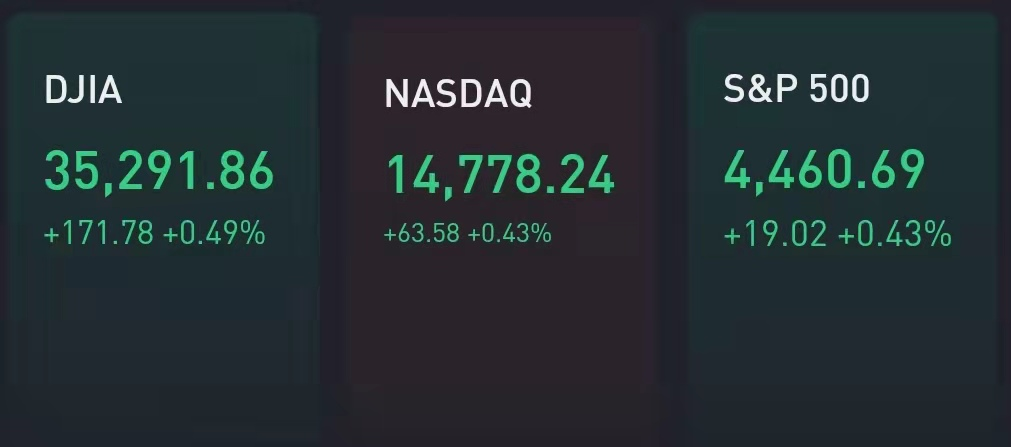

The Dow Jones Industrial Average gained 171 points, or nearly 0.5%. The S&P 500 and Nasdaq Composite rose about 0.4% as well.

Shares of vaccine makers are higher in premarket trading with investors' eyes on the FDA, which is expected to give the two-dose Pfizer-BioNTech Covid-19 vaccine full approval Monday.Pfizer is up about 3% and BioNTech jumped 7%.

Bitcoin hit a three-month high on Sunday, punching above $50,000 and pulling crypto-adjacent stocks up with it.Coinbase rose 3% higher in early trading, while Microstrategy climbed 4%.

Major averages are coming off a losing week as investors grew worried that the Fed's potential move to pull back monetary stimulus could slow down the economic recovery that is already challenged by the spread of the delta Covid-19 variant.

Traders are eagerly awaiting the Jackson Hole symposium for clues on the Fed’s timeline for dialing back its $120 billion a month bond-buying program. The event takes place virtually on Thursday and Friday. The Fed previously was going to conduct the event in a mixed virtual and live presentation, but decided Friday to go all virtual in light of the rising virus risk.

Chairman Jerome Powell’s speech will be titled “The Economic Outlook,” which “may suggest the speech could have a more near-term focus,” Nomura economist Aichi Amemiya said in a note.

“Given the recent deterioration in incoming data and the pandemic situation, we see some risk Powell focuses on increased uncertainty due to the latest COVID-19 surge,” Amemiya added. “At a minimum, we view recent comments from Fed officials as supporting our view of a December tapering announcement despite a preference on the FOMC for November as of the July meeting.”

The blue-chip Dow fell 1.1% last week, while the S&P 500 declined nearly 0.6%, breaking a two-week winning streak. The tech-heavy Nasdaq dipped 0.7% during the week.

“We suspect investor conviction is being challenged by the potential for upcoming monetary policy changes, shifting growth vs. value rotations, and a rising trajectory of new coronavirus cases,” Craig Johnson, technical market strategist at Piper Sandler, said in a note.

For the month of August, major benchmarks are poised to post modest gains. The S&P 500 is up 1.1% month to date, while the blue-chip Dow has gained 0.5% and the Nasdaq has climbed 0.3%.

“August is a historically volatile month for markets and this year is no different, with investors currently climbing multiple walls of worries,” said Rod von Lipsey, managing director at UBS Private Wealth Management. “Upticks in Covid-19 cases and a downward spiral in Afghanistan are creating a crisis of confidence, at a time when many investors are on holiday.”

精彩评论