- U.S. stock futures traded mixed in early pre-market trade

- Virgin Galactic stock surged another 6% in premarket trading

Futures tracking the S&P 500 paused at an all-time high on Monday as investors stayed away from making big bets ahead of data on the health of a U.S. labor market recovery and corporate earnings later in the week.

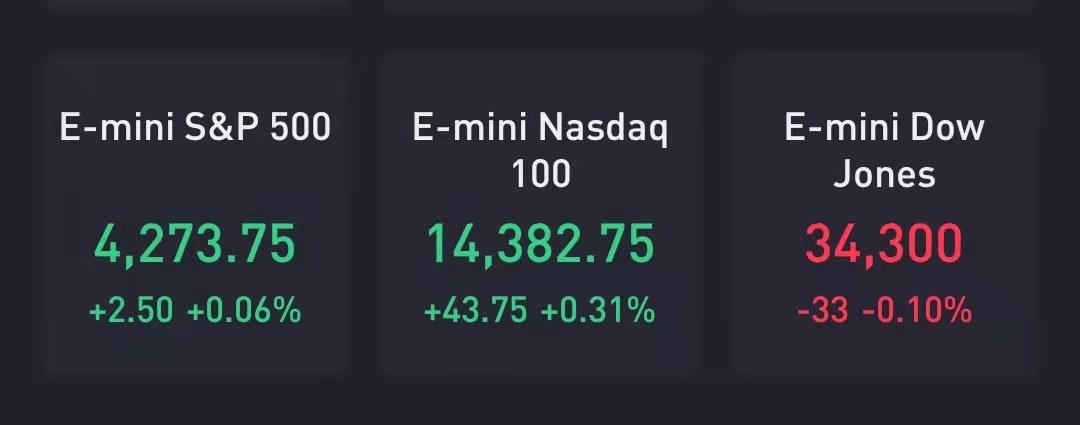

At 8:05 a.m. ET, Dow e-minis were down 33 points, or 0.1% and S&P 500 e-minis were up 2.5 points, or 0.06%.

Nasdaq 100 e-minis were up 43.75 points, or 0.31% as megacap companies including Microsoft, Amazon and Facebook Inc edged higher in premarket trading.

Crypto stocks follow the rise of Bitcoin in premarket trading.Marathon Digital,Riot Blockchain,Canaan and SOS Limited climbed between 1.8% and 6%.

Quarterly results from Micron Technology, ConocoPhillips and Walgreens are slated for this week. On the economic front, attention will be on consumer confidence data, a private jobs report and a crucial monthly nonfarm payrolls report.

Stocks making the biggest moves in the premarket:

Virgin Galactic (SPCE)– Virgin Galactic shares surged another 6% in the premarket after geting the green light from the FAA to fly passengers to space.Virgin Galactic shares soared 38.87% to $55.91 on last Friday in the regular session. The company’s shares have returned 135.6% on a year-to-date basis.

Boeing (BA) – Boeingis not likely to receive certification for its 777X long-range aircraft until mid-to-late 2023 at the earliest. That’s according to a letter from a Federal Aviation Administration official to Boeing that was obtained by CNBC, saying there were numerous technical issues that needed to be resolved. Boeing shares fell 1.2% in the premarket.

Baidu (BIDU) – U.S-listed shares of Chinese tech giant Baidu rose 1.2% after its smart electric vehicle venture with automaker Geely [RIC:RIC:GEELY.UL], Jidu Auto, hired Frank Wu, formerly at Cadillac, to lead its design studio.

Tesla (TSLA) – Tesla is virtually recalling nearly 300,000 cars to implement a software update related to assisted driving. The owners will not actually have to return the vehicles in order to receive the update.

Nvidia (NVDA) – Nvidia received support for its planned $40 billion takeover of ARM from some of the U.K. chip maker’s major customers, according to a report in the Sunday Times. The public display of support comes from Broadcom(AVGO),Marvell(MRVL) and MediaTek.

Intellia Therapeutics (NTLA) – Intellia shares surged 55.4% in the premarket after the Massachusetts-based company and partner Regeneron(REGN) announced positive results in a phase 1 study of a gene-editing treatment for a disease called transthyretin amyloidosis. Regeneron shares gained 1.6%. Two other companies involved with the same gene-editing technology also rallied in premarket trading, with CRISPR Therapeutics(CRSP) soaring 13.5% and Editas Medicine(EDIT) jumping 17.1%.

Perion Network (PERI) – The advertising technology company’s shares surged 9.9% in the premarket after reporting upbeat second-quarter earnings and increasing its full-year forecast.

Johnson & Johnson (JNJ) – Johnson & Johnson will pay $263 million to resolve opioid-related claims in a settlement involving both the state and Nassau and Suffolk Counties. The settlement – in which J&J does not admit or deny guilt – removes the company from an opioid trial set to begin Tuesday.

Biogen (BIIB) – House lawmakers announced an inquiry into the process that approved Biogen’s Alzheimer’s treatment as well as its pricing. Biogen told Reuters it would cooperate with any inquiries it received from lawmakers.

MetLife (MET) – MetLife received an offer from Netherlands-based insurer NN Group for some of MetLife’s European businesses, though NN did not say which businesses were involved or how much it had offered.

MicroStrategy (MSTR) – The business analytics company’s stock gained 3.3% in premarket trading, continuing to trade in sync with bitcoin. MicroStrategy has several billion dollars of the virtual currency on its books.

Ocwen Financial (OCN),JOANN (JOAN) – Both stocks will be included in the small-cap Russell 2000 index as of today. Ocwen is a mortgage origination and servicing company, while JOANN is an arts and crafts retailer.

NRG Energy (NRG) – The energy provider’s stock was added to the Conviction Buy list at Goldman Sachs, which also increased its price target on the stock to $57 per share from $46. The stock closed at $38.49 per share Friday, and gained 1.8% in premarket trading.

精彩评论