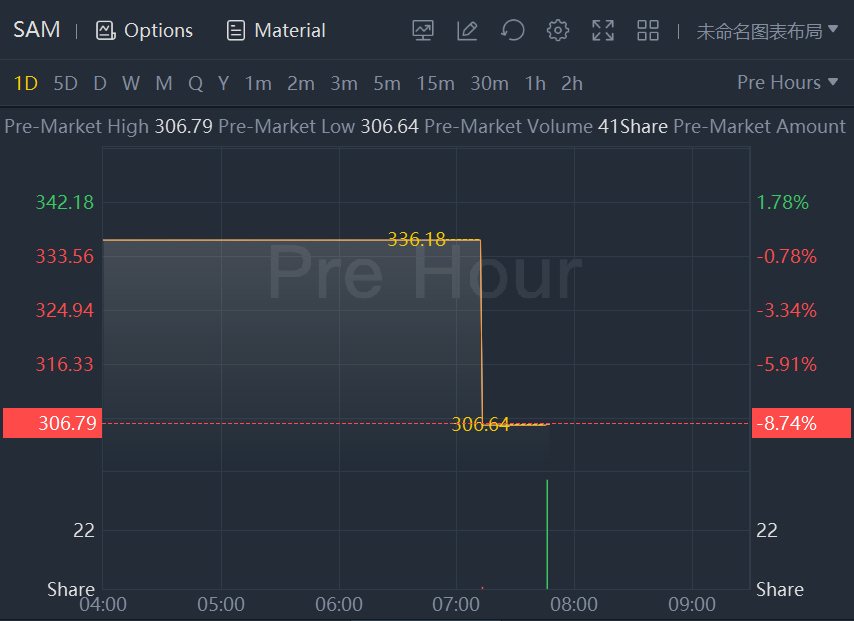

Boston Beer Co. shares dropped more than 8% in premarket trading Friday following the company’s reported Q2 results, with EPS of $4.31 coming in worse than the consensus estimate of $4.79.

Revenue for the beer brewer grew 2.2% year-over-year to $655 million, compared to the consensus estimate of $628.99 million, driven by pricing and strength in Twisted Tea shipments. Depletions and shipments decreased 7% and 1.1% year-over-year, respectively.

The company expects its full 2022-year EPS to be in the range of $6.00-$11.00 (vs. $11.00-$16.00 prior), compared to the consensus estimate of $11.67. The guidance excludes the impact of ASU 2016-09 and is highly sensitive to changes in volume projections, in particular related to the hard seltzer category and supply chain performance as well as inflationary impacts. As a result, the actual 2022 EPS could vary significantly from the current guidance.

精彩评论