WASHINGTON(Reuters)-U.S. consumer spending increased more than expected in August, but a downward revision to July data kept intact expectations that economic growth slowed in the third quarter as a resurgence in COVID-19 infections curbed demand for services.

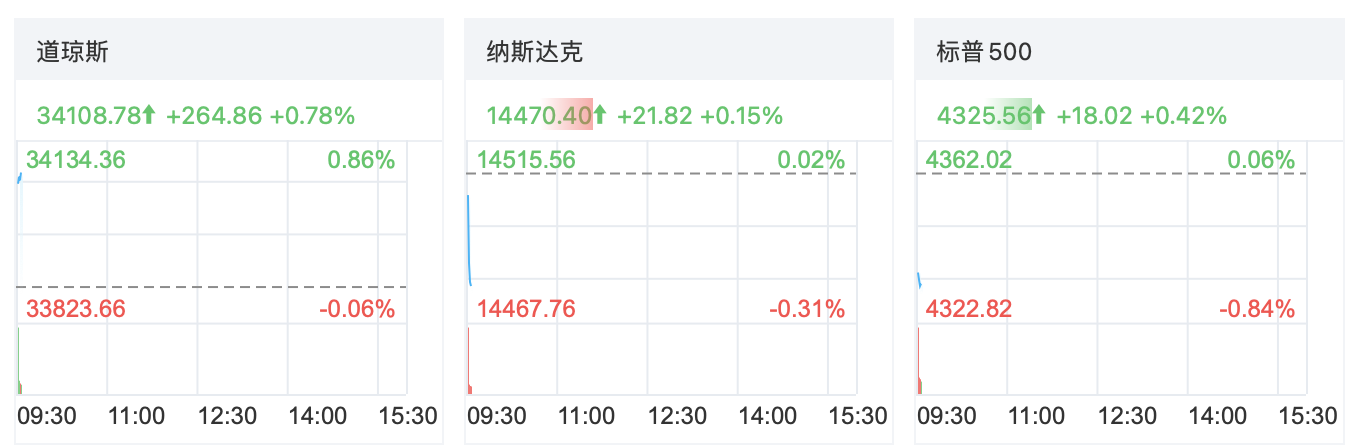

Dow added 260 points, or 0.8%. The S&P 500 and the Nasdaq Composite rose 0.5% and 0.2%, respectively.

The new drug from Merck appeared to boost travel stocks. Shares of Royal Caribbean and Las Vegas Sands added more than 1% in premarket trading. Southwest Airlines led a gain in airline stocks after JPMorganupgraded the stockand said most of the group was worth buying for a trade.

The 10-year Treasury yield fell back below 1.50% in early trading. Futures on the tech-heavy Nasdaq went into the green as yields fell.

The market just capped a tumultuous September as inflation fears, slowing growth and rising rates kept investors on edge. The S&P 500 finished the month down 4.8%, breaking a seven-month winning streak. The Dow and the Nasdaq Composite fell 4.3% and 5.3%, respectively, suffering their worst months of the year.

“A combination of slowing growth, less accommodative monetary policy, China headwinds, fading fiscal stimulus, and nagging supply chain bottlenecks all conspired to weigh on investor sentiment as we head into fall and 4Q21,” Chris Hussey, a managing director at Goldman Sachs, said in a note.

Consumer spending grew at a robust 12.0% annualized rate in the second quarter, accounting for much of the economy's 6.7% growth pace, which raised the level of gross domestic product above its peak in the fourth quarter of 2019. Growth estimates for the third quarter are below a 5.0% rate.

"Consumer momentum should improve in the months ahead, driving the economy closer to a full post-pandemic recovery and keeping inflation hot," said David Kelly, chief global strategist at JPMorgan Funds in New York.

Inflation maintained its upward trend in August. The personal consumption expenditures (PCE) price index, excluding the volatile food and energy components, climbed 0.3% after increasing by the same margin in July.

In the 12 months through August, the so-called core PCE price index increased 3.6%, matching July's gain.

The core PCE price index is the Federal Reserve's preferred inflation measure for its flexible 2% target. The Fed last week upgraded its core PCE inflation projection for this year to 3.7% from 3.0% back in June.

The U.S. central bank said it would likely begin reducing its monthly bond purchases as soon as November and signaled interest rate increases may follow more quickly than expected.

Fed Chair Jerome Powell told lawmakers on Thursday that he anticipated some relief from high inflation in the months ahead.

精彩评论