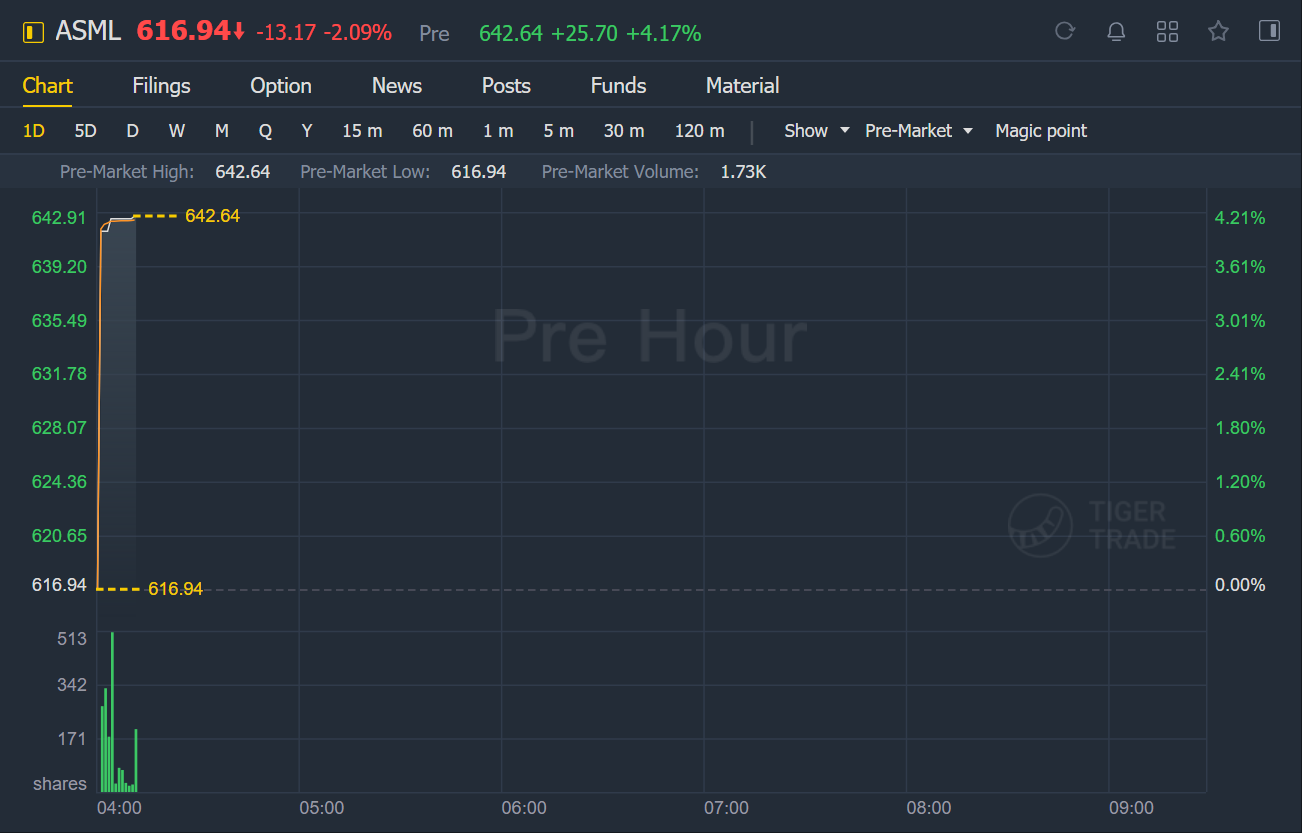

ASML stock jumped 4% in premarket action because ASML Q1 profit beats estimates, order book surges amid semiconductor shortage.

ASML Holding NV, one of the biggest suppliers to semiconductor companies, on Wednesday reported a better-than-expected net income for the first quarter and raised its full-year sales forecast, citing strong demand amid a global computer chip shortage.

The company now sees full year sales growth at 30%, up from its forecast of at least 10% in January. Sales in the first quarter were 4.36 billion euros.

"Compared to three months ago, we are seeing a significant increase in demand across all market segments and our product portfolio," said Chief Executive Officer Peter Wennink.

He noted that in addition to demand for the company's hardware, customers were buying utilization software in order to increase capacity as quickly as possible, which helped margins.

ASML customers include all major chipmakers, with TSMC, Samsung and Intel all recently having announced major expansion plans that will require ASML equipment.

ASML company posted a quarterly net profit of 1.33 billion euros ($1.60 billion), while analysts had expected 1.08 billion euros, on revenue of 4.02 billion euros, according to Refinitiv data.

Based in the southern Dutch town of Veldhoven, ASML is the dominant maker of lithography systems, enormous machines that focus beams of energy to help map out the tiny circuitry of computer chips and cost up to 200 million euros ($240 million) each.

The company said on Wednesday net bookings improved to 4.74 billion euros at March 31, up from 4.24 billion euros at year-end 2020. ASML said it is expanding supply chain capacity for its newest machines by 10% in 2022.

The bulk of ASML's sales are to Taiwan and South Korea, with China third and the U.S. fourth, though its sales to China face export licence restrictions as some of its machines are considered "dual use" technology with military applications.

Wennink said that in addition to consumer demand for electronics, recent plans by the U.S. and Europe to build up their computer chip industries in a quest for "technological sovereignty" are another driver of demand for its products, though it will likely waste some capital.

"Well, there is a beneficiary of that capital inefficiency and that's us."

ASML shares closed on Tuesday at 512.00 euros, up 29% so far this year.

($1 = 0.8315 euros)

精彩评论