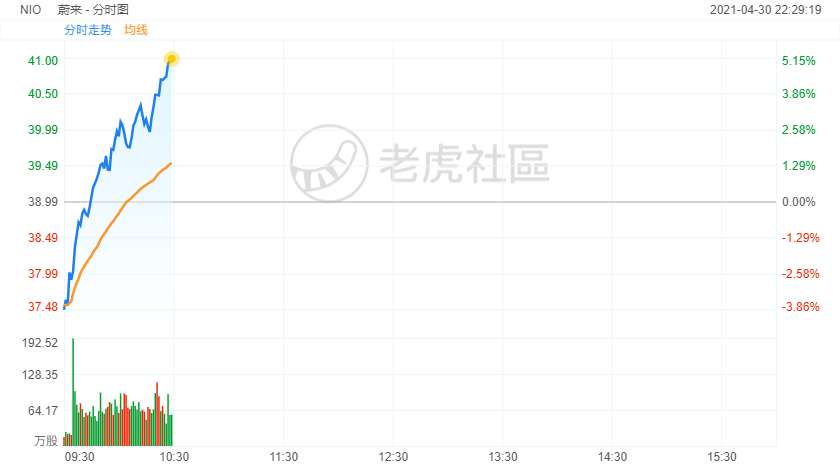

NIO rose more than 5%, after falling nearly 4% before.

NIO Earnings Looked a Lot Like Ford’s. What to Know.

Chinese electric vehicle maker NIO posted better than expected first quarter results. But the global automotive microchip shortage will hit production in the coming months.

NIO (ticker: NIO) is a highly valued, high-growth stock. Now NIO bulls have to decide whether solid earnings will trump the growth hiccup or whether the chip shortage can hurt the company in the long run.

NIO lost 23 cents a share on an adjusted, non-GAAP basis, from $1.2 billion in sales. Wall Street was looking for a comparable 84 cent loss from $1.1 billion in sales. NIO’s corporate gross profit margin came in at 19.5%, about 3 percentage points better than analysts projected and up from negative 12% a year ago. First quarter results look solid.

The stock isn’t moving though. NIO reported numbers at 5:30 p.m. eastern time and not a lot of stock is trading after hours. NIO shares closed down 5.3% in Thursday trading. TheS&P 500 and Dow Jones Industrial Average rose about 0.7%.

“NIO started the year of 2021 with a new quarterly delivery record of 20,060 vehicles in the first quarter,” said CEO William Bin Li in the company’s news release. “The overall demand for our products continues to be quite strong, but the supply chain is still facing significant challenges due to the semiconductor shortage.”

Management called the chip situation “very severe” on its conference call and projected 21,000 to 22,000 vehicle deliveries for the second quarter and sales of about $1.3 billion. The Street is projecting $1.2 billion in sales. But the unit delivery guidance is a little lower than Deutsche Bank analyst Edison Yu had expected.

For the full year, Yu is modeling 95,000 deliveries. With about 42,000 deliveries likely for the first half of 2021, the resolution of the global chip shortage will go a long way to deciding whether or not NIO can reach Yu’s number.

Yu rates NIO shares Buy and has a $60 price target for the stock.

The overall quarter feels a little like Ford Motor‘s (F) quarter, which was reported Wednesday. Ford reported sales and earnings far better than Wall Street projected. Unit volumes were below the company’s internal projections, but improving vehicle mix boosted sales beyond Street projections. Ford prioritized making higher-end vehicles in the face of limited chip supply. Looking ahead, Ford said the impact of the chip shortage would be at the high end of the company’s initial $1 billion to $2.5 billion cost guidance.

Ford stock close down 9.4% Thursday, the day after the Wednesday evening report. The NIO second-quarter guidance isn’t as surprising as Ford’s. And NIO doesn’t have full-year guidance. But calling NIO’s stock price reaction is difficult.

Ford trades for less than 7 times estimated 2022 earnings. NIO is expected to become profitable on a full-year basis in 2022. What’s more, NIO is worth about 50% more than Ford.

NIO’s conference call wrapped up about 10 p.m. eastern time. After the chip shortage, analysts focused questions on EV competition in China and NIO’s production expansion. NIO is putting in place capacity to produce hundreds of thousands of vehicles in coming years.

精彩评论