Ford Motor Company is having an impressive year, up over 125% year-to-date and sitting just below the $20 level heading into the holidays.

Even with such a strong year in 2021, option traders are bullish on Ford heading into the new year, both in the short and long term.

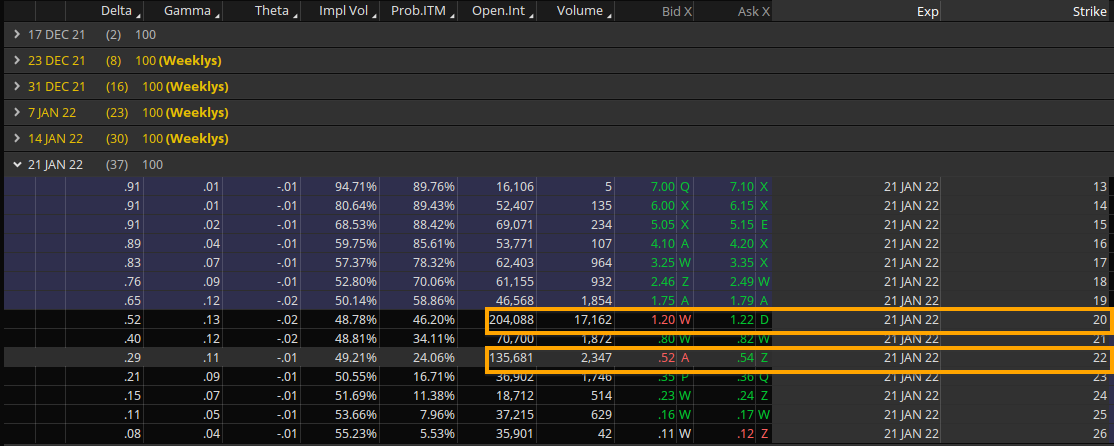

Looking at the shorter-term Jan. 21 expiry for next year, there has been a lot of call buying at the $20 strike, with over 17,000 options traded at that strike Wednesday. This is combined with the strong open interest at the $20 and $25 strikes with 204,000-plus options at the $20 STR and 135,000-plus at the $22 strike (image below).

Why It Matters:The heavy amount of volume and open interest will create liquidity at those strikes and could pull the stock to these upside targets for the Jan. 21 expiry next year.

While a portion of the $20 strikes could be call sellers collecting premium on their long stock holdings, it's less likely for the $22 strikes considering the premium is so low at 54 cents. Hence, it is more probable the open interest at the $22 strike is long calls.

What's Next:In the short term and into the Jan. 21 expiry for next year, Ford option traders are expecting a move above the $20 strike and potentially up to the $22 strike.

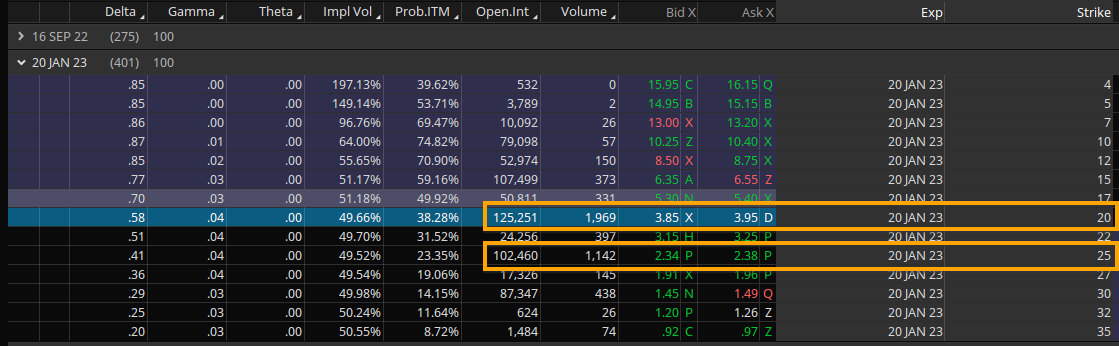

This bullish sentiment in the option flows is also captured in the Jan. 20 expiry for 2023, with heavy open interest at the $20 and $25 strikes with a potential "moonshot" target of $30 by the first month in 2023 (image below).

Meanwhile, should the stock head lower, there is strong volume and open interest between the $15 and $20 strikes, which could be potentially good levels for dip buying.

精彩评论