U.S. stock futures fell slightly on Tuesday night after the S&P 500 rose to another fresh record during the regular session.

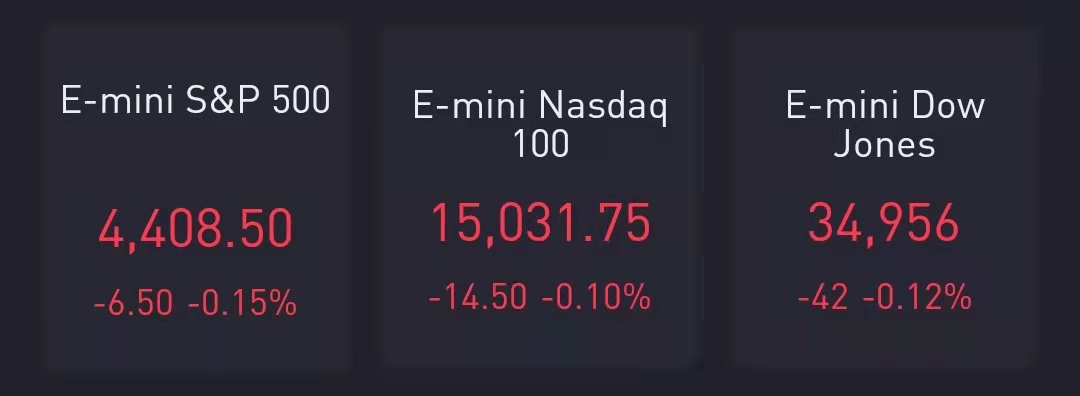

At 8:35 p.m. ET,Dow Jones Industrial Average futures fell 42 points, or 0.12%. S&P 500 and Nasdaq 100 futures dipped 0.15% and 0.10%, respectively.

Stocks making the biggest moves after hours:

Lyft (NASDAQ: LYFT)0.5% HIGHER;The ride sharing company’s reported quarterly results that beat analysts’ estimates. The company said demand continued growing in July even with heightened Covid-19 cases. Lyft reported a loss of 5 cents per share, compared to Wall Street forecasts of 24 cents per share.

Caesars Entertainment (NASDAQ: CZR)2.6% HIGHER;The gaming and hotel chain's quarterly earnings report. Caesars reported earnings of 34 cents per share, beating analysts’ estimates by 52 cents, and revenue of $2.5 billion, also beating expectations. The company attributed its growth to a strengthening of the Las Vegas market as well as continued strength in regional markets.

Activision Blizzard (NASDAQ: ATVI)6.1% HIGHER;The maker of “Call of Duty” and other video games saw its second-quarter earnings report. The company reported 91 cents per share and $1.92 billion in revenue, both of which beat analysts’ expectations. On Tuesday morning, the company announced president J. Allen Brack is leavingamid a harassment lawsuitagainst the firm.

Match Group(NASDAQ: MTCH)3.5% LOWER;Online dating company Match reported weaker than expected earnings, despite showing strong sales growth in the U.S. amid a recovering dating scene. Match — whose portfolio of brands includes Tinder, Hinge and OkCupid — reported 46 cents per share for the quarter, falling below Wall Street forecasts by 6 cents.

Zymergen (NASDAQ: ZY)67% LOWER; no longer expects product revenue in 2021, announces CEO transition.

Cerus (NASDAQ: CERS)13.5% HIGHER; reported Q2 EPS of ($0.09), in-line with the analyst estimate of ($0.09). Revenue for the quarter came in at $37.7 million versus the consensus estimate of $31.48 million. Cerus sees FY2021 revenue of $118-122 million, versus the consensus of $134.8 million.

LivePerson (NASDAQ: LPSN)12.4% LOWER; reported Q2 GAAP EPS of ($0.31), which may not compare to the analyst estimate of ($0.13). Revenue for the quarter came in at $119.6 million versus the consensus estimate of $113.3 million. LivePerson sees Q3 2021 revenue of $117-119 million, versus the consensus of $117.92 million. LivePerson sees FY2021 revenue of $460-471 million, versus the consensus of $465.33 million.

OraSure Technologies (NASDAQ: OSUR)8% LOWER; reported Q2 EPS of ($0.02), $0.06 worse than the analyst estimate of $0.04. Revenue for the quarter came in at $57.6 million versus the consensus estimate of $56.69 million. OraSure Technologies sees Q3 2021 revenue of $45-50 million, versus the consensus of $67.9 million. OraSure Technologies sees FY2021 revenue of $230 million, versus the consensus of $287.63 million.

InVitae (NYSE: NVTA)8% HIGHER; reported Q2 EPS of ($0.85), $0.20 worse than the analyst estimate of ($0.65). Revenue for the quarter came in at $116.3 million versus the consensus estimate of $108.3 million. InVitae sees FY2021 revenue of $475-500 million, versus the consensus of $463 million.

Paycom Software (NYSE: PAYC) 6.7% HIGHER; reported Q2 EPS of $0.97, $0.13 better than the analyst estimate of $0.84. Revenue for the quarter came in at $242.1 million versus the consensus estimate of $232.12 million. Paycom Software sees FY2021 revenue of $1.036-1.038 billion, versus the consensus of $1.02 billion.

RingCentral, Inc. (NYSE: RNG)3% HIGHER; reported Q2 EPS of $0.32, $0.04 better than the analyst estimate of $0.28. Revenue for the quarter came in at $379 million versus the consensus estimate of $359.51 million. RingCentral, Inc. sees FY2021 EPS of $1.28-$1.30, versus the consensus of $1.26. RingCentral, Inc. sees FY2021 revenue of $1.539-1.545 billion, versus the consensus of $1.51 billion.

Cardlytics (NASDAQ: CDLX)2% LOWER; reported Q2 EPS of ($0.39), in-line with the analyst estimate of ($0.39). Revenue for the quarter came in at $58.9 million versus the consensus estimate of $62.81 million. Cardlytics sees Q3 2021 revenue of $57-66 million, versus the consensus of $71 million.

精彩评论