US index futures were little changed as investors weighed the start of the earnings season against growing stagflation, tightening, energy

crisis.

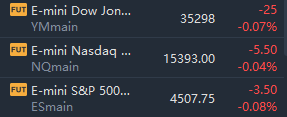

At 8:00 a.m. ET, Dow e-minis were down 25 points, or 0.07%, S&P 500 e-minis were down 3.5 points, or 0.08%, and Nasdaq 100 e-minis were down 5.5 points, or 0.04%.

- United Airlines (UAL US) gains 2% in U.S. premarket trading after the airline posted a narrower loss than expected despite the impact of the coronavirus delta variant. Cowen notes that 3Q was better than expected and also ahead of management’s last guidance from early September

- Novavax (NVAX US) shares fall as much as 25% in U.S. premarket trading after Politico reported a potential delay in registering its Covid-19 vaccine candidate with the U.S. Food and Drug Administration in connection with inadequate purity levels

- Vinco Ventures (BBIG US) shares slump 15% in premarket trading after the company reported the resignations of Chief Executive Officer Christopher Ferguson and Chief Financial Officer Brett Vroman

- Ford (F US) shares gain 1.7% premarket after Credit Suisse upgrades to outperform with joint Street-high target of $20 following a significant turnaround over the past year

- Stride (LRN US) gained 7.9% Tuesday postmarket after the education company forecast revenue for the full year that beat the highest analyst estimate

- WD-40 (WDFC US) sank 10% in postmarket trading after forecasting earnings per share for 2022 that missed the average analyst estimate

- Omnicom (OMC US) fell 3% in postmarket trading after third quarter revenue fell short of some analyst estimates

- Canadian National (CNI US) U.S.-listed shares rose 4.6% in postmarket trading after reporting adjusted earnings per share for the third quarter that beat the average analyst estimate

- Akero Therapeutics (AKRO US) shares rose as much as 12% in Tuesday extended trading after co. said the U.S

In rates, treasuries were narrowly mixed and off lows reached during Asia session after being led higher during European morning by gilts,

where short maturities outperform. The 10-year TSY yield touched 1.67%, the highest level since May. The treasury futures rally stalled after a block sale in 10-year contracts, apparently fading strength.

In commodities, crude futures drift lower. WTI drops 0.9% near $82.20, Brent is 1% lower holding above $84. Spot gold slowly extends Asia’s gains, rising $9 to trade near $1,780/oz. Most base metals are under pressure with LME copper and aluminum underperforming peers.

In cryptocurrencies, bitcoin stood at $64,068, near its all-time peak of $64,895 as the first U.S. bitcoin futures-based exchange-traded fund began trading on Tuesday.

精彩评论