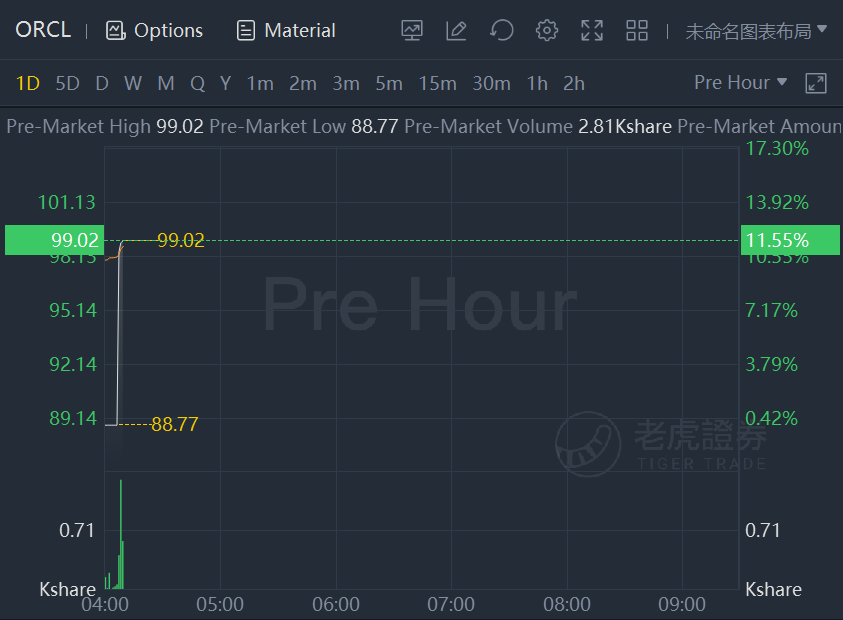

Oracle stock spiked more than 11% in premarket trading after the enterprise software giant posted better-than-expected financial results for its fiscal second quarter ended Nov. 30.

For the quarter, Oracle reported revenue of $10.4 billion, up 6% from a year ago, and ahead of both the company’s guidance range of 3% to 5% growth, and the Street consensus forecast for $10.2 billion. It was the company’s best quarter of growth since 2018.

Non-GAAP profits were $1.21 a share, up 14% from a year ago, and a dime ahead of the Street consensus at $1.11 a share. Oracle’s guidance had been for profits of $1.09 to $1.13 a share. The company said cloud service and license support was $7.6 billion, up 6%. Cloud license and on-premise license revenues were up 13% to $1.2 billion.

Under generally accepted accounting principles, the company lost 46 cents a share, reflecting a judgment tied to a 10-year old legal dispute related to the hiring of the late Mark Hurd as the company’s CEO.

Oracle CEO Safra Catz said in a statement that the company saw 22% growth in its infrastructure and applications cloud business. Fusion ERP, the company’s financial software for large businesses, saw revenue growth of 35%, while NetSuite ERP, which serves smaller customers, grew 29%. Fusion HCM, the company’s HR software application, was up 25%. Oracle Cloud Infrastructure consumption revenue was up 86%.

Oracle also announced a new $10 billion stock-repurchase authorization. In the quarter, the company bought back $7 billion of stock. Catz noted that the company over the last 10 years has repurchased 47% of its stock at an average price about half of the current level.

On a conference call with analysts on Thursday afternoon, Catz said Oracle had a “fantastic quarter,” with “broad-based outperformance across the company.” She noted that the better-than-expected results came despite a currency headwind of $100 million in revenue and a penny a share in profits.

Catz said the company’s fiscal 2022 revenue growth continues to accelerate from the 2021 level. Oracle, she said, is being driven by growth in its cloud business in the mid-20 percentage range, accelerating from the Q2 level.

For the fiscal third quarter, Catz said, the company sees growth of 6% to 8% in constant currency, and 3% to 5% as reported, and profits of $1.14 to $1.18 as reported, or $1.19 to $1.23 in constant currency. Catz said the company sees a currency headwind in the quarter of 3% for revenue and 5 cents for earnings per share.

精彩评论