Qualcomm shares are rising in premarket trading Thursday after the provider of mobile phone chips posted better-than-expected quarterly results and offered strong guidance for its current quarter, driven by strong smartphone demand.

For the fiscal fourth quarter ended Sept 26, Qualcomm reported revenue of $9.26 billion, up 43% from a year ago. That’s above the company’s guidance range of $8.4 billion to $9.2 billion and the Wall Street consensus forecast of $8.86 billion.

Adjusted non-GAAP profits were $2.9 billion, or $2.55 a share, also exceeding both the company’s guidance range of $2.15 to $2.35 and analysts’ consensus at $2.26 a share. Under generally accepted accounting principles, the company earned $2.45 a share.

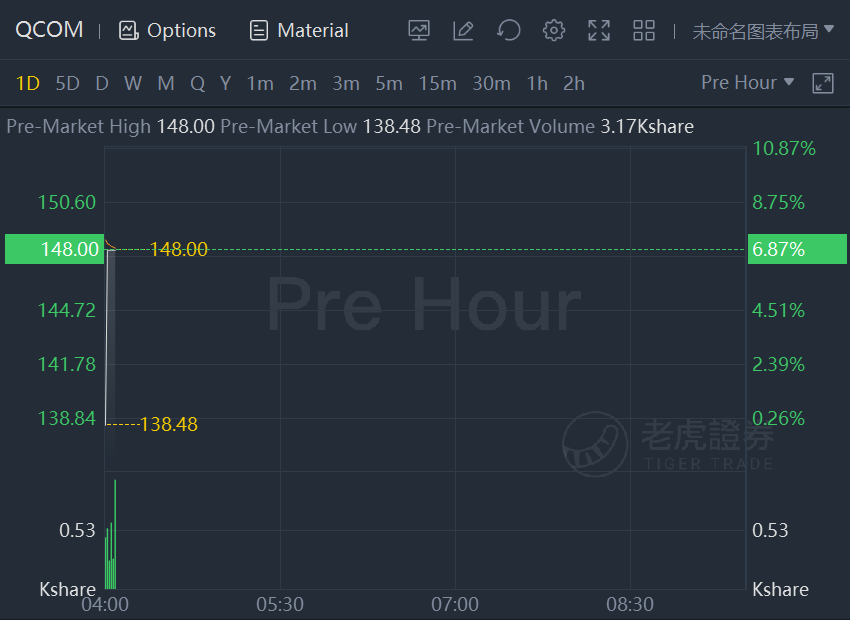

Qualcomm shares are up nearly 7% in premarket trading.

Revenue in the company’s chip business, known as QCT, was driven by the company’s handset segment, which grew 56%, to $4.68 billion. The company’s “RF front end” business, which includes radio chips used in mobile devices, expanded 45% in the quarter. The IoT, or internet of things, segment grew 66%, while the automotive segment increased 44%. Overall QCT revenue was up 56%, while the company’s licensing business, known as QTL, grew 3%.

In a statement, Qualcomm CEO Christiano Amon noted that the company beat its 2021 financial goals laid out at the company’s 2019 analyst day for both revenue growth and margin expansion. “We are well positioned to continue to lead in mobile and enable the digital transformation of industries with our broad portfolio of relevant technologies,” he said. “Our results across RF front-end, Automotive and IoT attest to the success of our technology road map and revenue diversification strategy.”

For the full fiscal year, the company posted revenue of $33.47 billion, with non-GAAP profits of $9.8 billion or $8.54 a share, up from $21.65 billion and $4.19 a share a year earlier.

Qualcomm sees fiscal first quarter revenue of between $10 billion and $10.8 billion, with non-GAAP profits of between $2.90 and $3.10 a share. The Wall Street consensus had called for revenue of $9.7 billion and profits of $2.60 a share. The company now sees total calendar 2021 global handset shipments ranging from 500 to 550 million, narrowing the range from a previous forecast of 450 million to 550 million.

Qualcomm also said it bought back $771 million of stock in the quarter, boosting the total for the full year to $3.4 billion.

精彩评论