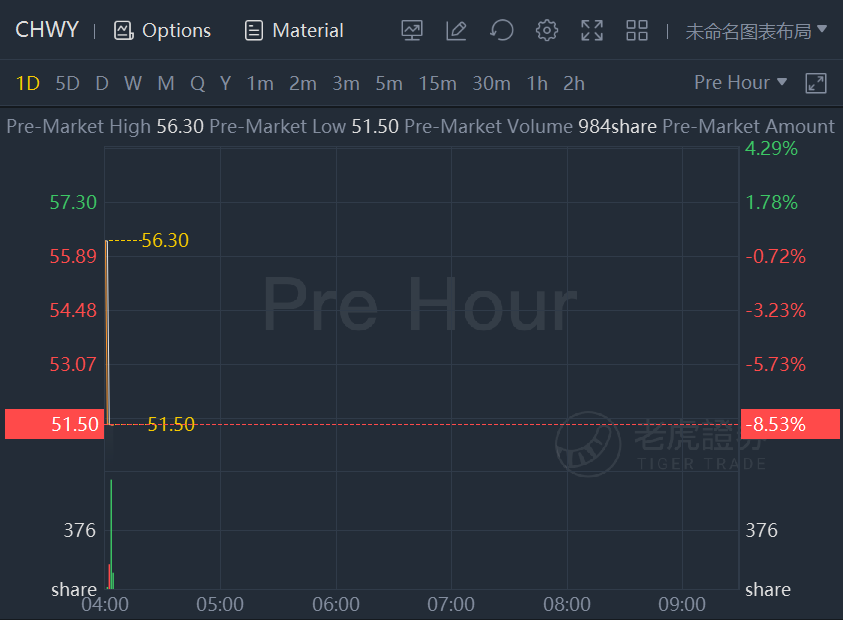

Chewy shares tumbled 8.5% in premarket trading after the online food products retailer posted disappointing results for its fiscal third quarter ended Oct. 31, reflecting higher-than-expected supply chain and labor costs.

For the quarter, Chewy posted revenue of $2.21 billion, up 24% from a year earlier, and right in line with both guidance and Street estimates. But the company posted a loss for the quarter of 8 cents a share, wider than the Street consensus forecast of a loss of 4 cents a share. Adjusted Ebitda, or earnings before interest, taxes, depreciation and amortization was $6 million, up 9.9% from a year ago. Adjusted Ebitda margin was flat at 0.3%. Active customers were up 14.7% from a year ago, while net sales per active customer were up 15.4%.

The company said profitability measures in the quarter reflected “the impact of ongoing supply chain disruptions, labor shortages, and higher inflation.”

Chewy sees revenue for the fiscal fourth quarter of $2.4 billion to $2.44 billion; at the midpoint, that’s a hair below the old Street consensus at $2.43 billion.

The company now sees full-year fiscal 2022 revenue of $8.9 billion to $8.94 billion, narrowing the range from a previous forecast of $8.9 billion to $9 billion. Chewy also said it now sees its adjusted Ebitda margin flat for the year with fiscal 2020. Previous guidance called for margins to increase by 0.8 to 1.2 percentage points from a year earlier.

精彩评论