- Stocks to rise after Dow, S&P 500 had best month since November.

- 10-year Treasury yield holds around 1.72% ahead of jobless claims data.

- J&J, Emergent BioSolutions, Micron Technology & more making the biggest moves in the premarket.

(April 1) Stock futures traded higher Thursday morning after a record-setting day on Wall Street.

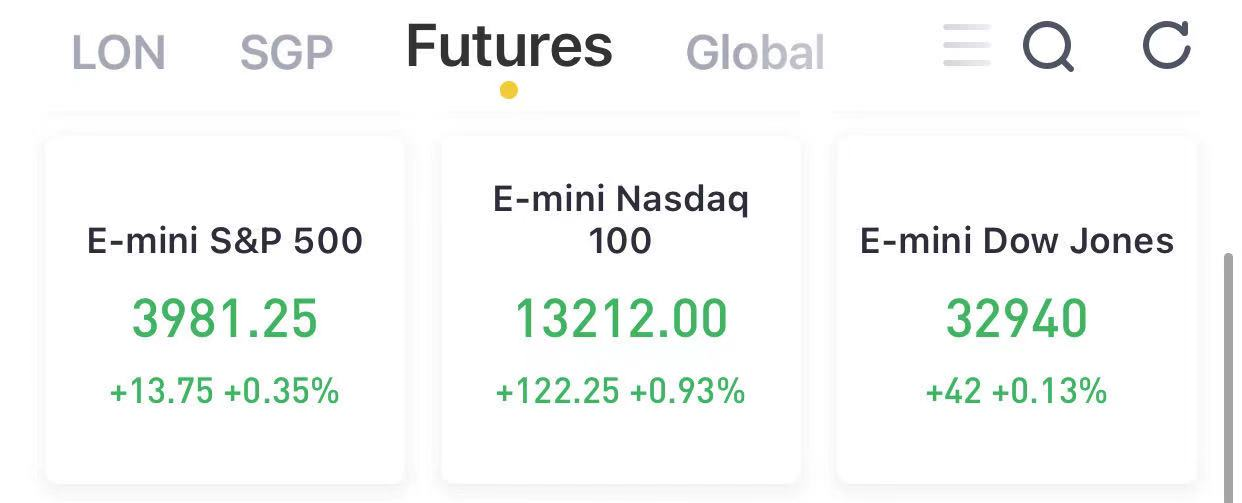

At 8:00 a.m. ET, Dow e-minis were up 42 points, or 0.13%, S&P 500 e-minis were up 13.75 points, or 0.35%, and Nasdaq 100 e-minis were rose 122.25 points, or 0.93%.

Thursday's session marks the first of the second quarter and of April. Historically, the month has been fortuitous for equities. Stocks have closed April higher in 14 out of the past 15 years, and since 1950, it has been the second best month for stocks, according to an analysis by Ryan Detrick, LPL Financial chief market strategist.

Heading into the second quarter, stock leadership has tilted strongly in favor of cyclical and value stocks, which have earnings most closely tethered to the broad-based reopening of business across the U.S. economy. The energy, financials and industrials sectors have outperformed in the S&P 500 for the year-to-date, while last year's winners – like the information technology and communication services sectors – have lagged by comparison. Many analysts think this trend will continue into the coming months.

"I think we’re going to see more of the same in terms of market leadership. This is an environment in which the economy is likely to accelerate,” Kristina Hooper, Invesco chief global market strategist, told Yahoo Finance. “And I think that means that we’ll see continued outperformance of areas like energy, like financials, like consumer discretionary, material, industrials — those areas of the stock market that are most sensitive to the economy.”

Stocks making the biggest moves in the premarket: J&J, Emergent BioSolutions, Micron Technology & more

1) Johnson & Johnson(JNJ) – J&J said a batch of its Covid-19 vaccine that came from a Baltimore factorydid not meet quality standardsand will not be distributed. The company said the problem stemmed from a quality issue for a vaccine ingredient made byEmergent BioSolutions(EBS). J&J fell 1.1% premarket, while Emergent BioSolutions tumbled 8.5%.

2) Pfizer(PFE) – New data released by the drugmaker and partnerBioNTech(BNTX)showed 91% efficacyfor its Covid-19 vaccine after six months. Pfizer edged higher by 0.3% in premarket trading, while BioNTech was up 1.1%.

3) CarMax(KMX) – The auto retailer reported quarterly earnings of $1.27 per share, with revenue essentially in line with forecasts. CarMax also announced it would acquire the remaining part of Edmunds that it didn’t already own, in a cash-and-stock deal valuing the auto information provider at $404 million. CarMax shares slid 3.5% in premarket action.

4) Micron Technology(MU) – The computer chip maker reported quarterly profit of 98 cents per share, beating consensus estimates by 3 cents a share. Revenue came in slightly above Wall Street forecasts. The company also issued an upbeat forecast amid elevated demand for semiconductors. Separately, The Wall Street Journal reported Micronis exploring a deal for Kioxiathat could value the Japanese chip maker at around $30 billion. Micron shares jumped 4.5% in the premarket.

5) Abbott Laboratories(ABT) – The Food and Drug Administration approved Abbott’s Covid-19 rapid antigen test for over-the-counter sales and use at home for people without current Covid symptoms. The retail price is still undetermined, but a company spokeswoman told Reuters the tests will be sold to retailers for less than $10 each. At the same time, the FDA also approved an at-home test for Covid-19 made by diagnostics companyQuidel(QDEL).

6) Exxon Mobil(XOM) – The energy giant released data in a Securities and Exchange Commission filing that points to the possibility of the company’s first profit in five quarters. Raymond James analyst Justin Jenkins said the data point to a profit of $2.55 billion, or 60 cents per share, with Exxon benefiting from higher oil and gas prices.

7) FuboTV(FUBO) – The live streaming sports TV platform announced an agreement to carry all non-nationally televised Chicago Cubs games this season. FuboTV shares jumped 4.8% in premarket action.

8) Nio(NIO) – The China-based electric vehicle maker said it delivered 7,257 vehicles in March, a 373% increase over the same month last year. Nio surged 5.8% in premarket trading.

9) Sherwin-Williams(SHW) – The paint maker’s 3-for-1 stock split – announced on March 2 – is effective as of today. It’s the first time Sherwin-Williams has split its stock since 1997. Sherwin-Williams gained 1.2% in the premarket.

10) Taiwan Semiconductor(TSM) – The semiconductor maker will invest $100 billion over the next three years to increase manufacturing capacity at its plants, in a move to deal with increased demand and a worldwide shortage of chips. Taiwan Semi rose 2.1% in premarket action.

Big News

1. Stocks to rise after Dow, S&P 500 had best month since November

U.S. stock futureswere beginning April higher after theS&P 500closed out itsbest month since Novemberwith a gain of 4.2%. The index hit an all-time intraday high Wednesday but it failed to close at a record.

TheDow, which closed at a record Monday, saw its second modest decline in a row Wednesday. But the 30-stock average, like the S&P 500, had its best month since November, posting a March gain of 6.6%. For the quarter, the blue-chip Dow and the S&P 500 rose 7.8% and 5.8%, respectively, for their fourth positive quarter in a row.

TheNasdaqbroke a two-session losing streak, with a 1.5% gain Wednesday. The tech-heavy Nasdaq has recently been the relative underperformer as technology stocks are especially sensitive to rising market interest rates because they depend on borrowing money cheaply to invest in future growth. For March, the index gained just 0.4%. For the quarter, it gained 2.8%.

2. 10-year Treasury yield holds around 1.72% ahead of jobless claims data

The 10-year Treasury yield, which is used as a benchmark for many corporate and consumer loan rates, hit another new 14-month high over 1.77% on Tuesday. Two days later, it traded lower butheld around 1.72%ahead of the government's 8:30 a.m. ET release of data on weekly jobless claims. Economists expect 675,000 new filings for unemployment benefits last week. That would be 9,000 fewer than theprior week, when initial claims tumbled to their lowest level in more than a year. The Labor Department is set to issue its monthly employment report Friday despite the Good Friday closure of the stock market.

What to watch today

Economy

- 8:30 a.m. ET: Initial jobless claims,week ended March 27 (675,000 expected; 684,000 during prior week)

- 8:30 a.m. ET: Continuing claims,week ended March 30 (3.750 million expected, 3.870 million during prior week)

- 9:45 a.m. ET: Markit U.S. Manufacturing PMI,March final (59.2 expected, 59.0 in prior print)

- 10:00 a.m. ET: Construction spending,month-over-month, February (-0.9% expected, 1.7% in January)

- 10:00 a.m. ET: ISM Manufacturing,March (61.5 expected, 60.8 in February)

Earnings

- 6:50 a.m. ET: CarMax (KMX)is expected to report adjusted earnings of $1.26 per share on revenue of $5.19 billion

精彩评论