U.S. stock index futures rose on Tuesday as Apple shares edged higher after sharply dropping in the previous session, while investors focused on another round of earnings to gauge the strength of corporate America.

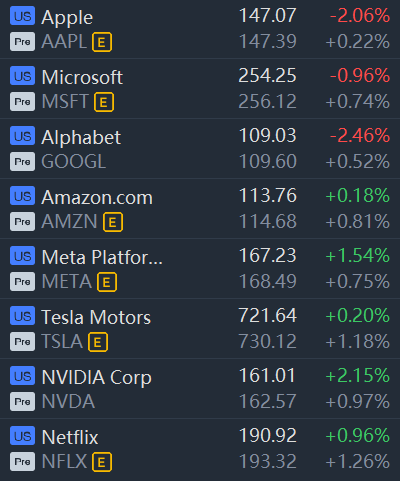

Shares of the iPhone maker rose 0.2% in premarket trading on Tuesday, along with other high-growth stocks including Tesla Inc, Microsoft Corp, Meta Platforms Inc and Amazon.com Inc.

Market Snapshot

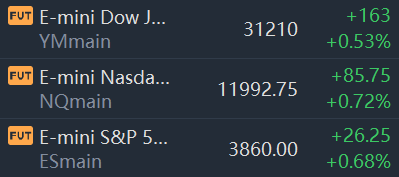

At 7:45 a.m. ET, Dow e-minis were up 163 points, or 0.53%, S&P 500 e-minis were up 26.25 points, or 0.68%, and Nasdaq 100 e-minis were up 85.75 points, or 0.72%.

Pre-Market Movers

IBM (IBM) – IBM slid 6.3% in premarket action despite beating top and bottom line estimates for the second quarter. IBM warned of a $3.5 billion impact to earnings because of the strong U.S. dollar.

Johnson & Johnson (JNJ) – The health-care company reported quarterly profit of $2.59 per share, 5 cents a share above estimates. Revenue beat forecasts as well. J&J cut its full-year guidance, however, due to the strength of the U.S. dollar rather than operational issues.

Lockheed Martin (LMT) – U.S. weapons maker Lockheed Martin Corp lowered its 2022 revenue and earnings per share targets on Tuesday after F-35 fighter jet sales fell amid pandemic-related headwinds and as losses at its venture arm and other one-time charges piled up. Lockheed Martin shares dropped 4% in premarket trading.

Hasbro (HAS) – The toy maker topped estimates by 21 cents a share, with quarterly earnings of $1.15 per share. Revenue was very slightly below forecasts. Hasbro said it continues to take steps to cut costs, and to ensure that it has sufficient holiday season inventories.

Boeing (BA) – Boeing is near a deal to sell a small number of 787 Dreamliners to aircraft leasing company AerCap Holdings, according to people familiar with the matter who spoke to The Wall Street Journal. Boeing added 1.1% in premarket action.

Halliburton (HAL) – The oilfield services company’s stock rose 1.8% in the premarket after beating top and bottom line estimates for the second quarter. Profit was up nearly 41% from a year earlier as the jump in oil prices spurred a significant increase in drilling demand.

NCR (NCR) – NCR surged 11.7% in the premarket after The Wall Street Journal reported that private-equity firm Veritas Capital was in exclusive talks to buy the financial technology provider.

Sunrun (RUN), Sunnova Energy (NOVA) – Piper Sandler downgraded both solar company stocks to “neutral” from “overweight,” noting both the failure of President Joe Biden’s “Build Back Better” program to pass Congress as well as cash flow prospects in a potentially recessionary environment. Sunrun fell 3.3% in premarket trading, while Sunnova lost 2.8%.

Cinemark (CNK) – The movie theater operator’s stock gained 5.4% in premarket action after Morgan Stanley upgraded it to “overweight” from “equal-weight.” Morgan Stanley said the return of consumers to theaters represents a trend not reflected in the stock’s price.

Truist Financial (TFC) – The banking company’s stock gained 1.9% in premarket trading after reporting better-than-expected profit and revenue for its latest quarter. Truist said its results reflected strong loan growth and an expansion of its net interest margins.

Market News

Apple to Slow Hiring and Spending for Some Teams Next Year

Apple Inc. plans to slow hiring and spending growth next year in some divisions to cope with a potential economic downturn, according to people with knowledge of the matter.

The decision stems from a move to be more careful during uncertain times, though it isn’t a companywide policy, said the people, who asked not to be identified because the deliberations are private. The changes won’t affect all teams, and Apple is still planning an aggressive product launch schedule in 2023 that includes a mixed-reality headset, its first major new category since 2015.

Still, the more cautious tone is notable for Apple, a company that has generally beat Wall Street predictions during the Covid-19 pandemic and has weathered past economic turmoil better than many peers.

Twitter Claims Musk Is "Slow-Walking" Trial Over $44 Bln Deal

Twitter Inc on Monday accused Elon Musk of trying to "slow walk" the company's lawsuit to hold him to his $44 billion takeover and urged a September trial to ensure deal financing remains in place, according to a court filing.

"Millions of Twitter shares trade daily under a cloud of Musk-created doubt," the company wrote. "No public company of this size and scale has ever had to bear these uncertainties."

Twitter has sued Musk and asked a Delaware judge to order him to complete the merger at the agreed price of $54.20 per share.

Buffett's Berkshire Buys More Occidental Petroleum, Edges Closer to 20% Stake

Warren Buffett's Berkshire Hathaway Inc on Monday said it has bought another 1.94 million shares of Occidental Petroleum Corp, putting it nearer a threshold where it could record some of the oil company's earnings with its own.

Berkshire's latest purchases from July 14 to July 16 cost $112 million, and gave Buffett's conglomerate a 19.4% Occidental stake worth about $10.9 billion, regulatory filings show.

精彩评论