U.S. stocks fell on Thursday as the market continued to struggle to reach a new all-time high amid heightened speculative trading activity, while investors shrugged off better-than-expected labor market data.

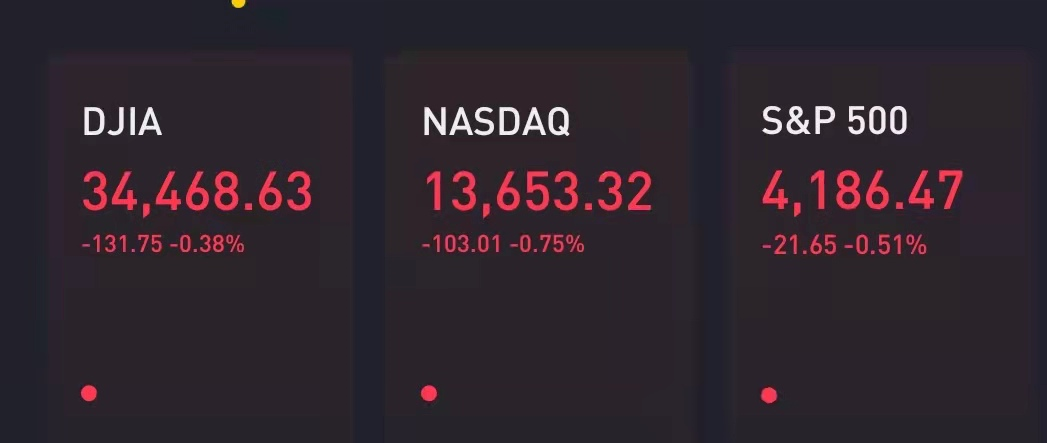

The Dow Jones Industrial Average slipped 132 points. The S&P 500 declined 0.5% and the tech-heavy Nasdaq Composite shed 0.8%.

The benchmark S&P 500 sits about 1% from its all-time high reached earlier last month, but it has been stuck around these levels for about the last two weeks. The S&P 500 is up 11% this year so far.

Stocks that have run up in anticipation of the economy reopening this year were weak. Marriott, Carnival and Gap all traded in the red.

Shares of General Motors rose 3% after the company said it expects its results for the first half of 2021 to be “significantly better” than its prior guidance.

Most of the early market action centered on meme stock and theater chain AMC Entertainment. The stock was up as much as 20% in premarket trading Thursday after practically doubling in the prior session. AMC later wiped out gains and fell 10% after the movie theater chain said it may offer and sell from time to time up to 11.55 million shares of its Class A common stock.

Another meme stock BlackBerry rallied 27% on Thursday, bringing its week-to-date gains to about 90%.

Reminiscent of what occurred earlier this year, retail traders rallying together on Reddit have triggered a short squeeze in the stock. On Wednesday, short-sellers betting against the stock lost $2.8 billion as the shares surged, according to S3 Partners. That brings their year-to-date losses to more than $5 billion, according to S3. Short sellers are forced to buy back the stock to cut their losses when it keeps rallying like this.

The meme stock bubble in GameStop earlier this year weighed on the market a bit as investors worried it meant too much speculative activity was in the stock market. As losses in hedge funds betting against the stock mounted, worries increased about a pullback in risk-taking across Wall Street that could hit the overall market. AMC's latest surge did not appear to be causing similar concerns so far, but that could change if the stock keeps going higher and triggers similar moves in other stocks.

On the date front, private job growth for May accelerated at its fastest pace in nearly a year as companies hired nearly a million workers, according to a report Thursday from payroll processing firm ADP.

Total hires came to 978,000 for the month, a big jump from April’s 654,000 and the largest gain since June 2020. Economists surveyed by Dow Jones had been looking for 680,000.

Meanwhile, the latest jobless claims data came in slightly above estimates. First-time claims for unemployment benefits for the week ended May 29 totaled 385,000, versus a Dow Jones estimate of 393,000.

The market may be on hold before the release of the jobs report Friday, which is likely to show an additional 671,000 nonfarm payrolls in May, according to economists polled by Dow Jones. The economy added 266,000 jobs in April.

精彩评论