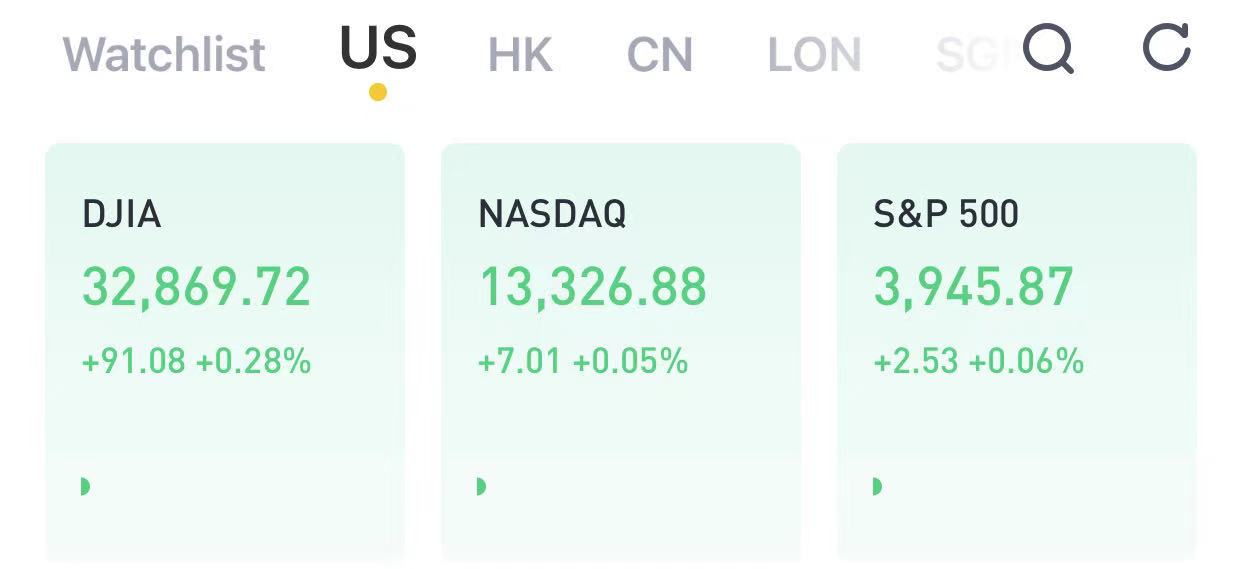

(March 15) Dow opens higher as blue-chip index looks to add to record.

U.S. stock index futures rose on Monday, indicating new record highs at the opening bell for the Dow and S&P 500.

Dow futures gained 80 points, or 0.24%. S&P 500 futures advanced 0.05%, while Nasdaq 100 futures were up 0.1%.

Stocks that will benefit most from a swift economic comeback from the pandemic led the gains in premarket trading. American Airlines and United Airlines shares were both up more than 2% in premarket trading. Boeing, Gap and various energy stocks were also higher.

The U.S. 10-year Treasury hit its highest level in more than a year on Friday. The benchmark Treasury note rate reached 1.642%, its highest level since February 2020.

The10-year Treasury yieldwas trading flat to slightly lower early Monday.

“Investors will have to continually grapple with the anxiety about economic overheating and Fed tightening that has gripped markets in recent weeks,” wrote David Kostin, Goldman’s chief U.S. equity strategist, in a note. “We believe equity valuations should be able to digest 10-year yields of roughly 2% without much difficulty.”

Stocks rose last week with the Dow Jones Industrial Average rising 4% and the S&P 500 gaining 2.6%. The S&P 500 and the Dow both closed at record highs Friday.

The Nasdaq Composite advanced 3% last week, despite a sell-off on Friday spurred by rising interest rates. The jump in bond yields has challenged growth stocks in recent weeks and sent investors into cyclical pockets of the market. The Nasdaq is up less than 1% this month, while the Dow and S&P are up 6% and 3.5%, respectively.

The small-cap benchmark Russell 2000 surged more than 7% last week as investors rotated into smaller stocks that benefit from a sharp economic comeback.

Last week, investors cheered the $1.9 trillion stimulus package that President Joe Biden signed into law. The IRS started processing $1,400 direct payments on Friday and checks started hitting bank accounts over the weekend. The bill will also put nearly $20 billion into Covid-19 vaccinations and $350 billion into state, local and tribal government relief.

Investors will be gearing up for Wednesdaywhen the Federal Reserve will deliver its decision on interest rates. The bond market in the coming week will likely take its cues from the Fed.

The central bank is expected to acknowledge much better growth in the economy. Bond pros are also watching to see whether Fed officials will tweak their interest rate outlook, which now does not include any rate hikes through 2023.

On the vaccine front, Biden announced last week that he would direct states to make all adults eligible for the vaccine by May 1. Biden also set a goal for Americans to be able to gather in person with their friends and loved ones in small groups to celebrate the Fourth of July.

精彩评论