Chinese food delivery giant Meituan reported a second consecutive quarterly loss on Friday, weighed down by its expansion into the community group-buying business that relies heavily on subsidies.

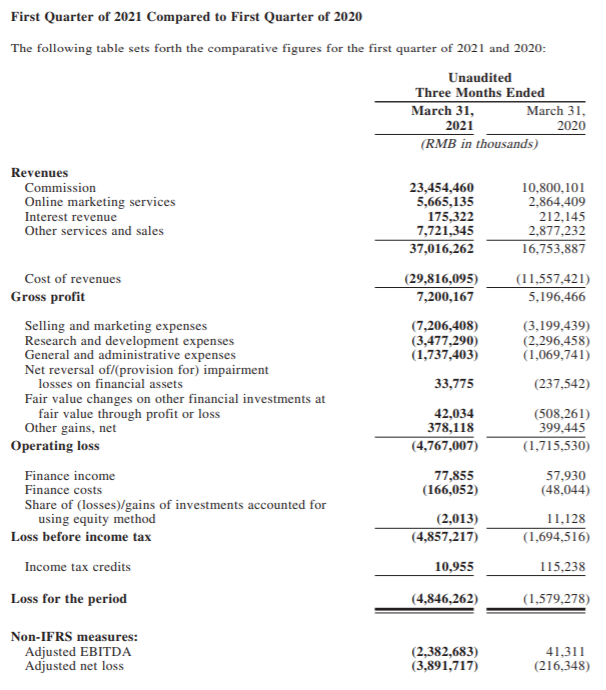

It reported a loss of 4.85 billion yuan ($762.4 million) in the period versus a 1.58 billion yuan loss a year earlier, when its business was hit by nationwide coronavirus curbs.

Company Financial Highlights

Thanks to the PRC government’s effective measures to contain the COVID-19 pandemic in China, company businesses experienced strong recovery during the first quarter of 2021.

Total revenues increased by 120.9% in the first quarter of 2021 to RMB37.0 billion from RMB16.8 billion for the same period of 2020. Company food delivery and in-store, hotel & travel segments posted stellar growth, realizing an aggregate operating profit by segment of RMB3.9 billion in the first quarter of 2021, an increase from RMB0.6 billion for the same period of 2020.

Operating loss for the new initiatives and others segment expanded as company accelerated our investment effort to provide services with more breadth. Both adjusted EBITDA and adjusted net loss for the first quarter of 2021 decreased year-over-year to negative RMB2.4 billion and RMB3.9 billion, respectively. net cash flows used in operating activities decreased to RMB4.4 billion in the first quarter of 2021 from RMB5.0 billion for the same period of 2020. Company had cash and cash equivalents of RMB17.8 billion and short-term treasury investments of RMB35.3 billion as of March 31, 2021, compared to the balances of RMB17.1 billion and RMB44.0 billion as of December 31, 2020, respectively.

During the first quarter of 2021, Meituan ramped up our investments in new initiatives. Retail, especially the community e-commerce business, continued to be our largest investment area. For the first quarter of 2021, revenues from the new initiatives and others segment increased by 136.5% year over year to RMB9.9 billion, primarily driven by the growth in retail businesses, B2B food distribution services, and ride-sharing services. Operating loss for the segment increased both year over year and quarter over quarter to negative RMB8.0 billion in the first quarter of 2021, while operating margin decreased to negative 81.6%.

精彩评论