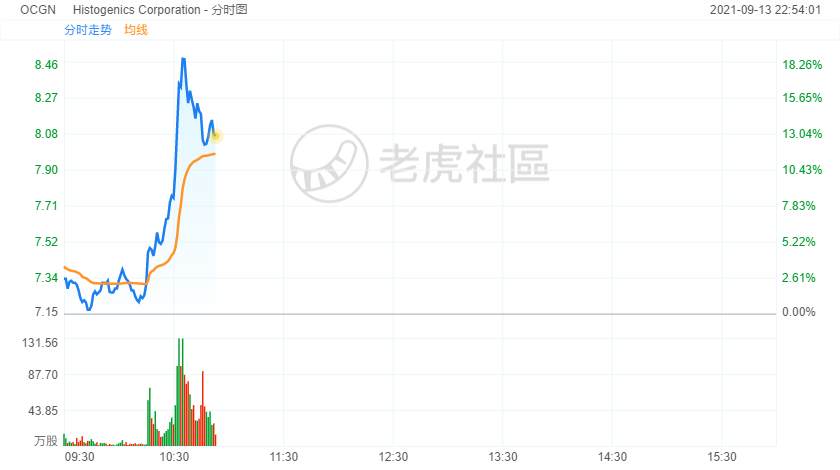

Ocugen shares surged more than 13% in Monday morning trading.

Various companies have been engaged in producing COVID-19 vaccines since the onset of the pandemic.

Clinical-stage biotech firm Ocugen (OCGN) joined the race in December 2020, announcing its partnership with India-based Bharat Biotech. Ocugen collaborated with the Indian biotech company to jointly develop Covaxin.

The announcement helped its stock to propel from under 30 cents a share to a stunning, eventual high of $18.77 a share in February. However, prices plummeted to nearly $9 per share in the next month.

As rival companies came forward with their vaccines while Ocugen lagged behind, the stock started to bleed.

However, OCGN stock is once again witnessing an upward move. Here’s a detailed analysis to find out what’s really happening with the stock. I’m neutral on Ocugen.

Delta Variant Concerns Pushing OCGN Stock up

Newly discovered variants of COVID-19 have been a major cause of concern lately. These variants are more infectious, and resistant, to the already existing COVID-19 vaccines. The Delta variant is one such dangerous strain that has caught the attention of people worldwide.

This new variant has piqued global interest in Ocugen, and its Covaxin. Notably, Covaxin is yet to receive approval from FDA. However, the once-forgotten OCGN stock is again back in the discussion, with stock prices moving up by a decent 8.5% in August.

According to many analysts, value investors aren’t interested in this stock. Rather, it is mainly retail investors who are eyeing Ocugen for some quick profit.

Short-term Catalyst behind the Sudden Spike

Ocugen has been jointly developing Covaxin with Bharat Biotech for use in the North American market. Share prices suffered a decline when Ocugen was denied emergency-use authorization from the FDA, which recommended that the company apply for a biologics-license application instead.

Health Canada is reviewing Covaxin currently. It has not yet been granted approval. However, the news of review was enough to push Ocugen stock higher.

Moreover, the company intends to submit an Investigational New Drug application for one of its gene therapy candidates. OCU400 is designed to target retinal diseases. Ocugen has already started to assess options to begin trials in Europe in 2022.

Ocugen Needs to Progress

The biotech company released a much-awaited business update on August 6. Ocugen failed to generate revenue during the second quarter. Unlike many of its rivals, it doesn’t have any commercialized products at the moment.

On top of that, it posted a net loss of $26 million during Q2. Expenses related to research and development stood at $18.9 million in the current quarter, as opposed to $1.6 million last year. In addition, administrative expenses increased by 279.8% year-over-year, to $6.8 million.

As of June 30, cash and cash equivalents stood at $115.6 million.

Wall Street’s Take

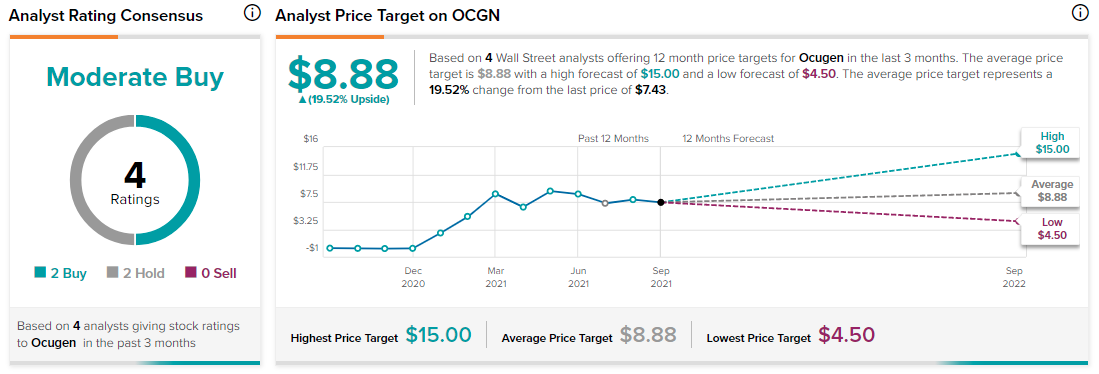

As per TipRanks’ analyst rating consensus, Ocugen stock is a Moderate Buy. Out of four analysts, there are two Buy recommendations, and two Hold recommendations.

The average OCGN price target is $8.88. The analyst price targets range from a high of $15 per share, to a low of $4.50 per share.

Bottom Line

Ocugen stock could very well profit from the mounting global concerns about the Delta variant.

There might even be a stock rally. However, the company is badly in need of positive regulatory updates right now.

It’s an interesting play, but not without risk.

精彩评论