AMC stock gains extended to 31% in premarket trading although Mudrick sold Entire AMC Stake and Called Shares Overvalued.

Mudrick Capital sold all its stock in AMC Entertainment Holdings Inc. as of Tuesday, the same day the movie theater chain disclosed that the investment firm had bought $230.5 million of fresh shares to bolster its finances, according to a person with knowledge of the matter.

Mudrick no longer holds any AMC shares and sold at a profit, the person said, asking not to be identified discussing a private matter. The firm disposed of its stake after concluding that AMC’s stock is overvalued, propped up by a recent wave of day-trader enthusiasm, the person said.

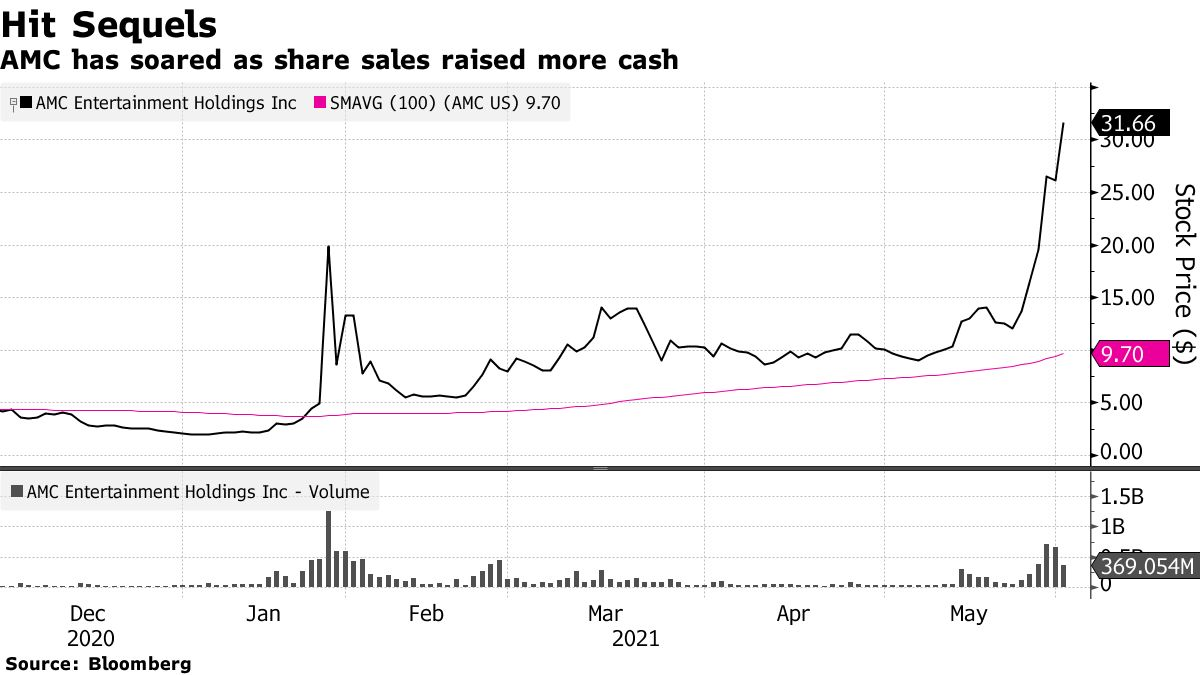

AMC jumped 23% to $32.04 at the close in New York. The shares more than doubled in May, pushing the year-to-date gain to a whopping 1,411% for the year.

No Lockup

AMC said Tuesday it sold stock to Mudrick with plans to “go on offense” for acquisitions. The agreement with New York-based Mudrick was for 8.5 million shares of common stock at $27.12 apiece. The stock purchase came with the assurance that the shares would be “freely tradable,” meaning the firm could sell the shares at any point or in any amount it chose.

Debt holders have also benefited from the recent equity rally. Some of its junk-rated second lien bonds due 2026 that were trading as low as 5 cents on the dollar in November are now close to face value, and quotes on its senior subordinated notes maturing in 2027 jumped about 4.5 cents Tuesday to almost 80 cents.

Mudrick has made big bets on AMC in the past, helping the movie theater chain as it pushed through the pandemic. In January, the firm agreed to buy $100 million of new secured bonds in exchange for a commitment fee equal to about 8 million AMC shares. The agreement also called for Mudrick to exchange $100 million of AMC bonds due 2026 for about 13.7 million shares.

Jason Mudrick previously worked at Contrarian Capital Management and founded his firm in 2009. His firm, which specializes in distressed companies, is expanding further into Europe with thetakeoverof a credit hedge fund previously run by CVC Credit Partners.

AMC has worked this year to raise cash through debt and equity deals, which helped stave off bankruptcy while its theaters were closed because of the coronavirus pandemic. Mudrick was among investors and creditors who suggested it sell more shares to pay down debt.

The most recent deal with Mudrick “will allow us to be aggressive in going after the most valuable theater assets, as well as to make other strategic investments in our business and to pursue deleveraging opportunities,” AMC Chief Executive Officer Adam Aron said in a statement disclosing the share sale.

精彩评论