- Stocks set to pop on strong earnings reports.

- Coinbase set to jump after strong but volatile debut.

- BofA top estimates on strong investment banking.

- Bank of America, Coinbase, Dell and more making the biggest moves in the premarket.

(April 15) Stock futures rose Thursday morning after a mixed session a day earlier, with traders awaiting the next batch of earnings results and a slew of economic data Thursday morning.

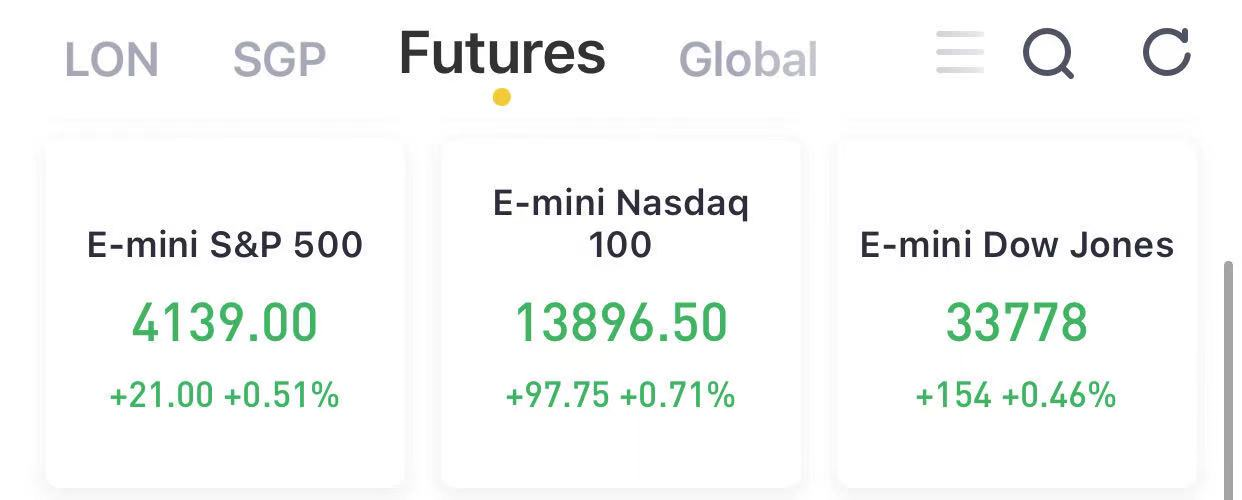

At 8:06 a.m. ET, Dow E-minis were up 154 points, or 0.46%, S&P 500 E-minis were up 21 points, or 0.51% and Nasdaq 100 E-minis were up 97.75 points, or 0.71%.

- Bank of Americashares rose as earnings last quarter blew past expectations on booming trading and investment banking.

- Pepsi shares gained ground after the consumer snack and drink maker said sales last quarter rose nearly 7%, topping estimates.

- Shares of UnitedHealth, a Dow component, advanced after results topped estimates, and the health insurer raised guidance for 2021.

On Wednesday, theS&P 500slipped from record levels in volatile trading as tech shares declined. TheNasdaqlost 1%. TheDow Jones Industrial Averagebucked the trend,posting a modest gain.

Stocks making the biggest moves in the premarket:

Bank of America(BAC) – The strong start to earnings season from Wall Street banks continuedwith a beat on the top and bottom lines for Bank of America. The bank released $2.7 billion in reserves for loan losses, boosting its earnings. Shares rose 1.2% before the bell.

Coinbase(COIN) – The cryptocurrency exchange continued its volatile start as a public company, withshares rising more than 7% in premarket trading. Thestock began trading at $381 per share in its direct listing on Wednesdayand rose in its opening minutes, but shares reversed later in the day and Coinbase closed near $328 per share. Additionally, BTIG initiated coverage of Coinbase with a "buy" rating.

Dell(DELL) – Shares of the tech company jumped after Dell announced that is hasdecided to spin offits 81% equity stake inVMWare. Dell’s stock rose more than 7%, while VMWare added 2.6% in premarket trading.

Nvidia(NVDA) – Raymond James upgraded the chip stock to a “strong buy” from “outperform,” saying the company was well positioned in the short and long term. The firm also initiated coverage ofAdvanced Micro Deviceswith an “outperform” rating. Nvidia and AMD rose 1.8% and 1.5%, respectively, in premarket trading.

UnitedHealth(UNH) – The managed care company beat estimates on the top and bottom lines for the first quarter, with adjusted earnings of $5.31 per share and more than $70 billion in revenue. UnitedHealth also raised its full-year earnings guidance. Shares were up 1.7% in premarket trading.

American Eagle(AEO) – The apparel company announced that itexpects first-quarter revenue to top $1 billion,a mid-teens growth from the same period in 2019, before the pandemic. American Eagle also projected operated income to more than double compared with the same period. The company will report its full results on May 1. Shares rose more than 6% in premarket trading.

CrowdStrike(CRWD) – Deutsche Bank initiated coverage of the cybersecurity stock with a “buy” rating, saying in a note that the company’s margins could exceed 30%. Shares of CrowdStrike rose 3% in premarket trading.

PepsiCo(PEP) – The beverage companyreported adjusted earnings of $1.21 per share, which was 9 cents above estimates, according to Refinitiv. Revenue also come in higher than expected as organic revenues rose 2.4%. Shares of PepsiCo rose 0.6% in premarket trading.

BlackRock(BLK) – The asset management giant reported $7.77 in adjusted earnings per share and $4.4 billion in revenue for the first quarter, slightly above estimates on both counts, according to Refinitiv.The firm’s asset under management hit $9 trillion. Shares rose 0.4% in premarket trading.

Dell Technologies Inc announcedplanned spin-offof 81% equity interest in VMware, Inc.. Under the terms, VMware will distribute special cash dividend of $11.5 billion to $12 billion.

Polestar, the premium Swedish electric car company owned by Volvo Cars Group and China’s Zhejiang Geely Holding Group Co said on Thursday it has raised $550 million from a group of long-term financial investors and is in talks with global investors to raise more funds.

XPeng Inc. has confirmed it isexploring makingits own dedicated chips for autonomous driving, CNBC reported.

American Eagle Outfitters, IncAEOsaid it sees Q1 sales of over $1 billion, versus the $904 million estimate.

精彩评论