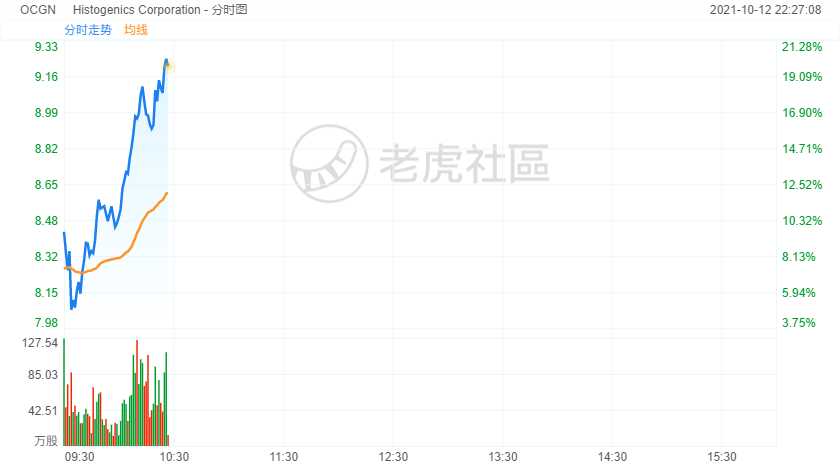

Ocugen stock surged another 20% in morning trading.The stock rose more than 8% yesterday.

The biotech's stock is moving northward this morning on the news that the COVID-19 vaccine, Covaxin, was granted emergency use approval for children ages 2 to 18 by India's Subject Expert Committee. This vaccine is among the first to receive such a broad emergency use authorization label in the entire world.

Ocugen is partnered with India's Bharat Biotech to commercialize Covaxin in Canada and the United States. The pair are now waiting on word from the World Health Organization on the vaccine's emergency use application. This critical regulatory decision is expected any day now.

Ocugen's goal is to become an important second- to third-tier COVID-19 vaccine player in key developed markets like Canada and the United States. The problem with this strategy is that there are already a surfeit of novel coronavirus vaccines in these high-value territories, with more on the way.Novavax's highly anticipated COVID-19 vaccine known as NVX-CoV2373, for example, should be available in the U.S. early in 2022. As a result, it's not entirely clear how much of a commercial opportunity will be left for late-comers like Ocugen.

Is Ocugen's stock a buy on this news? This is an extremely positive regulatory development, to be sure. But it is unlikely to have any bearing on the vaccine's regulatory fate in either Canada or the United States.

That said, the biotech's shares should still perform well over the long term. If the vaccine can carve out a profitable niche in these increasingly crowded markets where the company owns a commercial license, Ocugen could end up with a healthy and perhaps fairly long-lived revenue stream.

精彩评论