U.S. stock futures mixed on Thursday, although increasing cases of the new Omicron coronavirus variant across the world continued to drive volatility in markets.

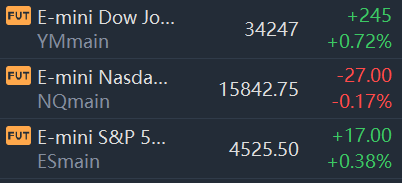

At 8:35 a.m. ET, Dow e-minis were up 245 points, or 0.72%, S&P 500 e-minis were up 17 points, or 0.38%, and Nasdaq 100 e-minis were down 27 points, or 0.17%.

Initial claims for unemployment insurance rose last week but held at levels consistent with how the job market looked before the Covid-19 pandemic devastated the U.S. jobs picture, the Labor Department reported Thursday.

First-time filings for the week ended Nov. 27 totaled 222,000, less than the 240,000 Wall Street expected. That was higher than the 194,000 from the previous week, but that total, the lowest since 1969, was revised even lower from the initial 1999,000 reported.

The totals are the product of heavy seasonal adjustments, though the unadjusted number was actually lower, at 211,896.

Stocks making the biggest moves premarket:

Grab — Grab stock jumped 13% in premarket trading.Grab, Southeast Asia's biggest ride-hailing and food delivery firm,lists on Nasdaq on Thursday following its $40 billion merger with special-purpose acquisition company (SPAC) Altimeter Growth Corp.

Snowflake — The cloud data company's shares jumped more than 13.8% after the company reported quarterly results that beat revenue estimates. Snowflake also reported sales of $334 million during the third quarter, which exceeded the $306 million expected by analysts surveyed by Refinitiv.

Apple — Shares of Apple fell 2.5% after the company told some of its suppliers there could be slowing demand for iPhone 13 models, according to a report by Bloomberg. It previously expected the reduction in its initial production goal to be made up in 2022 but said that may not materialize now.

Boeing— Shares of the aircraft maker rose 5.5% after Bloomberg reported it’s in talks with the new owners of previously bankrupt Jet Airways about bringing its fleet of 11 planes to more than 100 in five years. Jet Airways made an order for 225 of Boeing’s 737 Max aircraft that it could revisit, a deal which would be worth more than $12 billion, according to the report.

Signet Jewelers — Shares of Signet Jewelers gained about 1.1% in the premarket after the company posted a better-than-expected earnings report. Signet notched a profit of $1.43 per share, 71 cents higher than the Refinitiv consensus estimate. Revenue also came in higher than projected. Signet raised its fiscal 2022 guidance.

Five Below — The retailer’s shares gained more than 11% after reporting quarterly results that beat on both earnings and revenue. It also reported an increase in comparable-store sales of 14.8%, smashing the estimates of 5.3%, according to Refinitiv.

Okta — Shares of the identity company added 3.5% following the company’s quarterly results. Okta brought in a quarterly loss of 7 cents per share, which is narrower than the 24 cents per share loss estimated by analysts. It also beat revenue estimates and issued fourth-quarter guidance above estimates.

Lands’ End — Lands’ End saw its shares sink more than 18% in early morning trading after reporting lower-than-expected third-quarter revenue. The apparel retailer posted revenue of $375.8 million versus the StreetAccount consensus estimate of $398 million. Lands’ End earned 22 cents per share, in line with projections. The company also issued fourth-quarter earnings and revenue guidance below expectations.

Dollar General — Dollar General shares fell 3.1% after the company revealed plans to open 1,000 Popshelf stores by the end of the 2025 fiscal year. The vision for Popshelf, aimed at wealthier suburban shoppers, was announced a year ago. There are currently 30 Popshelf stores in six states.

精彩评论