U.S. stocks fell o Friday as bond yield jumped, rekindling fears that rising rates will take the comeback momentum out of equities, especially tech names.

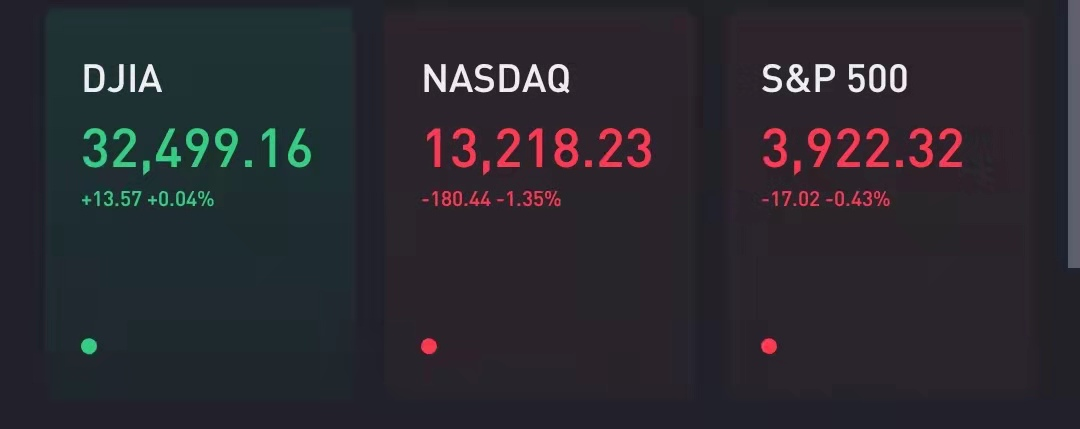

The S&P 500 lost 0.4%, falling from a record high reached in the previous session. The tech-heavy Nasdaq Composite shed 1.4%. The Dow Jones Industrial Average rose 14 points as bank stocks gained amid rising rates.

The 10-year Treasury yield jumped back to near its high level for the year. The yield was last at 1.61%, up about 8 basis points overnight. (1 basis point equals 0.01%)

A quick rise in bond yields put pressure on the Nasdaq names earlier in March as investors shifted toward economically sensitive, cyclical stocks. Sharp increases in interest rates can put outsized pressure on high-growth tech stocks as they reduce the relative value of future profits.

Shares of Tesla fell more than 3% in premarket trading. Netflix, Apple, Amazon, Microsoft and Facebook were all down at least 1% in early trading.

“Higher rates, less dovish central banks are now considered to be the single biggest threat for risk assets,” Ralf Preusser, Bank of America’s rates strategist, said in a note. With the passage of the US fiscal stimulus package and the blistering progress in vaccinations in the US, a number of other key risks are falling by the wayside.”

Ned Davis Research estimated that theNasdaq 100,the tech heavy index which tracks the 100 largest non-financial companies in the Nasdaq Composite,would drop another 20%if the 10-year yield hits 2%.

Before Friday’s open, the Nasdaq is up 3.7% on the week and is outperforming both the S&P 500 and the Dow over the period.

U.S. stocks climbed to record highs during Thursday’s regular session as a rebound in tech shares resumed and Biden’s $1.9 trillion Covid-19 relief package became law. The S&P 500 jumped 1% and hit a new closing high, surpassing its previous record from Feb. 16.

Signs that the U.S. economy may be set for a healthy 2021 were plentiful on Thursday afterBidensigned his much-anticipated $1.9 trillion coronavirusrelief package into law. The plan will send direct payments of up to $1,400 to many Americans, and will also put nearly $20 billion into Covid-19 vaccinations and $350 billion into state, local and tribal government relief.

Biden announced Thursday evening that he woulddirect states to make all adults eligiblefor the vaccine by May 1 in his first primetime address as president.

“While we expect conditions to remain volatile, the most recent developments on three of the main market drivers—stimulus, pandemic news, and inflation data— point to further equity upside,” wrote Mark Haefele, chief investment officer at UBS Global Wealth Management.

“The stimulus is substantially larger than had been expected earlier in the year. Its provisions are also likely to be highly supportive for consumption and growth,” he added in reference to the stimulus. “This windfall comes on top of existing signs of pent-up demand from US consumers.”

精彩评论