(March 2) Wall Street’s main indexes opened little changed on Tuesday after a strong start to March as investors closely monitored the bond market as well as progress on the next round of fiscal stimulus.

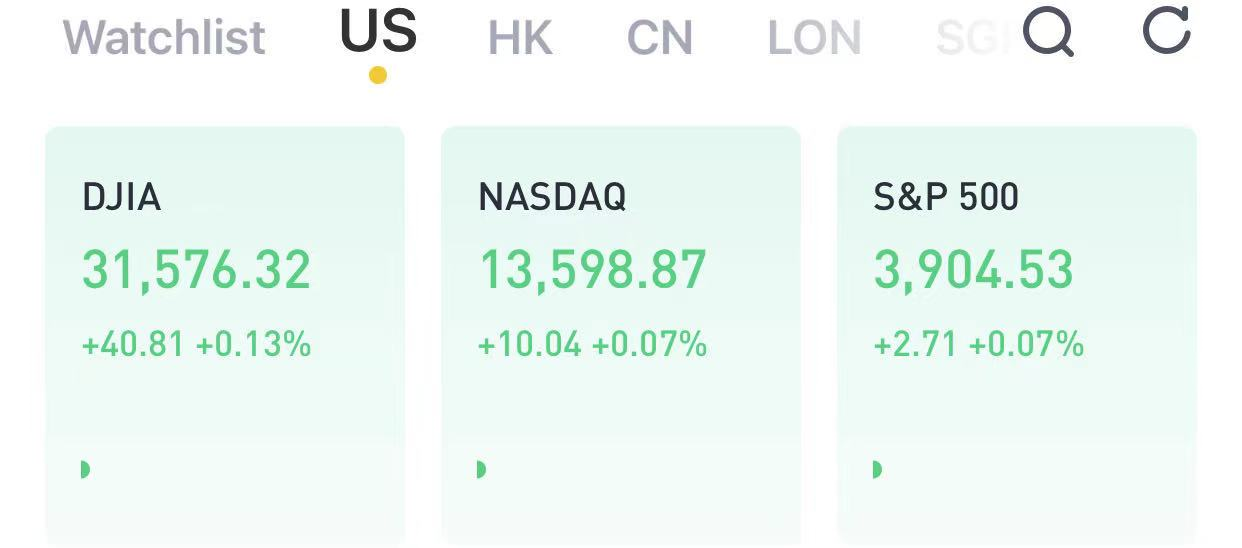

The Dow rises 0.13%, the S&P 500 up 0.07%, and the Nasdaq Composite advances 0.07%.

On Monday, the S&P 500 jumped by 2.4% for its best session since June 2020, while the Nasdaq jumped 3% to recuperate some losses after technology stocks slumped last week. Shares of Zoom Video Communications (ZM), a darling of the "stay-at-home" trade, jumped more than 7% overnight after the company delivered earnings results and guidance that far exceeded expectations,helping assuage fears of a slowdown as more in-person activities resume.

The10-year Treasury yield, a point of focus lately for equity investors, was flat at 1.45%.

Shares of Target gained 0.5%after reporting booming sales. Though the retailer declined to provide a forecast for 2021.

U.S. equitiesbegan March on a strong note on Mondaywith theS&P 500up 2.38%, theDow Jones Industrial Averageadding 1.95% and the tech-heavyNasdaq Compositejumping just over 3% after shedding 4.9% last week.

All 11 S&P sectors finished in the green and the S&P 500 posted its best day since June 5. Both the Dow and the Nasdaq clinched their best trading day since November.

Economically sensitive, cyclical sectors like energy and financials continued to outperform the broader market amid optimism about vaccines and economic resurgence. Meanwhile, a pause in the market for U.S. debt allowed high-growth tech names to recoup a sizable portion of their recent losses. Facebook added 2.8%, Apple rose 5.4% and Tesla climbed 6.4%.

The 10-year yield, which had kept investors on edge for much of last week, dipped to a session low of 1.41% Monday before drifting back near the flatline. The 10-year yield stabilized around that level, below its high of 1.6% last week, which encouraged investors last week's rapid rise in borrowing costs has abated for now.

"Anxiety over yields appeared largely responsible for a 3% retreat in the S&P 500 from a record high in the middle of" February, Mark Haefele, chief investment officer at UBS Global Wealth Management, said in a note.

"We expect this interruption to the equity rally to be temporary and believe investors should put the pullback in context," he added. "The rise in yields has been led by optimism over growth, not inflation worries, and so doesn't yet pose a threat to risk assets."

Investors on Tuesday will pore over comments made by both Securities and Exchange Commission Chair nominee Gary Gensler and Federal Reserve Governor Lael Brainard.

Gensler will testify before the Senate Banking Committee at 10 a.m. ET while Brainard will deliver a speech entitled "U.S. Economic Outlook and Monetary Policy" via a virtual meeting hosted by the Council on Foreign Relations.

精彩评论