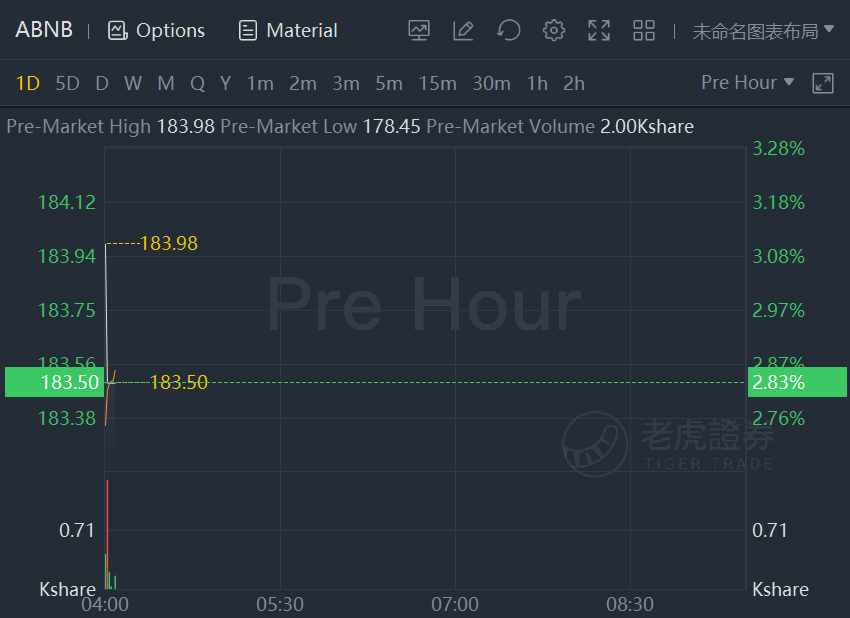

Airbnb shares jumped 3% in premarket trading after the short-term room rental service’s earnings blew past expectations.Travel picked up around the world as countries continued to emerge from the pandemic period.

For the third quarter, Airbnb reported revenue of $2.2 billion, up 67% from a year ago, 36% higher than the level two years ago prior to the pandemic, and above the Street consensus at $2.1 billion.

Gross bookings were $11.9 billion, up 48% from last year and 24% higher than two years ago. “Nights and experiences” booked were 79.7 million, up 29% from a year ago but down 7% from two years ago.

Net income was $834 million, or $1.34 a share, the company’s highest quarterly profit ever, up 280% from a year ago and well ahead of the Street consensus forecast at 75 cents a share.

“The travel rebound that began earlier this year accelerated in Q3, resulting in Airbnb’s strongest quarter ever,” the company said in a letter to shareholders. “Revenue and net income were our highest ever. Adjusted EBITDA exceeded $1 billion, also our highest ever. This summer, we reached a major milestone of 1 billion cumulative guest arrivals as more people got vaccinated and travel restrictions were relaxed. Host earnings reached a record $12.8 billion in the quarter, and active listings continued to grow.”

For the fourth quarter, the company sees revenue ranging from $1.39 billion to $1.48 billion, in line with the Street consensus forecast at $1.44 billion. The company said that adjusted Ebitda margins in Q4 should show greater expansion over both one and two years than in the third quarter.

“In Q4, we continue to see the positive effect of travel restrictions being lifted and global vaccination progress on our growth in Nights and Experiences Booked for stays in Q4 and into 2022,” the company said. “We expect Nights and Experiences Booked in Q4 2021 to significantly outperform Q4 2020 levels and approximate Q4 2019 levels.” The company said gross bookings should be substantially above both fourth quarter 2020 and fourth quarter 2019 levels.

“Looking to 2022, vaccination progress and the recovery of international travel in Q4 2021 will be key themes for growth heading into the new year,” the company added.

精彩评论