(March 5) Stocks were set to rebound after a stronger-than-expected jobs report boosted optimism about a faster economic reopening.

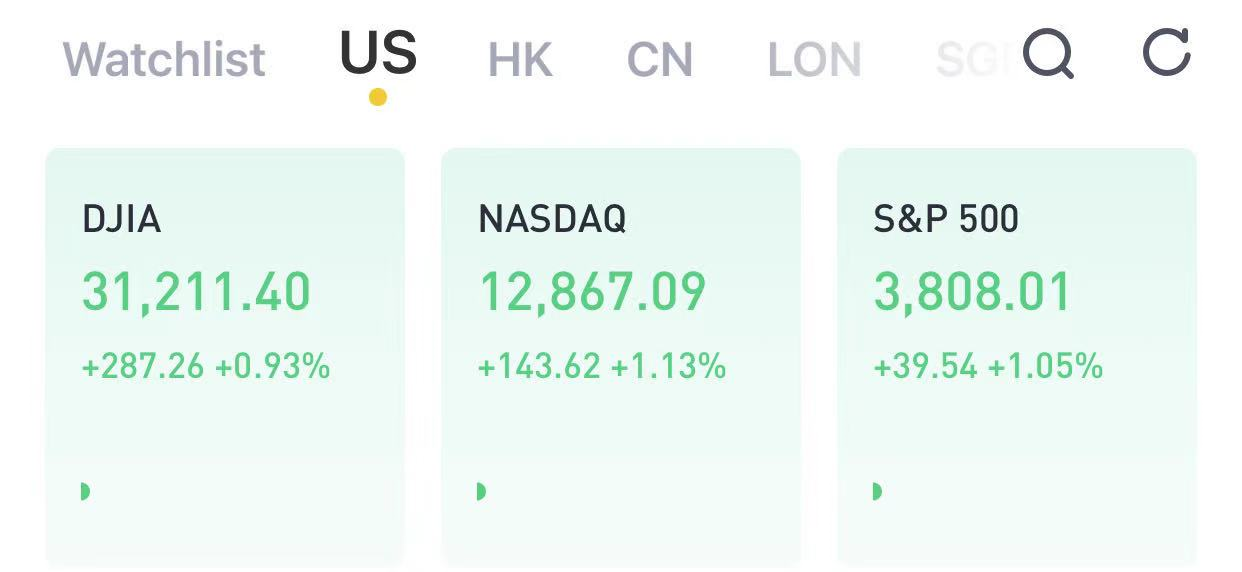

The Dow up 0.93%, the S&P 500 rose 1.05%, and the Nasdaq Composite jumped 1.13%.

The U.S. 10-year Treasury yield popped above 1.6% after the February jobs report. The Labor Department on Fridayreportedthat nonfarm payrolls jumped by 379,000 for the month and the unemployment rate fell to 6.2%. That compared to expectations of 210,000 new jobs and the unemployment rate to hold steady from the 6.3% rate in January, according to Dow Jones.

As rates jumped, tech shares with high valuations got hit again in the premarket, continuing the pattern this week. Tesla and Peloton shares fell declined.

The move in futures followed a sharp sell-off on Thursday triggered by Federal Reserve Chair Jerome Powell’s remarks on rising bond yields. The Fed chair said the recent runup caught his attention but he didn’t give any indication of how the central bank would rein it in. Some investors had expected Powell to signal his willingness to adjust the Fed’s asset purchase program.

The economic reopening could “create some upward pressure on prices,” Powell said in a Wall Street Journal webinar Thursday. Even if the economy sees “transitory increases in inflation … I expect that we will be patient,” he added.

“Equity investors, in our conversations, are really grappling with two things they may not have had to deal with for the last 10 years,” said Tom Lee, Fundstrat’s co-founder head of research. “One is the potential for inflation to actually have to be priced into equities. I think there’s a lot of confusion.”

“Then it’s a bond market that seems to be testing the Fed, which kind of scares people,” added Lee, who believes the sell-off this week is a buying opportunity.

Tech stocks led the market decline Thursday, especially those with high valuations and small or no profitability. The Nasdaq Composite dropped 2.1% Thursday, bringing its losses this week to 3.6%. The tech-heavy benchmark also turned negative for the year and fell into correction territory, or down 10% from a recent high, on an intraday basis.

Tesla shares were off their lows in Friday premarket trading but still down 0.3%.

The S&P 500 and the Dow both fell more than 1% Thursday, headed for a losing week. Energy outperformed with a 2.5% gain in the previous session amid a jump in oil prices.

“Rates soared once again, which opened the door for more selling of technology stocks,” said Ryan Detrick, chief market strategist at LPL Financial. “The bright side is the economy continues to improve and leadership from financials and energy is something that suggests this isn’t a sell everything moment.”

精彩评论