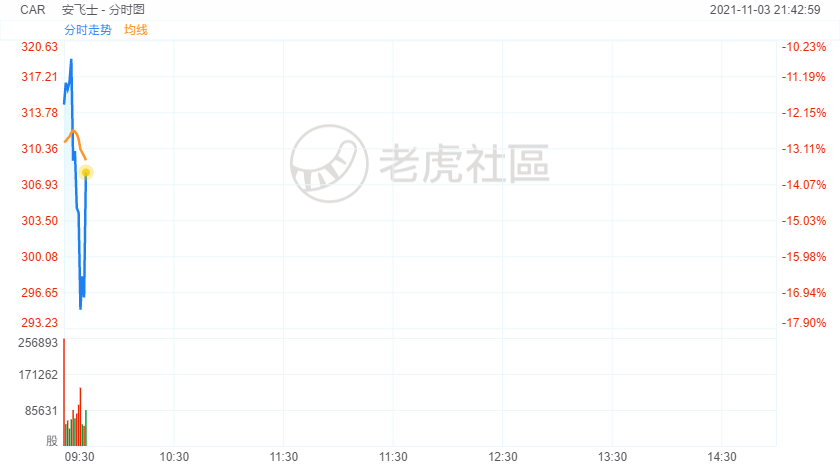

Avis Budget stock tanked 17% in morning trading as major firms downgraded Avis after stock doubled in single day, saying fundamentals no longer matter.

Two top Wall Street firms are warning investors to back away from Avis Budget after the stock rocketed higher Tuesday.

The rental car company posted a huge earnings beat for the third quarter and expanded its stock buyback plan,sending shares soaring. The stocks was up more than 200% for the day at one point and closed 108% higher.

However, a move that large was unjustified by even the strong financial results, according to several Wall Street analysts.

JPMorgan’s Ryan Brinkman double-downgraded Avis Budget to underweight from overweight, saying in a note to clients Wednesday that technical factors may have caused the stock’s move to get out of hand.

JPMorgan did raise its price target on the stock to $225 per share from $100 per share, but that is still more than 30% below where the stock closed Tuesday.

Deutsche Bank analyst Chris Woronka also downgraded the stock to sell from hold, saying in a note to clients that Tuesday’s move showed that trading had shifted “away from fundamentals.”

Deutsche Bank hiked its price target on the stock to $210 per share from $119 per share, which would represent downside of roughly 37% for Avis Budget.

精彩评论