Sea Limited shares jumped more than 4% in morning trading.

Also Read:Sea Limited: A Deep Dive To Understand The Recent Selloff

Summary

- Sea Limited is a highly diversified business firing on all cylinders in some of the fastest-growing economies in the world.

- I dive into each of its segments to understand the recent selloff and justify the current valuation.

- I consider Sea one of my ten highest conviction investments.

Thesis

A by-parts analysis of Sea Limited's (NYSE:SE) segments shows that its current valuation is roughly fair, but there are many long-term growth drivers that could surprise to the upside and drive very strong returns for years to come.

Introduction

I recently wrote an article highlighting my top 10 stock picks for 2022. I'd already done an in-depth analysis of my other nine picks in other Seeking Alpha articles, so I thought it would be good to close out the year with an article about Sea.

Furthermore, with shares down significantly over the past couple of months (but still slightly up for the year), I believe this article may prove timely. I don't speculate on short-term market movements, but I personally added to my Sea shares recently. It's one of my only losing positions that I didn't sell out of temporarily for tax-loss harvesting, and in this article, I will explain why Sea is such a high conviction holding for me.

It's also worth noting that many professional investors seem to share this opinion. Sea is the 121st largest company in the world, but it's the16thmost popular holding among hedge funds. This implies that big money is overweight Sea, with 71% of shares held by institutions.

Because Sea operates in many different areas, I will do a separate analysis of each of its operating segments to justify its current valuation and explain how that valuation could drive unexpectedly strong returns for years.

Gaming

Sea Limited's gaming segment Garena is best known for Free Fire, a mobile battle royale game that was developed in-house.

The game was released in 2017 and has been very popular ever since. It currently has the second most monthly active users among all Android games globally. The game is available worldwide, but it's particularly popular in emerging markets like SEA, LATAM, and India, where it's been the highest-grossing mobile game for over two years.

With the game having been popular for a long time already, there's some concern that gamers will move on to the next big thing. Although there are some mobile games that are older than Free Fire and still very popular - like Roblox, Clash of Clans, and Pokemon Go - there are many more that have been forgotten. Until Garena releases more games and proves that it can be successful with them too, there will always be questions about whether its studio is a one-hit wonder.

Regardless, Garena is a critical part of Sea because it's the only profitable segment and it doubles a social platform that provides free advertising for Sea's non-gaming products. Cross-promotion is a huge competitive advantage for Sea.

Thus, one reason for Sea's recent selloff could be the Q4 guidance implied for Garena.

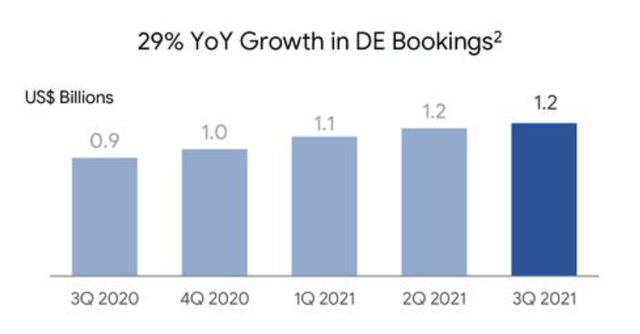

In Q2 this year, Garena raised its guidance to $4.5B-$4.7B for 2021 bookings (up from $4.3B-$4.5B). With the first three quarters already totaling $3.5B, this implies that Q4 bookings will come in at $1.0B-$1.2B, up between 0% and 20% year over year, and likely down sequentially. This is compared to 29% growth in the most recent quarter and 44% projected growth for the full year.

While 20% isn't a terrible deceleration, 0% certainly is. Even 20% growth isn't spectacular compared to the historic levels. At the 10% midpoint, Garena's growth looks more similar to that of a mature company like Activision (NASDAQ:ATVI) or Zynga (NASDAQ:ZNGA) than a fast-growing company like Roblox (NYSE:RBLX).

Garena's implied valuation should - and did - suffer as a result. While a fast-growing company like Roblox can command a high double-digit P/S multiple, Activision and Zynga trade at an average P/S multiple of just 4. Garena is slightly more profitable than them and probably has more risk to the upside, so I'll use a P/S multiple of 5 for my implied valuation. This implies a P/E of about 10 for a business growing at around 10%, which is very reasonable in today's market.

This means Garena is worth $23.5B based on the high end of management's guidance.

I believe this valuation is actually conservative for a few reasons:

- Next year has tough comps and growth could re-accelerate in the following years or even next year, especially if Garena releases a new hit game. The growth rate past next quarter is not based on explicit guidance from the company, only industry forecasts.

- The peer valuations I used are from companies also trading at the lower end of their valuation range for the past year.

- Garena has a good track record and is continuing to invest in Free Fire. One example of this is the recently released Free Fire MAX, which improves the experience for users with higher-end phones and even adds a metaverse-like customizable map called Craftland. To me, this implies that Garena believes Free Fire is still in the earlier part of its lifecycle.

- Although I'd obviously prefer that Garena develops more games in house, in the meantime it's still not a one-trick pony. In addition to Free Fire, Garena distributes games from third-party developers like Tencent (OTCMKTS:OTCPK:TCEHY). These are popular titles like League of Legends and Call of Duty, which meaningfully diversify Garena's revenue.

E-Commerce

Sea's e-commerce platform Shopee is currently its big growth driver. This platform is often considered the Amazon (NASDAQ:AMZN) of Southeast Asia, and it recently expanded into more markets including Brazil.

There's always some debate about who is really the Amazon of a region. Shopee certainly has competition, including from Alibaba's (NYSE:BABA) Lazada, Tokopedia in Indonesia, MercadoLibre (MELI) in Brazil, and even Amazon itself. With most of the competition being private or tucked away into a larger company, many of the competitors don't publish exact revenue numbers, which makes it difficult to measure the competition. Even Sea hasn't published explicit revenue numbers for some countries like Brazil.

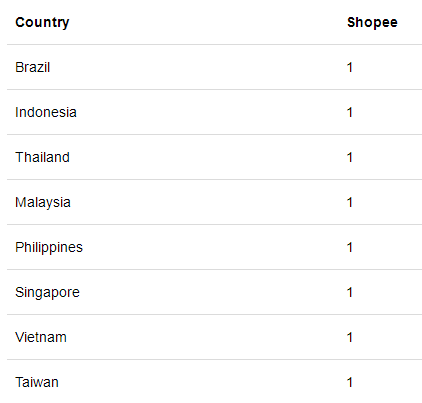

One neutral source that can be assessed is the Alexa site rank, which as its name suggests ranks sites by their popularity. Keep in mind that these are ranks, so a lower score is better.

Shopee is very mobile-focused, but the above table only considers the website. To check App Store app ranks for the shopping category, we can use App Annie.

On the mobile side, there's no need to look at the competition because Shopee is consistently the number one shopping app in every country listed. In a mobile-first world, this bodes very well. Even on the web side, Shopee wins out except in a few specific regions like LATAM and (barely) Indonesia, which have more local competitors.

Of course, traffic doesn't always translate to GMV. But for a shopping app where most people will use the app to buy something, it's a decent proxy. A third party estimates that Shopee accounts for57%of all e-commerce in Southeast Asia. It's Shopee's dominance in the mobile app ranks and market share that make me consider it the Amazon of Southeast Asia.

So why would a company with so much potential sell off?

After the recent earnings report, some analysts expressed concern that Shopee is branching out into other countries like Poland and Mexico before validating its business model in the current markets. In these countries, Shopee has less of a presence; it's bounced between the 3-5 spots on the Mexico App Store for shopping apps, and between spots 1 and 3 in Poland. Although analysts hate uncertainty - and the CEO's comments that they don't have a concrete measure of success in these earlier stage countries won't help with that - Shopee has a history of entering new countries successfully and I am willing to give management some time to try expanding more. After all, if they're successful, then it could drive even more unexpected growth in the future.

Another complaint from analysts was that the basket size (average purchase size) is trending down. While that could also have contributed to the recent selloff, it's hard to complain when the overall sales increased a lot despite a decrease in basket size.

The company raised its guidance for e-commerce again in Q3, now guiding for $5.0B-$5.2B in 2021 e-commerce revenue. That's 75%-100% growth in Q4 and about 135% growth for the year. These are much more exciting numbers than the gaming side, although the guidance still implies a slight deceleration in Q4. But compared to Amazon's $340B in 2020 e-commerce sales, Shopee looks like it's just scratched the surface. E-commerce is at only11%penetration in Southeast Asia compared to18.7%in the USA, and Southeast Asia economies are generally growing faster than the USA's.

Despite being in a blue skies industry, it's more difficult to value the e-commerce segment because it operates at a loss (whereas the gaming segment is highly profitable). Shopee's success is not guaranteed because it's not clear at this point whether the platform can become profitable while retaining its market share. Stocks like this tend to experience more volatility, which could partially explain the recent selloff.

For unprofitable software companies, I like to use the Rule of 40 to assess the business. But it's difficult to apply this rule to a more cyclical e-commerce company with naturally lower margins. Even so, it's worth noting that despite being unprofitable, Sea's Rule of 40 score of 104 is better than most SaaS companies', and also better than e-commerce peers Amazon (21), MercadoLibre (73), and Alibaba (43).

To understand Shopee's terminal valuation once it becomes profitable, we can look at industry peers. Amazon is one profitable and slower-growing peer, and it trades at 4x P/S. AWS pushes this number up, but Amazon's high exposure to first-party sales offsets that. Other e-commerce marketplace peers trade at similar valuations: Alibaba at 3x P/S, MercadoLibre at 9x P/S. All of these valuations are basically all-time lows.

If Shopee keeps doubling revenue over the next couple of years (which it's easily done every year since 2016), becomes profitable (which scaling up tends to help with), and will have Amazon's P/S multiple in two years, then at 16 P/S today it would trade flat for two years. But if it keeps growing much faster than Amazon over a longer period like a decade, and/or if the overall industry multiples expand to more normal historical levels, then even at 16x P/S this segment has potential upside. On the other hand, if it stops growing or never becomes profitable then investors will be very disappointed at any P/S.

Given this wide range of outcomes, each person is going to have their own way of valuing this segment. For me, when I look at Shopee's mobile dominance, relatively small current size, the funding coming in from Garena, and the precedent set by Amazon, Alibaba, and MercadoLibre for the sustainable long-term success of this business model, I am optimistic about this segment's future. I recognize that it's currently an unprofitable and thus risky segment, but I also see the massive potential.

So I am happy paying a 16x P/S multiple, which values the e-commerce segment at $83.2B. Some people will call that way too high, and those people will probably never get a chance to invest in this company, for better or for worse.

Thus, with just Garena and Shopee, I have Sea being worth $106.7B. Its current market cap is $123.1B. To account for the difference, let's look at the other parts of Sea.

FinTech & Investments

The easiest addition to my computed valuation is Sea's $12B cash pile, partially offset by $4B in debt. This adds some nice optionality to the company and ensures that it won't be bankrupt any time soon despite losing money with Shopee. Adding in the $8B cash difference puts my computed valuation at $114.7B, just $8.4B short of the actual valuation.

Then there is Sea's FinTech arm, SeaMoney. The main product here is a mobile wallet, which was responsible for $4.6B in payment volume in the last quarter (~$20B over a year). This segment accounted for $132 million in Q3 revenue, up a whopping 818% year over year. This implies a "take rate" of 2.9%, which is even better than established FinTech companies like Visa (V). Because of this high take rate, I'm not worried about SeaMoney losing money while it scales.

Despite SeaMoney being a small segment, it's now reaching a point where it can be factored into the valuation. Maybe it's only worth a couple of billion, but this is just the start. Five years ago, nobody would have expected that an e-commerce platform accounting for 5% of Sea's sales would today be worth more than the gaming segment. But Sea's management - combined with Garena's ability to fund new segments and drive their viral adoption - made it happen. It's certainly not guaranteed that Sea will have the same success with FinTech, but there is precedent for it.

If one day this segment is worth a third or more of Sea (in 2020, FinTech accounted for 36% of MercadoLibre's revenue) then getting it for just 7% of the business today will be well worth it, even if that implies a somewhat high 16x P/S multiple for the segment today. Actually, this multiple is already lower than Visa's, Mastercard's (NYSE:MA), and Affirm's (NASDAQ:AFRM). Realistically, a segment growing at 818% year over year should probably get a higher multiple than these slower-growing companies', but we don't even need to speculate about what a fair multiple is, since we can reach Sea's current valuation by using 16x P/S in my model valuation.

One way this segment could grow even more is through the introduction of more products besides the mobile wallet. Sea noted in their recent earnings that they have started "early initiatives in other digital financial services such as buy now pay later, digital bank, and insurtech." These guys sure know how to hop on the latest high growth trend.

Finally, there's the investments arm. Sea is investing in early-stage tech companies, especially in Southeast Asia. There's strong precedent for companies like Tencent (which is itself an investor in Sea) and Shopify (NYSE:SHOP) managing successful investment portfolios that ultimately factor meaningfully into their valuation. Right now Sea's investment arm is very early stage, so I don't include it in my valuation model. But it doesn't have to be factored in to justify the current share price. It's just one more area that might be worth a large part of Sea one day.

Conclusion

Looking at each of Sea's segments, my valuation model indicates that Sea is fairly valued today. However, my model doesn't account for the significant optionality of the newer segments. Just like e-commerce did over the last five years, FinTech (and/or investments) could grow to become a very large part of Sea's business. With the FinTech segment currently growing at 818% year over year, it doesn't take much imagination to see how this happens. Just another year or two of growth at something close to that rate will make the FinTech arm impossible for investors to ignore.

This optionality combined general strength in each business has allowed Sea to post an average revenue beat of 7% over the past year. Earnings haven't been as strong, and I expect that to be the main point of contention with my valuation model, as is the case for most unprofitable companies. In particular, I expect some readers will disagree with my valuation of the e-commerce segment. But even if you drop e-commerce all the way down to 5x P/S (a multiple seen today by much slower growing e-commerce companies) that implies 54% downside from today's prices. It's a steep drop for sure, but most companies in today's market would be looking at such a decline if one were to use the most conservative valuation standards possible.

Only fast-growing companies like Sea can quickly offset such a decline with revenue growth. As a result, the businesses with the most long-term potential will hardly ever trade at the most conservative valuation possible. And Sea certainly has long-term potential. It's one of the few high-growth companies I own that I could see reaching a trillion-dollar market cap this decade.

精彩评论