- Goldman Sachs Q3 equities revenue $3.10 bln vs. $2.05 bln; FactSet consensus $1.85 bln

- Goldman Sachs Q3 global markets revenue $5.61 bln vs. $4.55 bln; FactSet consensus $3.70 bln

Goldman Sachs shares rose more than 2% after quarterly results beat expectations.

The Goldman Sachs Group, Inc. today reported net revenues of $13.61 billion and net earnings of $5.38 billion for the third quarter ended September 30, 2021. Net revenues were $46.70 billion and net earnings were $17.70 billion for the first nine months of 2021.

Diluted earnings per common share (EPS) was $14.93 for the third quarter of 2021 compared with $8.98 for the third quarter of 2020 and $15.02 for the second quarter of 2021, and was $48.59 for the first nine months of 2021 compared with $12.65 for the first nine months of 2020. In the prior year, net provisions for litigation and regulatory proceedings reduced diluted EPS by $9.46 for the first nine months of 2020.

Annualized return on average common shareholders’ equity (ROE)1 was 22.5% for the third quarter of 2021 and 25.7% for the first nine months of 2021. Annualized return on average tangible common shareholders’ equity (ROTE)1 was 23.8% for the third quarter of 2021 and 27.2% for the first nine months of 2021.

Highlights

Results in the third quarter of 2021 evidenced continued strong overall performance with net revenues of $13.61 billion, 26% higher than the third quarter of 2020.

In the first nine months of 2021, the firm generated net revenues of $46.70 billion, net earnings of $17.70 billion and diluted EPS of $48.59, each surpassing the previous full year records.

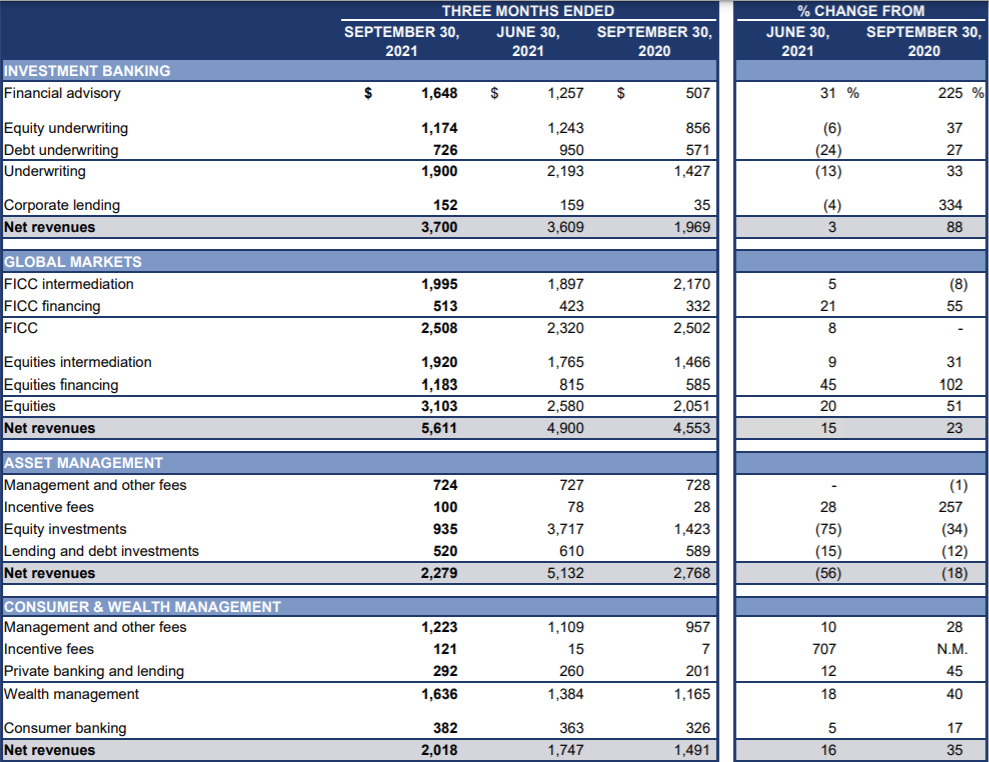

Investment Banking generated its second highest quarterly net revenues of $3.70 billion, reflecting record quarterly net revenues in Financial advisory and continued strength in Underwriting.

The firm remained ranked #1 in worldwide announced and completed mergers and acquisitions, and in worldwide equity and equity-related offerings, common stock offerings, and initial public offerings for the year-to-date.

Global Markets generated quarterly net revenues of $5.61 billion, primarily reflecting strong performance in Equities, including record Equities financing net revenues, and the second highest Fixed Income, Currency and Commodities (FICC) financing net revenues.

Consumer & Wealth Management produced quarterly net revenues of over $2 billion for the first time, 35% higher than the third quarter of 2020.

Firmwide assets under supervision increased $67 billion during the quarter, including long-term net inflows of $49 billion, to a record $2.37 trillion. Firmwide Management and other fees were a record $1.95 billion for the third quarter of 2021.

Book value per common share increased by 4.7% during the quarter and 17.4% during the first nine months of 2021 to $277.25.

During the third quarter of 2021, the firm announced the acquisitions of NN Investment Partners and GreenSky, Inc., to accelerate the firm’s strategy to drive higher, more durable returns. Both are expected to close by the end of the first quarter of 2022.

精彩评论