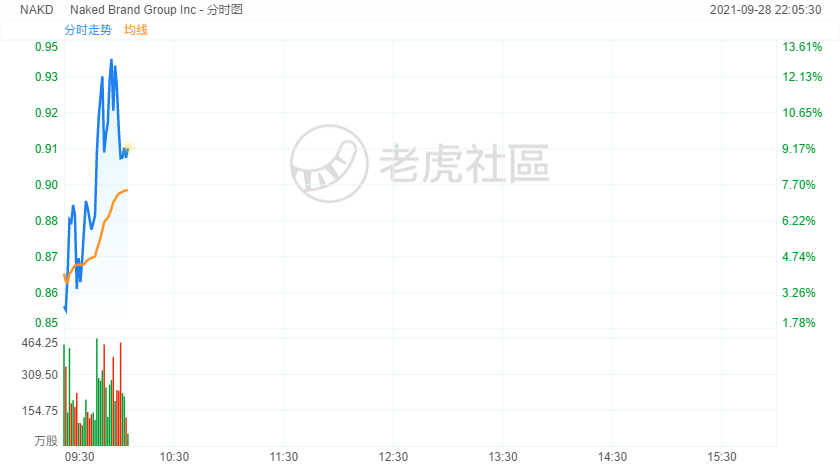

Naked Brand stock surged 9% on the swimwear retailer Looking for a move into clean tech.

One of the companies that garnered attention in the meme stock trading hysteria is shooting to the moon again.

Shares of Naked Brand, a lingerie and swimwear retailer, have surged since Friday after its chief executive, Justin Davis-Rice, informed shareholders the company had found a “disruptive opportunity in the clean technology sector.”

The stock pop 21.8% when the markets closed Monday.

Davis-Rice said Naked (ticker: NAKD) had been looking for an acquisition opportunity ever since the board voted to divest the brick-and-mortar operations of its Bendon brand in April, which provided the company with a $270 million windfall.

While the move into clean technology may be unexpected for a swimwear retailer, Davis-Rice said he had always been attracted to ESG opportunities.

“This company is a market leader with cutting edge patented proprietary technology that we believe satisfies those ESG mandates,” he said.

The CEO didn’t give any further details on the potential deal, but said due diligence was progressing on both sides.

Naked shares have gained more than 333% year to date, and over 600% over the past 52 weeks, benefitting primarily from January’s retail customer trading frenzy. The company used the frenzy to raise cash quickly, issuing stock to capitalize on the market’s renewed attention.

Naked was one of the eight brands retail broker Robinhood restricted in January, alongside GameStop,Koss,AMC Entertainment, Express,Genius Brands,BlackBerry and Nokia.

精彩评论