TSMC stock surged 2.7% in premarket trading on profit, margins topping analyst expectations.

Taiwan Semiconductor Manufacturing Co.’s quarterly profit beat expectations as demand for the chips stayed robust in the face of worsening snarls in the supply chain.

The world’s No. 1 foundry said Thursday net income for the three months ended September rose 14% to NT$156.3 billion ($5.6 billion), compared with the NT$149.6 billion average of analyst estimates. The company posted record revenue of NT$414.7 billion for the quarter, according to previously disclosed figures.

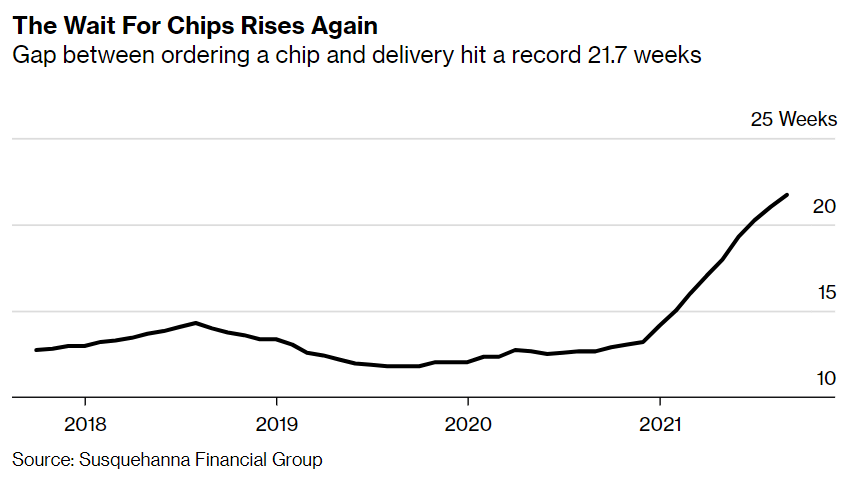

Demand for semiconductors that power everything from cars to the latest smartphones have driven lead times to record highs and helped contract chipmakers like TSMC fill order books. But capacity constraints have limited the Taiwanese company’s ability to fully capitalize on the boom, even as it set aside $100 billion to grow output over three years and evaluated potential new plants in Japan and Europe.

Bottlenecks elsewhere in the supply chain, including in packaging and testing, as well as snarls in logistics have weighed on the industry.Apple Inc., which accounts for a quarter of TSMC’s revenue as its biggest customer, is likely to slash its projected iPhone 13 production targets this year by as many as 10 million units, Bloomberg News reported this week.

Gross margin in the September quarter was a better-than-expected 51.3%, following improvements in “backend profitability and a more favorable technology mix,” TSMC said. It’s rebounding from a nearly two-year low reached in the previous three months, in part because of currency fluctuations. TSMC will likely raise prices next year, Taiwanese media reported in August, a move that could help offset concerns over margins.

“TSMC will be the last foundry to raise pricing during the ongoing semis shortage as some peers have already enacted two to three increases,” Cowen Inc. analysts led by Krish Sankar wrote in a Oct. 11 report. “We expect semis shortages will ease by 2H22 as incremental foundry industry capacity come online.”

The most advanced technologies accounted for 52% of TSMC’s revenue during the quarter, with 5 nanometer making up 18% and 7 nanometer 34%. Smartphones continue to be the largest contributor by product type at 44% of total revenue, while automotive customers made up 4% of revenue, in line with the previous quarter. TSMC has said it will increase shipments to the sector, which has been among the most badly affected by supply shortages.

精彩评论